After a year-long, $4bn ICO, the anticipated EOS mainnet finally went live in early June 2018. The migration of EOS tokens from the ERC-20 standard to the independent EOS blockchain has brought with it increasing scrutiny regarding the true extent of decentralization on the EOS network.

In an effort to ensure an even spread of token holdings across investors, EOS ran a phased ICO with no hard cap.

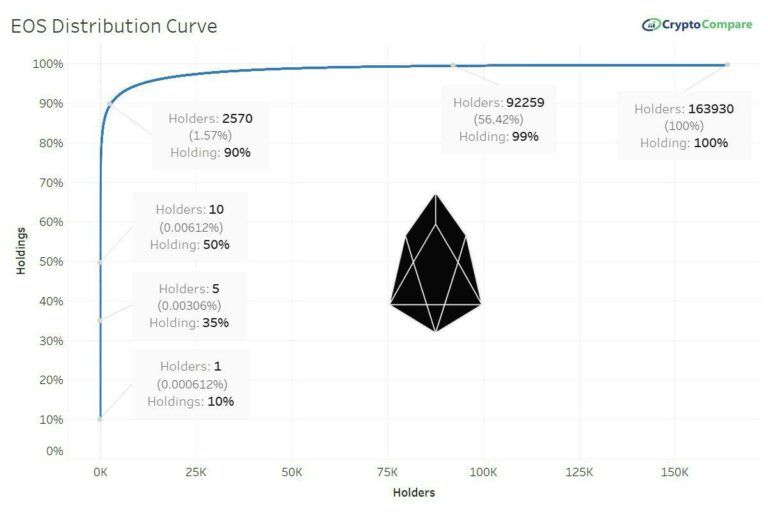

Wealth inequality on the EOS network sees the top 1.6% of token holders controlling 90% of the supply while the bottom 44% have to make do with a mere 1% of EOS.

The nature of EOS’s consensus mechanism exacerbates the centralization issue as new token supply is distributed exclusively to the delegates in the delegated proof-of-stake system. These delegates are voted in by EOS token holders, with the top 5 wallets owning a third of the tokens and therefore a third of the votes and serve as block producers on the network.

In return for their service, they are remunerated by the increasing token supply. At an estimated 5% annual inflation, the inflation pool used to reward delegates is expected to total 4.5 million EOS tokens, currently valued at $45million by the end of the year.

EOS has the highest level of centralisation in comparison to its peers. CryptoGlobe Research recently looked at the unnatural distribution of masternode coins such as DASH and NEM (see chart below), however, these cryptocurrencies are still more distributed than EOS.

As blockchains look to scale to the point of accommodating mass adoption, projects will have to find a way around the scalability trilemma. For EOS, that means preserving their platforms transaction speed and security while ensuring a fairer distribution of wealth and power on their network.