NEOUSD Medium-term Trend: Bullish

Supply zones: $80.00, $90.00, $100.00

Demand zones: $50.00, $40.00, $30.00

The bulls are back in the medium-term outlook of Neo. The bears’ pressure that started on April 30 when the price was at the $94.00 supply zone came to an end on May 18 at the $56.00 demand area.

This was with the formation of three hammer candlestick patterns at the demand area. As you can see from the chart, each touched the upward trendline, which bullishly bounced it upward. The bulls’ strong momentum on May 19 pushed the price really high above the moving averages crossover.

All of the bears’ efforts for a downward push were rejected as the 12-day EMA acted as strong resistance. The three EMAS are fanned apart which suggests strength in the context of the trend and in this case, of the uptrend.

Daily candles are bullishly above the moving averages crossover. The price maintains a higher highs and higher lows formation that is a simple uptrend characteristic. The bulls’ target in the medium term is likely the supply area at $69.00 for a possible fourth touch, which most probably will result in an upward breakout.

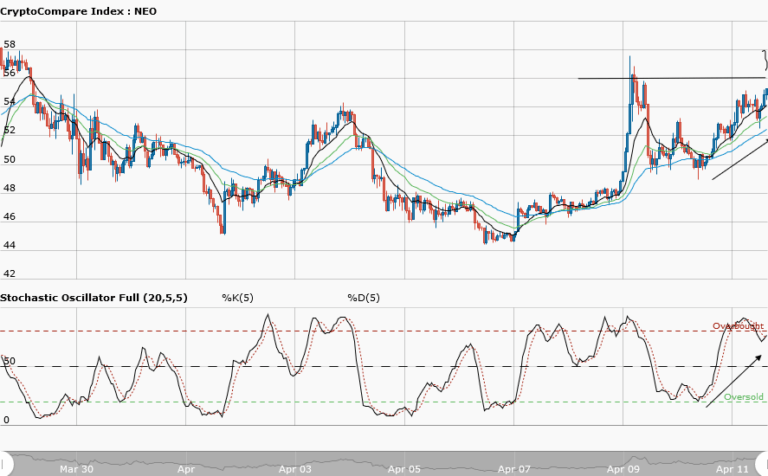

NEOUSD Short-term Trend: Bullish

Neo remains bullish in the short-term. The bears lost momentum at the $60.00 demand zone after a series of attempts to push the price down failed. The bulls’ strong comeback broke through several supply zones, and its price was pushed up to the $66.00 supply area.

The bears’ minor price pullback saw the price hit the $64.00 demand area. It was another opportunity for the bulls to come back for further upward push. The Stochastic Oscillator is pointing up, which means strong momentum and more buyer pressure. As the bullish momentum increases, more bullish candles are likely to form above the moving average crossover and new highs can be attained in the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.