In an interview on April 9, 2024, with Sonali Basak from Bloomberg TV, Marathon Digital (NASDAQ: MARA) CEO Fred Thiel shared his extensive insights into the evolving landscape of Bitcoin mining and the anticipated impacts of the upcoming Bitcoin halving (expected around April 20).

Bitcoin Price and ETFs Influence: Thiel believes the U.S. SEC’s approval of spot Bitcoin ETFs in January has significantly influenced the cryptocurrency market. According to him, the successful launch of these ETFs has attracted considerable capital into the market, potentially accelerating the price appreciation that typically follows a halving event. He said, “I think the ETF approval, which has been a huge success, has attracted capital into the market and essentially brought forward what could have been the price appreciation we typically would have seen three to six months post-halving.”

Marathon’s Strategic Moves: To optimize operations ahead of the halving, Marathon Digital has shifted from an asset-light model to acquiring more control over its mining facilities. Thiel explained that previously, the company relied on third-party services for infrastructure but now owns over 53% of its facilities. This transition allows Marathon to reduce costs and improve efficiencies by eliminating the middleman.

Cost of Mining and Operational Efficiency: Thiel shared that Marathon’s average cost to mine one Bitcoin is in the low $20,000 range, which includes energy and operational overhead. With the halving, he anticipates this cost will effectively double due to increased energy requirements per Bitcoin mined, although the operational expenses, such as personnel, remain unchanged.

International Expansion and Technological Innovations: Looking ahead, Thiel revealed plans for international expansion to diversify Marathon’s operational base and reduce reliance on any single geopolitical area. He also emphasized Marathon’s investment in a vertically integrated technology stack and innovative cooling technologies, which could have applications beyond cryptocurrency mining.

Sustainability and Future Outlook: A significant part of the interview focused on the sustainability of mining operations. Thiel introduced an intriguing concept of “energy harvesting,” which involves using methane gas from landfills, biomass from various industrial processes, and other sources to power mining operations. This approach apparently not only reduces the cost of energy but also leverages the heat generated from mining to serve industrial needs, creating a symbiotic relationship between crypto mining and other industries.

Impacts of the Halving: The halving will reduce the daily Bitcoin emissions, which poses challenges and opportunities for miners. He said, “The halving event will reduce the supply of Bitcoin by about 450 a day, the new emissions of Bitcoin, which will have some small impact on price most probably. But as miners, we’re very excited to go into a halving where, for once, the price has not declined prior to the halving but rather has gone up.” Thiel anticipates that less efficient miners may struggle, potentially leading to acquisitions and further consolidation in the industry. He also expects this will spur technological advancements and operational optimizations among surviving firms.

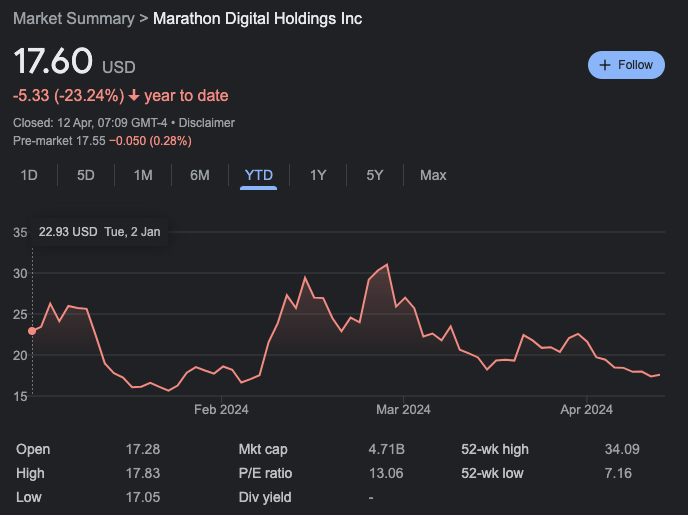

On 11 April 2024, Marathon Digital shares closed at $17.60, down 23.24% for the year-to-date period.

Featured Image via Pixabay