XMRUSD Medium-term Trend: Bullish

Supply zones: $320.00, $340.00, $360.00

Demand zones: $180.00, $160.00, $140.00

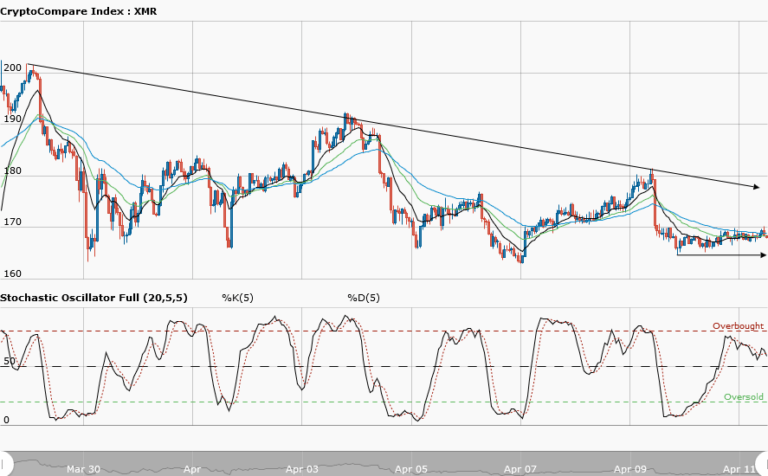

Monero remains bullish in the medium-term outlook. Today’s opening price is on a bullish note within the exponential moving average of $264.60. This area is in the buyers’ area. It means we are likely going to see high buying pressure in the pair. The diagonal trendline is very important. The price has made three touches on it. With the price advancing towards the trendline, a fourth touch is most likely, and this is going to lead to a breakout. Monero’s journey to the moon has already started. The bears’ pullbacks seem to be over. Buying at $260.00 demand area is recommended after a bullish engulfing candle formation above the three moving averages crossover. The stocastic oscillator is in the overbought region and its signal is pointing down to a downward momentum. A rejection to the downside is most likely around the 70% level for the upward trend continuation to take effect.

XMRUSD Short-term Trend: Ranging

The short-term bias for Monero is still ranging although the bulls are coming back and closing the range gap after the bears’ weakening impact. They pushed the price high to the $270.00 supply area which is the resistance level of the range. The bears couldn’t do much as the $260.00 demand area was the limit they could push the price down to. The price is moving towards the diagonal trendline and this will be the fifth time it will be touching it. It therefore implies a breakout is most probable. More bullish candles formation within the moving average will likely occur and this will see Monero comfortably above the $270.00 supply zone. A breakdown of the $250.00 demand area, which is the support level of the range is very remote. Traders should do more buying within the range, as the outlook favors the bulls.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.