Ethereum Price Medium-term Trend: Ranging

Supply zones: $500, $550, $600

Demand zones: $200, $150, $100

ETH continues in the range of its medium-term outlook. Bullish momentum pushed its price to $370.39 in the supply area, but its candles closed below the 10-day EMA. An inverted hammer formation saw bears return to the market.

The cryptocurrency was then led down to $362.00 in the demand area below the 10-day EMA. The bears then lost momentum as the market reject the continuation of a downward movement. The day opened with a bullish 4-hour candle at $360.39, topping yesterday’s opening at $355.63. This means more buyers are present in the market.

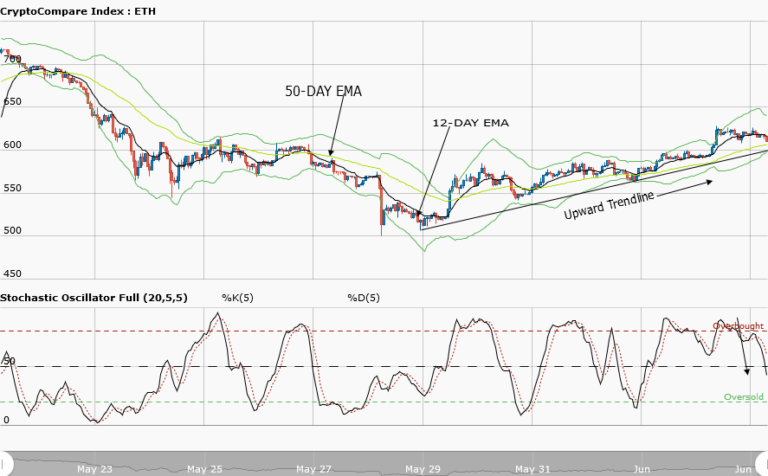

The stochastic oscillator is at 40% and its signal points up which signals upward movement for the cryptocurrency. ETH is still ranging and trading between $385.13 in the upper supply area and at $346.62 in the lower demand area of its range. Traders should be patient and wait for a breakout before taking a position.

Ethereum Price Short-term Trend: Ranging

ETH went into consolidation in its short-term outlook. Bullish momentum pushed its price from $350.83 in the supply area to $370.39 in the demand area. The formation of an evening star candle pattern saw the bears push the price down to $355.36 in the demand area

The stochastic oscillator is at 44% and its signal points up which implies upward momentum for ETH. It’s still in a range trading between $372.68 in the upper supply area and $353.53.30 in the lower demand area. Traders should be patient, waiting for either a breakout to happen before taking a position.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.