Ethereum Chart By Trading View

Ethereum Chart By Trading View

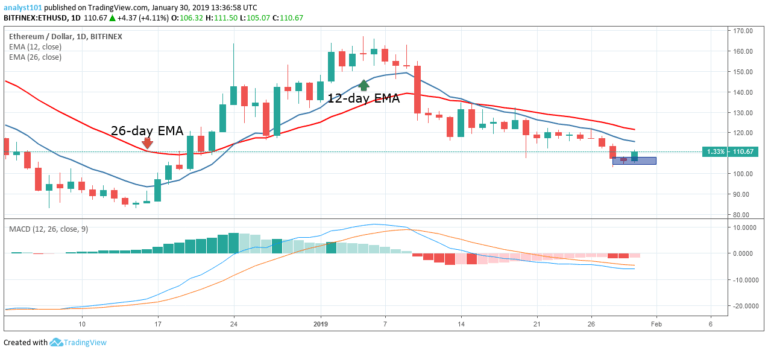

ETHUSD Medium-term Trend: Bearish

- Resistance Levels: $230, $240, $250

- Support Levels: $100, $90, $80

The ETHUSD pair was trading in the sideways trend as the crypto fell to the $100 price level. On January 28, the crypto fell to the low of $107.49 to commence a range bound movement. The appearance of small body candlesticks like the Doji and spinning tops describe the indecision of buyers and sellers at the $100 price level. It is not clear how long the price will range at the $100 price level.

From the price action, the ETH price is still below the 12-day EMA and the 26-day EMA which indicates that the price is likely to fall. This indicates that ETH price is in a bullish momentum and a buy signal. On the Upside, if the $100 price level is holding traders should look out for buy setups to initiate long trades. Meanwhile, the MACD line and the signal line are below the zero line which indicates a sell signal.

ETHUSD Short-term Trend: Bullish

Ethereum Chart By Trading View

Ethereum Chart By Trading View

On the 4-hour chart, the price of Ethereum is in the bearish trend zone. On January 28, the crypto’s price fell to the low of $105.71 and the ETH price was fluctuating above the $100 price level. A bullish candlestick is breaking the 12-day EMA. If the bulls break above the EMAs and the price is sustained above it, the crypto will reach the high of $120 but will face resistance at $ 160 price level.

Meanwhile, the stochastic indicator is out of the oversold region but above the 40% range which indicates that the ETH price is in a bullish momentum and a buy signal.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research. .