CoinShares, a prominent European alternative asset manager with a focus on digital assets, released its latest Digital Asset Fund Manager Survey on April 24, 2024. This edition is particularly notable as it follows the recent approval of U.S. spot Bitcoin ETFs, providing fresh insights into investor attitudes and allocations within the digital asset space.

The survey gathered data from 64 respondents who collectively manage $600 billion in assets, offering a substantial look into the trends and shifts in digital asset investment strategies among institutional players.

Key Findings from the CoinShares Digital Asset Fund Manager Survey

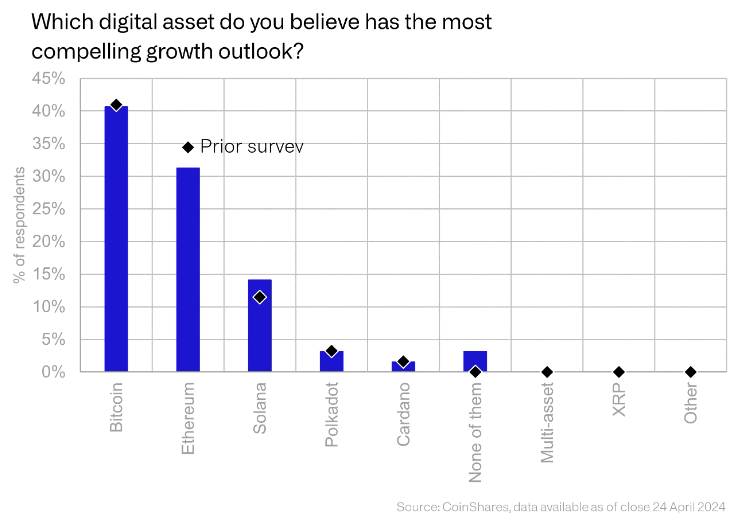

Bitcoin Retains Its Leading Position

Bitcoin continues to be the most favored digital asset among the surveyed investors. According to the survey, 41% of respondents believe Bitcoin offers the most compelling growth outlook.

Increased Digital Asset Weightings in Portfolios

The survey indicated a significant rise in the allocation of digital assets in investor portfolios, increasing from 1.3% to 3%. This is the highest level since the survey’s inception in 2021, with the previous peak being 1.7% in November 2021. The increase is largely attributed to institutional investors who have begun incorporating Bitcoin into their portfolios through the newly available U.S. ETFs.

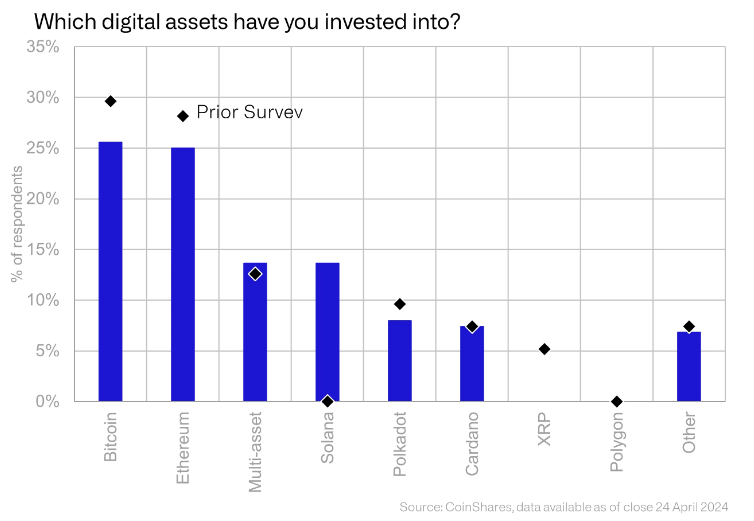

Diversifying into Altcoins

Investors are not just sticking to Bitcoin and Ethereum; there’s a notable shift towards diversifying into altcoins. Solana, in particular, has seen a remarkable increase in allocations, likely driven by large investments from a few key players.

In contrast to the growing interest in some altcoins, XRP has experienced a significant downturn, with none of the respondents currently holding this asset. This shift could reflect broader market sentiments or reactions to regulatory uncertainties surrounding XRP.

The Draw of DeFi and Distributed Ledger Technology

When asked about their reasons for adding digital assets to their portfolios, many investors cited the appeal of distributed ledger technology. Despite the price increases since January, an increasing number of investors view digital assets as good value, driven by client demand and positive price momentum. However, the focus on investing solely for diversification purposes has seen a decline.

Barriers and Risks in Digital Asset Investment

Despite the growing interest and increased allocations, significant barriers remain for certain investor cohorts, especially within the wealth management and institutional spaces. Regulatory concerns continue to be a major hurdle, as corporate restrictions and the interpretation of regulatory guidelines restrict broader adoption.

Moreover, while issues like volatility and custody concerns are decreasing, regulatory and political risks still dominate the landscape, posing challenges for both potential and current investors.

Featured Image via Pixabay