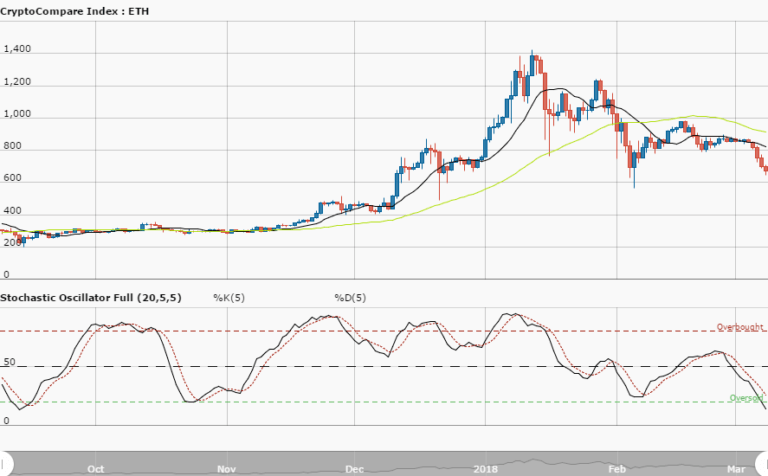

ETHUSD Long-term Trend – Bearish

Distribution territories: $800.00, $900.00, $1,000.00.

Accumulation territories: $300.00, $200.00, $100.00.

ETHUSD, after going through a tough price over a whole week, still saw another notable price decline last week. Between June 17 and 21, the cryptocurrency was moving in a range-bound at a close distance to the 13-day SMA’s trend-line. Soon after the pair managed to touch the 13-day SMA’s trend-line, a short bearish Japanese candlestick emerged on June 22. Source: CryptoCompare

Source: CryptoCompare

The bears have once again gained market advantage over the bulls’ dullish momentum. The market’s price has been fairly averaging towards the accumulation territory of $400.00.

The trend lines of both SMAs are bent southwards as the 50-day SMA is on top of the 13-day SMA. The Stochastic Oscillators have touched range 20 but are now found between the ranges of 50 and 20, now slightly pointing southward.

The bulls’ current inactivity can still come into play over the next few weeks. The bears, breaking below the April 6 bearish Japanese candlestick, can drive the price towards the accumulation territory of $300.00 or a bit below. Traders can wait for a strong price action to enter a trade along its direction by applying proper money management rules.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.