On April 2, David Spika, Chief Market Strategist at Turtle Creek Wealth Advisors, shared his insights on CNBC’s “Power Lunch” regarding the investment dynamics between Bitcoin and gold, especially against the backdrop of the current fiscal situation in the US and global economic conditions.

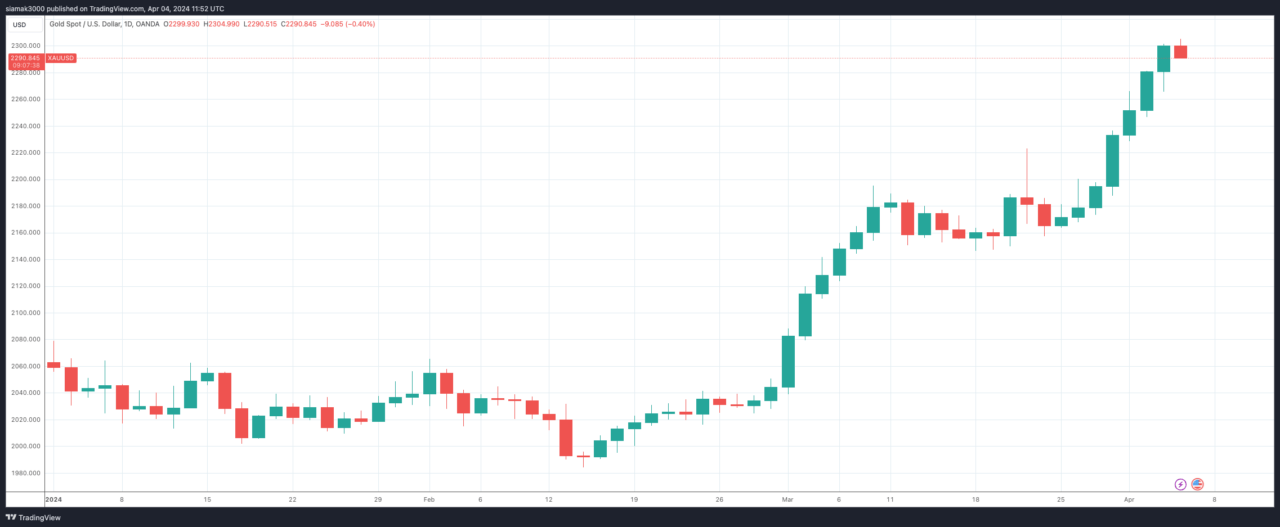

Spika opened by addressing the anomaly in gold’s performance amidst expectations of a soft landing and a favorable stock market rally. He attributed gold’s resilience partly to the fiscal situation in the US, including the near $2 trillion deficit and the burgeoning total debt, projected to hit $40 trillion. He believes this scenario makes gold an attractive investment, overshadowing Bitcoin and fiat currencies like the dollar for prudent investors:

“Gold is a great place to invest… especially if I see that the US is going to run another close to $2 trillion deficit.“

Spika cautioned, however, that a sustained rally in the stock market and a true soft landing would typically not favor a gold rally, suggesting that gold’s current strength might signal underlying economic concerns.

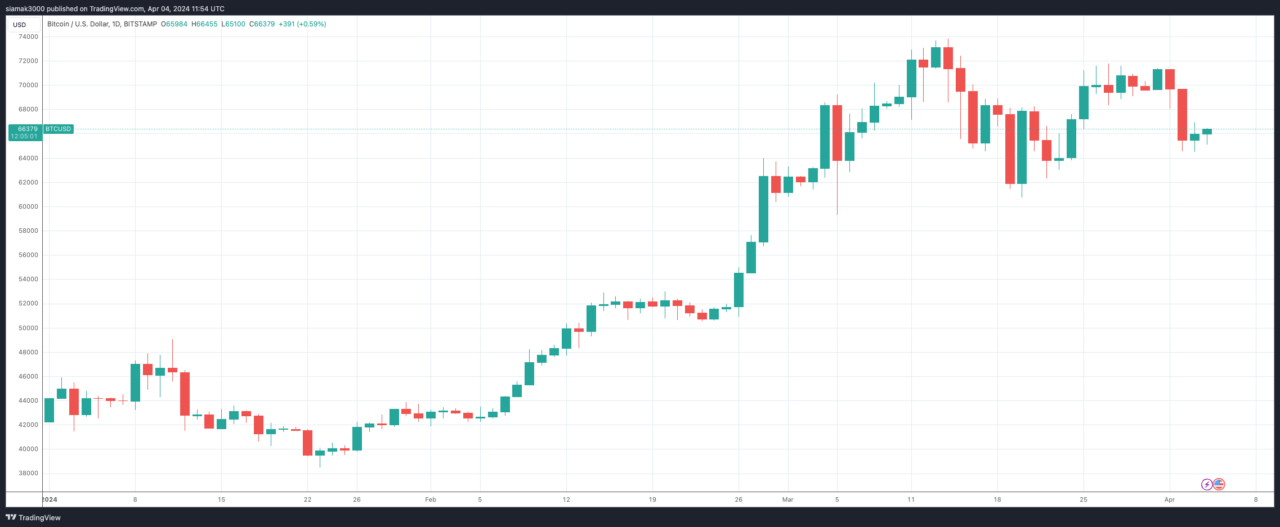

Turning to Bitcoin, Spika categorically classified it as a risk asset, dismissing the notion of it being “digital gold” or a viable substitute for fiat currencies. He argued that Bitcoin thrives in environments of high liquidity and risk appetite but struggles as liquidity tightens, such as during tax season. Spika was skeptical of Bitcoin serving as a safe haven or a hedge against fiscal irresponsibility, countering the core argument of Bitcoin bulls.

He anticipated that Bitcoin’s role and volatility could fundamentally change only if and when it comes under the regulation of central banks worldwide:

“At some point in time, if cryptocurrency becomes regulated by the central banks… it won’t be nearly as volatile.“

In response to a query about Chinese consumer investment trends, Spika acknowledged the traditional affinity for gold but highlighted the competitive pressure from the stock market and other investment vehicles. He conceded that central banks might temporarily view gold as a preferable reserve to US dollars and Treasuries due to the US’s daunting fiscal outlook and rising rates. However, he maintained that the US Treasury Market’s unmatched liquidity ensures continued demand for treasuries, limiting gold’s potential to significantly disrupt the dollar’s dominance.

He said:

“I can see central banks around the world looking at gold as an alternative at least in the short term to the US dollar and treasuries … Gold will take a piece of [the reserves] but I don’t think that really is a threat to the US Treasury Market or the dollar in general.“

Featured Image via Pixabay