Ethereum Medium-term Trend: Ranging

Supply zones: $400, $450, $500

Demand zones: $150, $100, $50

ETH continues in the range in its medium-term outlook. The strong bear pressure from the bearish railroad of 21st October at $210.16 within the range continues to push the price down. ETHUSD was down to $205.01 in the demand area yesterday before a minor pullback by the bulls. The price was up at $207.34 in the supply area before the end of the session. The 4-hour opening candle at $206.56 was a bearish inverted hammer an indication that the bears may continue the downward push of price within the range.

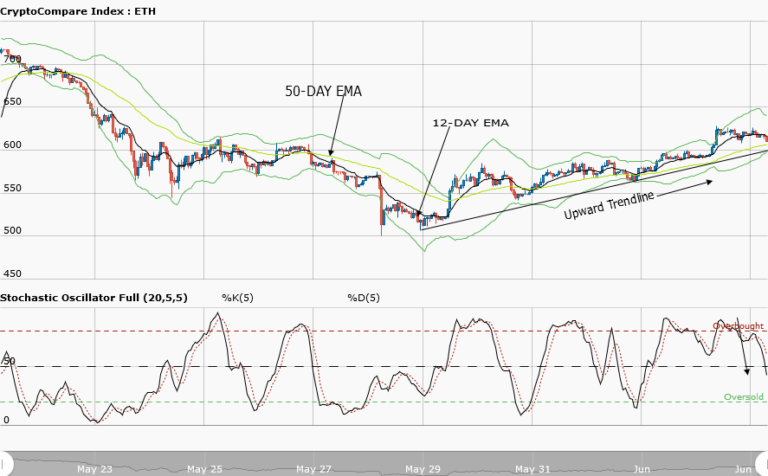

The price is below the two EMAs and the stochastic oscillator is in the oversold region at 13% and its signal points down. This suggests a bearish pressure continuation.

ETH is in consolidation and trading between $220.00 in the upper supply area and at $195.00 in the lower demand area of the range. A breakout at the upper supply area or breakdown at the lower area may occur hence patience is required to allow this to happen before a position is taken.

Ethereum Price Short-term Trend: Bearish

ETH is in a bearish trend in its short-term outlook. The bears’ pressure from the head and shoulder of yesterday’s analysis saw ETHUSD down to $205.01.

Despite a bullish 1-hour opening candle at $206.46, the bearish pressure had ETHUSD down to $205.16 in the demand area earlier today. The price is below the two EMAs and the stochastic oscillator at has its signal points down which implies downward movement in price.

$204.00 is still on the cards as the bears’ pressure increases.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research