Comment of the Day @lopp

My favorite theory is that Satoshi was an NSA team and the coins are sitting there as an early warning system for advances in quantum computing.

— Jameson Lopp (@lopp) February 9, 2018

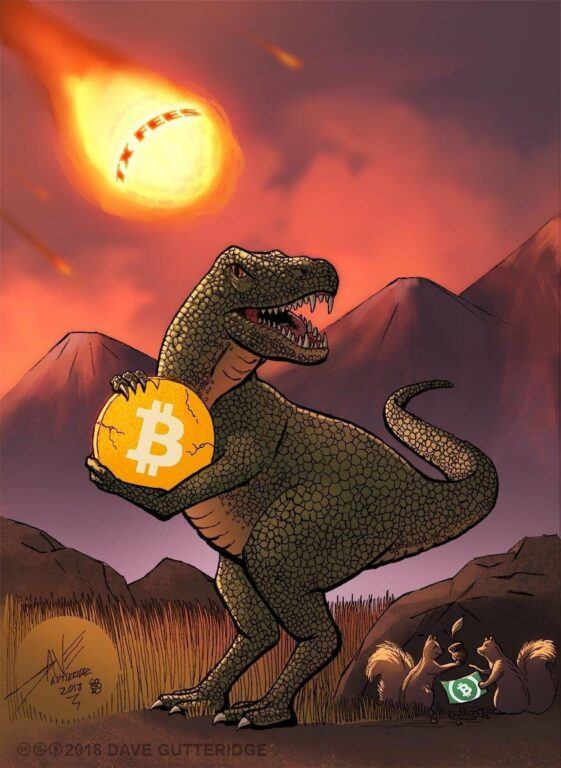

Roger Ver Insists BCH Is Bitcoin

Despite the Bitcoin mempool and average cost of transaction fees reaching 4 month lows due to SegWit adoption and lower spam attacks, Roger Ver is still insisting that Bitcoin Cash and its bigger blocks are essential for the survival of the currency. He recently tweeted a photo of a T-Rex holding a Bitcoin whilst a meteour with ‘TX Fees’ blasts to earth.

The BTC and BCH charts on Bitcoin.com were recently changed to turn the BCH houses into skyscrapers just like the Bitcoin ones. Which is a little desperate in my opinion.

His most recent tactic was to buy 50 BCH for $500,000 from an ATM provider in an agreement for the ATM provider to list BCH across all their ATMs. However customer support has been swamped with requests asking for help because they bought BCH instead of BTC and lost coins by sending them to the Bitcoin addresses. I’m all for a free market and Roger can waste his bitcoins pumping BCash, but when it comes at the expense of new crypto participants, it should be stopped.

-Where's my bitcoin?

-Sorry dummy you sent it to a bitcoin cash wallet.

-But the handsome greasy rich man said that BCash WAS bitcoin?

🙇🏻— Sartre (@CryptoSartre) February 13, 2018

Any bets how long it will take before they will remove it due to customers losing money due to confusion? Or even worse: they get sued? 🤔 other atms already removed it. https://t.co/iFFNGVN1fh

— WhalePanda (@WhalePanda) February 13, 2018

Roger has drawn a lot of flak from Twitter since the John Carvalho viral interview with Roger Ver where he rage quit and gave the middle finger. He also drew a lot of hate for going after Andreas Antanopolous. The non stop BCash shilling hasn’t drawn much support from the community either. For the man that no longer lives in the US because he sold explosives on eBay and resides in Japan, the quest for Bitcoin dominance appears doomed. He may yet become the first crypto celebrity to go off the rails…

John McAfee Apologises To Binance

There were scares that Binance exchange got hacked after Binance tweeted they were experiencing issues on their replica database cluster. This required a full resync from the master server which took a day and a half. During that time withdrawals, deposits and trading were halted which caused panic, even John McAfee joined in pushing the rumor mill.

Binance has suspended trading. The company claims that they are doing a system upgrade and will resume at 2:00 AM GMT Friday. While I have no hard evidence, rumours are flying among top crypto influencers that they may have been hacked. Will keep you informed.

— John McAfee (@officialmcafee) February 8, 2018

Binance has not been hacked. Please do not spread false information. If you want to keep updated on the status of our system upgrade you're welcome to follow @cz_binance or @binance_2017

— binance (@binance_2017) February 8, 2018

After it became apparent that there was no hack, John McAfee tweeted an apology saying he was sorry for his part in spreading the FUD and that his cyber security ‘professionalism’ took over. Ironic that professionalism took over when the man that is accused of murder and loves drugs…

I would like to apologize to Binance and to CEO Changpeng Zhao for my part in the FUD regarding their outage last week. As a long time cyber security professional, my instincts, coupled with numerous reports which were dubious in nature, overrode my better judgment. Forgive me.

— John McAfee (@officialmcafee) February 12, 2018

Credits to McAfee for apologizing to Binance, now everyone is happy. Let's keep fud out of cryptocurrency community! https://t.co/hEu5lvv9L9

— Joseph Young (@iamjosephyoung) February 12, 2018

Regardless, the apology went down very well and the Binance CEO even wants to get him a drink.

All good man! Drinks on me when we meet. https://t.co/br4vxMYZVi

— CZ (@cz_binance) February 12, 2018