NEOUSD Medium-term Trend: Bearish

Supply zones: $80.00, $90.00, $100.00

Demand zones: $50.00, $40.00, $30.00

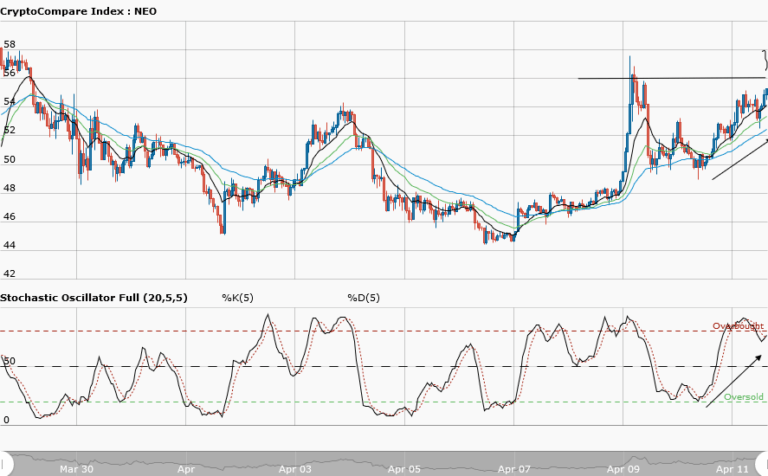

The bears are still dominating in Neo’s medium-term outlook. The bears’ pressure was really strong as they broke through the strong demand area at $59.00, at the fourth touch. They pushed the price to a new demand area at $56.60. The formation of dojis at this demand area led to the bulls’ comeback, pushing high up to the supply area at $59.50. The price was pushed below the moving averages crossover, which means further bearish pressure. The daily candle opened bearish at $57.63, lower than yesterday’s open of $61.33 which means more sellers are currently in the market. The stochastic oscillator is in the oversold region, with its signal pointing up, meaning an upward momentum will be seen, as the bulls stage a comeback. Nevertheless, this may not be for long, as a rejection to the upside will occur, setting up for the bears’ comeback. The overall outlook is bearish and the push to the $55.00 demand area is likely imminent before the main bears’ target of $50.00 in the medium-term.

NEOUSD Short-term Trend: Bearish

Neo is bearish in the short-term. The bears won the battle in the range and broke the lower demand area at $60.00. They took the price further down to a new demand area at $56.00. You can see the formation of the triple bottom in this new area. This brings the buyers back to the market and they are pushing for a higher price. The retest of the broken $60.00 area is possible as the bullish momentum increased. This should be seen as a pullback. A rejection to the upward may occur in this area, bringing back more sellers for a further bearish trend continuation.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.