At 06:24 UTC on Monday (24 December 2018), crypto exchange Binance announced on Twitter that the exchange was launching two new trading pairs with XRP as the base/quote currency: TRX/XRP and XZC/XRP.

Here is the tweet:

#Binance Adds TRX/XRP and XZC/XRP Trading Pairshttps://t.co/8WZ26XxmZR pic.twitter.com/rtXwR4PbWa

— Binance (@binance) December 24, 2018

Here is the text of Binance’s announcement:

“Binance will add TRX/XRP and XZC/XRP trading pairs with XRP as the quote asset into the new Combined ALTS Trading Market (ALTS) at 2018/12/24 11:00 AM (UTC).

The original ETH Trading Market (ETH) will be renamed into the ALTS Trading Market, to support more trading pairs with different quote currencies.

Please note that ALTS does not represent a new coin or token. It is the symbol for Binance's new Combined ALTS Trading Market.”

As you can, trading with these two new pairs is set to be enabled at 11:00 UTC on December 24th.

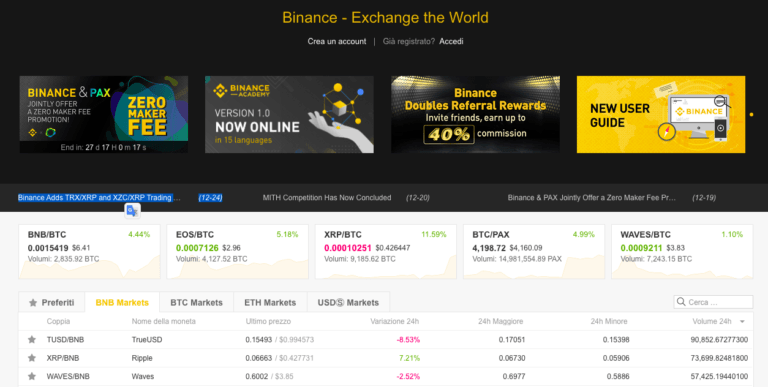

As for an expnantion of the second part of the announcement, here it goes. Binance supports four types of base/quote currencies:

- Bitcoin (BTC): the group of pairs that use Bitcoin as the base currency is referred to as “BTC Markets”;

- Ether (ETH): the group of pairs using ETH as base currency used to be called “ETC Markets”, but since more base currencies, such as XRP are being introduced, it is being renamed to “ALTS Markets”;

- Binance Coin (BNB): the group of pairs that use BNB as the base currency is called “BNB Markets”; and

- Stablecoins (USDT, TUSD, PAX, USDC): the group of pairs that use a supported stablecoin as the base currency is called “USDⓈ Markets”.

XRP fans knew they were going to receive from Binance as a Christmas or New Year present something they had been wishing for all year when the Co-Founder and CEO of Binance, Changpeng Zhao (“CZ”), sent out the following tweet around 1.5 hours earlier (at 04:56 UTC):

We will be adding a couple trading pairs with XRP as the quote currency shortly.

And rename ETH markets to ALTS market. Running out of space on the UI.

Merry Xmas!

— CZ Binance (@cz_binance) December 24, 2018

As XRP fans were cheering CZ’s tweet, they knew that “shortly” meant in the near future, but few suspected that it would be mean within the next few hours!

And in case you are wondering why CZ had chosen TRON (TRX) and Zcoin (XZC) as the first two cryptocurrencies to be supported, at 06:34 UTC, he sent out another tweet to explain that this was done “to thank TRX and XZC for supporting #Binance charity efforts.”

At press time, according to data from CryptoCompare, XRP, the second most valuable cryptocurrency, is trading at $0.4343, up 16.34% in the past 24-hour period.

Featured Image Courtesy of Binance