As we navigate through 2024, gold remains a beacon of stability amid a tumultuous global backdrop characterized by geopolitical conflicts and economic fluctuations.

According to a report by CNBC published on 16 April 2024, Goldman Sachs has recently reaffirmed its confidence in gold, terming the market as an “unshakeable bull market.” The firm has raised its year-end gold price target from $2,300 to $2,700 per ounce.

The CNBC report went on to say that Citi notes that the recent rally in gold prices has been driven by the ongoing geopolitical tensions, particularly those affecting the Middle East. This has coincided with record levels in equity indexes, suggesting a shift in investor preference towards safer assets. Citi projects that these factors could push gold prices even higher, potentially reaching $3,000 per ounce over the next 6 to 18 months.

In contrast, according to an article by Kitco News published on 15 April 2024, Caroline Bain from Capital Economics provides a more cautious analysis. She predicts that the recent peak in gold prices may represent a high-water mark for 2024, expecting a retraction to $2,100 per ounce by year’s end. Bain attributes this anticipated correction to the misalignment of gold prices with the current interest rate outlook, which suggests rates might remain higher for longer due to strong U.S. employment figures and inflation trends:

“The 16.5% surge in the gold price since the start of the year appears increasingly out of kilter with the interest rate outlook … Indeed, the strong US employment report last Friday and Wednesday’s March CPI print, which arguably suggested rates could be higher for longer, coincided with rises in the gold price, while Treasury yields and the US dollar also rose.“

Bain also points out that while geopolitical uncertainty has bolstered gold’s appeal, this trend may not be sustained. She highlights that despite the surge in gold, other safe havens have not seen comparable strength, and there have been persistent outflows from European gold ETFs. She added that as the demand for physical bullion, particularly in China, has driven prices up, but this demand is expected to weaken as market conditions stabilize:

“Chinese investor interest in gold is not so surprising given that potential investment opportunities in China have narrowed given the downturn in property valuations and plunge in equity prices there over the past couple of years … That said, we expect the Chinese frenzy around gold to eventually fizzle out, and for the more traditional drivers of prices to take up the reins later in the year. In part, this view is based on our forecast that Chinese equities will partially recover in the coming year.“

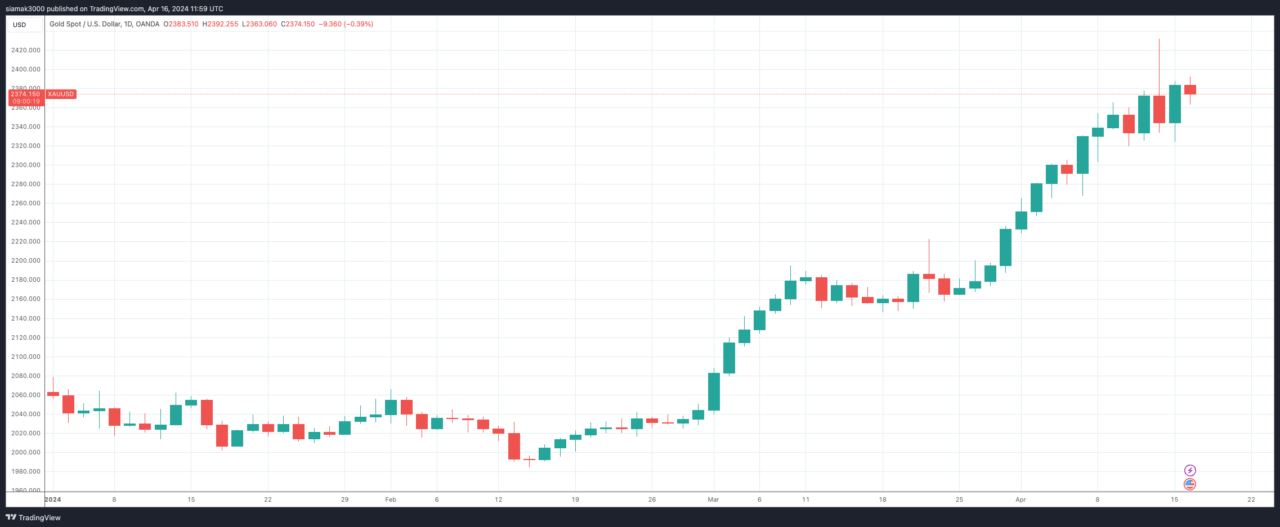

Gold is currently (as of 12:00 p.m. UTC on 16 April 2024) trading at $2374.14, down 0.39% on the day.

Featured Image via Unsplash