Bakkt, the bitcoin futures exchange, has faced a series of roadblocks this year which has forced the team to delay their launch multiple times. Now the launch has been delayed indefinitely, as the team waits until they are granted approval by the Commodity Futures Trading Commission (CFTC). The ongoing government shutdown in the US has reportedly played a major role in the recent approval delays.

However, Bakkt is still making progress. This week, CoinDesk reported that Bakkt has launched a hiring campaign, posting eight new positions to their website.

According to the listing, Bakkt is seeking experienced developers for mobile and blockchain applications, an institutional sales manager with experience in North America or Asia; and three management positions including a director of finance, director of security engineering and director for blockchain engineering.

Bakkt was also able to secure $182.5 million in funding before their launch.

About Bakkt

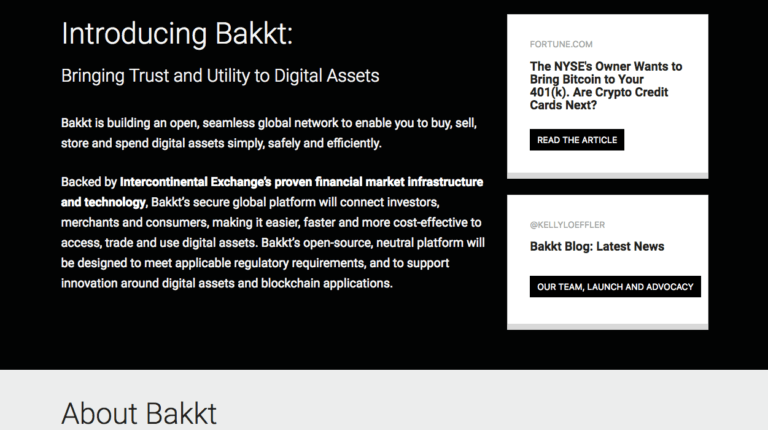

Bakkt is a platform developed and funded by the Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE). Bakkt is one of many institutional organizations from the legacy financial system to recently enter the cryptocurrency industry, but they are by far the most established and well connected. As CryptoGlobe reported late last year, Adam White, former Vice President and General Manager at Coinbase recently joined Bakkt as their chief operating officer.

The backing of regulated institutions like ICE will undoubtedly make many investors more comfortable trading cryptocurrencies. However, not everyone is excited about traditional financial institutions getting involved in cryptocurrency markets. Last year, CryptoGlobe reported that Dogecoin creator Jackson Palmer warned his followers about Bakkt specifically, suggesting that institutional influence could turn the cryptocurrency industry into “Wall Street 2.0.”