Keith Gill, widely known by his online alias “Roaring Kitty,” has significantly increased his stake in GameStop. On Thursday, Gill shared a screenshot of his E-Trade portfolio on Reddit’s Superstonk forum, revealing that he now holds over 9 million shares of GameStop and more than $6 million in cash. This marks a substantial increase from his initial 5 million shares disclosed at the beginning of June, alongside 120,000 call options on GameStop.

Call options provide the right, but not the obligation, to purchase shares at a predetermined price before a specific expiration date. It remains unclear how Gill maneuvered to his current position. He might have sold all 120,000 call options and used the funds to acquire more shares or sold a portion and exercised the rest early.

As CNBC reported, there was a significant uptick in trading volume on Wednesday afternoon for GameStop call options with a $20 strike price and a June 21 expiration date, identical to those held by Gill. This activity, coupled with a decline in GameStop’s share and call option prices, led to speculation that Gill had begun liquidating his options.

Exercising all his call options would have required approximately $240 million to buy 12 million shares at $20 each, far exceeding the amount shown in his E-Trade account. Despite the swirling speculation, Gill has not commented on the situation.

As of Thursday evening, the total value of Gill’s portfolio, including cash, was over $268 million, up from $210 million at the beginning of the month. GameStop’s shares saw a surge of more than 14% on Thursday.

Adding intrigue to Gill’s strategy, a report from Fortune published earlier today speculates that he might have broader ambitions beyond merely profiting from his trades. The article suggests that Gill could be positioning himself to exert influence over GameStop’s transformation by seeking a seat on the company’s board. This speculation arises as Gill’s recent update on Reddit disclosed that he has made $58 million since the start of the month, reflecting his significant financial gain and potential interest in a more active role within the company.

Meanwhile, GameStop’s annual shareholder meeting faced significant technical issues and was postponed. As CNBC explained, the meeting, which was scheduled to start at 11 a.m. ET on Thursday and to be hosted on ComputerShare, was disrupted due to server crashes caused by overwhelming interest. Many attempting to access the event received error messages, a problem confirmed by posts on social media and CNBC’s attempts to join the stream.

The meeting was briefly brought to order but was immediately adjourned due to these technical difficulties, with plans to reconvene at 12:30 p.m. ET on Monday. GameStop and ComputerShare representatives confirmed that the servers were overwhelmed by the high volume of traffic and were unprepared for such a surge.

Additionally, GameStop announced earlier in the week that it had raised over $2 billion through a recent equity sale, capitalizing on the revived interest in meme stocks. The company plans to use these funds for general corporate purposes, potentially including acquisitions and investments.

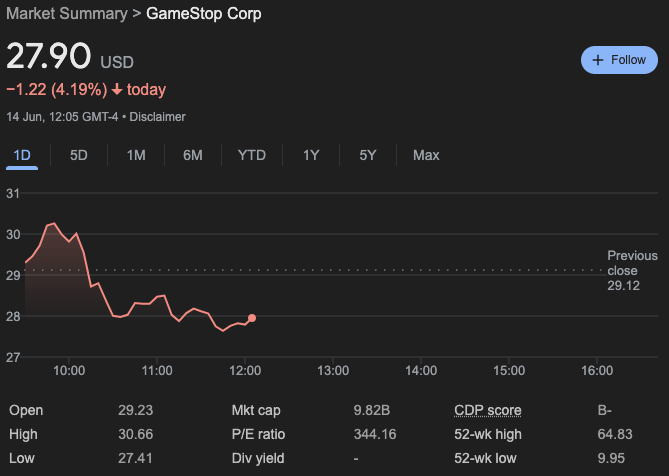

Currently (as of 11:05 a.m. ET on Friday), GameStop shares are trading at $27.90, down 4.19% on the day.

Featured Image via YouTube (Roaring Kitty’s Channel)