CCData serves as a leading provider of digital asset data and indices. They meticulously collect real-time and historical market data from a vast network of global cryptocurrency exchanges. This comprehensive data encompasses prices, trading volumes, order book information, and various other metrics crucial for understanding the ever-changing dynamics of numerous digital assets. CCData prioritizes the accuracy and reliability of this information for the benefit of its clients.

Beyond data collection, CCData specializes in developing and calculating highly granular crypto indices. These indices act as benchmarks for different market segments, providing valuable insights for investors. CCData adheres to transparent, rules-based methodologies to ensure the accuracy and consistency of their indices. They offer a diverse range of indices catering to various investment strategies, from those tracking overall market capitalization to ones focused on specific sectors or broader themes within the cryptocurrency landscape.

CCData also plays a role in expanding the cryptocurrency investment ecosystem. They collaborate with financial institutions to design and license their indices for use within ETFs, derivatives, and other investment products. This partnership provides investors with structured ways to gain exposure to specific areas of the crypto market. Additionally, CCData offers customized index solutions tailored to meet clients’ unique investment needs.

To make their data easily accessible, CCData provides developers and financial institutions with robust APIs (Application Programming Interfaces). These APIs empower clients to seamlessly integrate real-time and historical market data into their own trading platforms, research tools, and risk-management systems. Through their comprehensive data, transparent indices, and accessible data solutions, CCData facilitates informed decision-making for investors, traders, and researchers. They contribute to greater transparency and standardization within the dynamic cryptocurrency space.

On March 4, CCData released the February 2024 edition of its Digital Asset Management Review (DAMR). This report provides a comprehensive overview of the global digital asset investment product landscape, focusing on key developments across various product types. It aims to track the adoption of these products by analyzing metrics such as assets under management, trading volumes, and price performance, offering valuable insights for investors and market observers alike. This research report has revealed several key crypto market insights.

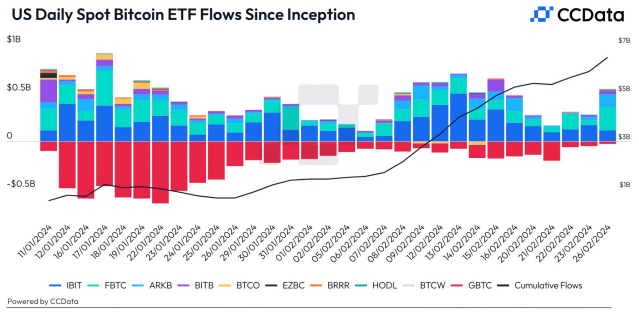

U.S. Spot Bitcoin ETFs experienced a surge in momentum throughout February, accumulating a total of $6.03 billion in inflows by the 26th. This uptick in total inflows corresponds with a significant reduction in Grayscale’s outflows, which, after increasing in January, dropped to a record low of $22.4 million on February 26th. Contributing to these inflows is the rise in BTC’s price, which hit a peak of $59,502 (up to February 28th). The optimistic market sentiment is largely driven by BlackRock’s iShares and Fidelity’s FBTC ranking among the top 10 ETFs by inflows according to Bloomberg data, with impressive inflows of $6.02 billion and $4.23 billion respectively, recorded up to February 26th.

The report also notes a surge in trading volumes, with the average daily aggregate trading volumes reaching $1.86 billion in February, a 14.85% increase from the previous month. This growth reflects the positive market reception of spot Bitcoin ETFs in the U.S., with major players like BlackRock’s IBIT, Fidelity’s FBTC, and Ark & 21Shares’ ARKB contributing significantly to the volume. VanEck’s HODL ETF stood out with a remarkable 2000% increase in trading volumes, totaling $584 million and marking the largest volume growth in February.

The U.S. has experienced an unprecedented increase in assets under management (AUM), reaching a record $40.7 billion and accounting for 83.1% of the total AUM for BTC-traded products. This level of AUM has not been seen since November 2021, when Bitcoin reached its previous all-time high. The DAMR report attributes this growth to substantial inflows and a preference among U.S. funds for lower fees, leading some asset managers to shift their investments from Canadian ETFs with higher fees.

As the market continues to mature, numerous firms are eagerly awaiting the verdict on spot Ethereum ETFs. In February, Franklin Templeton made a strategic entry into the spot Ethereum ETF race, while ARK 21Shares updated its ETF applications to include a cash redemption structure. This move aligns with the SEC’s preferences, as demonstrated in the approval process for spot Bitcoin ETFs.