The crypto market continues to expand rapidly, with Bitcoin reaching unprecedented heights and the overall capitalisation exceeding $2.37 trillion. This growth aligns with the impending implementation of the MiCA regulation, scheduled to come into effect on June 30, 2024, followed by another phase on December 30, 2024. These regulations are designed to enhance credibility and transparency, promoting broader adoption of cryptocurrencies.

With over 20,000 coins and tokens and a user base surpassing 300 million traders, the crypto market is increasingly attractive compared to the FX market, which offers 128 currency pairs and serves around 50 million traders. This rising appeal is driven by diverse applications in finance, fintech, payments, and other sectors, introducing innovative business models through technologies like L2 solutions and blockchain protocols.

To meet the growing demand for crypto trading, brokerages are actively seeking solutions to enter this lucrative market. In response, B2Broker has introduced the B2Trader Brokerage Platform (BBP), an advanced crypto spot broker solution tailored to help businesses capitalise on this growing trend and quickly generate revenue.

Who Benefits from B2Trader?

B2Trader offers a robust solution for various entities, including crypto brokers (CFD and Derivatives), OTC brokers, FOREX brokers, multi-asset and multi-market brokers, market makers, liquidity providers, payment systems, and banks. Here’s how each sector can leverage BBP:

FOREX Brokers

FX brokers can exclusively offer crypto spot trading by integrating B2Trader alongside traditional CFD trading platforms such as MT4, MT5, and cTrader. This addition attracts a new segment of crypto traders interested in physical ownership over margin trading or CFDs, facilitating revenue generation through commissions, markups, and effective risk management. Additionally, BBP provides a solution for regulated FX brokers to separate digital asset trading under a distinct license, promoting strategic diversification and competitive benefit.

Crypto Brokers

Brokers specialising in crypto CFDs, utilising crypto as collateral, and offering a blend of FX and crypto CFDs can enhance their existing solutions with crypto spot trading capabilities. The absence of crypto spot trading options may prompt clients to seek services elsewhere, making integration of B2Trader a strategic advantage for brokerages to adapt to market trends swiftly, fulfil the demand for crypto spot trading, and meet client expectations.

Market Makers

B2Trader enables market makers to access multiple exchanges, consolidate liquidity efficiently, achieve competitive spreads, optimise pricing, and allow smart routing execution across various sites.

Liquidity Providers

Adding cryptocurrencies to asset offerings can significantly enhance appeal to brokers, hedge funds, and professional traders. B2Trader streamlines this process, equipping providers with essential tools to expand market reach and accelerate earnings.

EMIs, Payment Systems, and Banks

B2Trader empowers EMIs, PSPs, and banks by facilitating varied asset management, monitoring, and liquidity pool creation. It enables these entities to incorporate crypto services into existing operations, conduct net transactions, offer crypto accounts, and facilitate instant swaps.

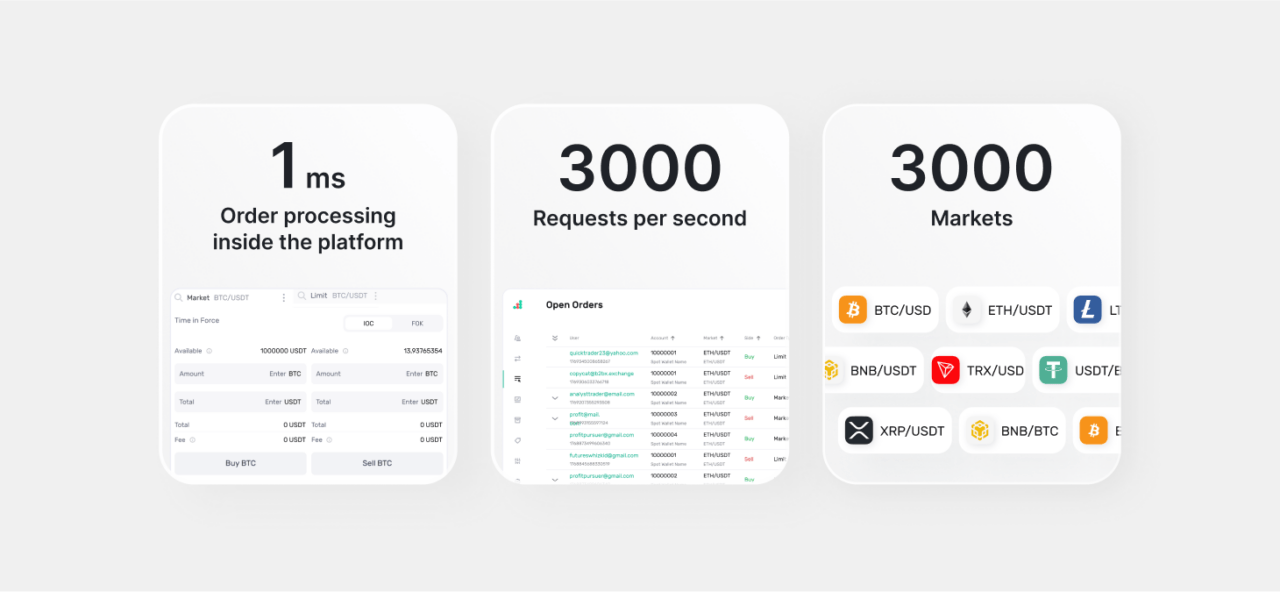

BBP unlocks limitless opportunities as a gateway to embracing crypto and its prosperous trends. With its extensive API and complete set of essential components and modules, B2Trader seamlessly integrates into any business model, ensuring high speed, high efficiency, and high-tech performance. It handles 3000 trading instruments and processes up to 3000 requests per second, offering real-time market data updates every 100 ms and ultra-fast order performance starting from 1 ms.

Implementing Modernisation: The Path of B2Broker

Arthur Azizov, CEO and Founder of B2Broker, stated:

“Today, B2Broker is a leading name in the FinTech industry. We began operating in the FOREX industry in 2014 and have been developing solutions for the crypto industry since 2017. B2Broker has earned multiple awards and recognitions, and our years of experience have allowed us to understand what the market needs exactly.

That’s why we created B2Trader. It’s our answer to the changing trends in finance. We poured 18 months of hard work and $5 million into B2Trader. BBP is built by our dedicated in-house team of 40 engineers, each contributing to a solution that truly meets the demands of today’s brokers. In the next 12 months, we are planning to double the team and enhance our offerings even further!”

Revolutionary Technology Stack

BBP arranges reliability, scalability, and security, leveraging the latest tools and protocols. Presented on AWS for reliable infrastructure, BBP lessens hardware risks. It utilises MongoDB and Amazon Redshift for data management, integrating TradingView for market insights. Kubernetes and Docker simplify scalable deployments, while CloudFlare provides DDoS defence. The FIX protocol enhances B2Trader’s productivity and trustworthiness.

Advanced Integrations

B2Trader, powered by B2Broker, offers robust integrations, including a trading platform, OMS, pre-trade and post-trade control, liquidity management system, Trading User Interface, CRM, back office, blockchain wallets for processing and collecting coins/tokens, blockchain management system for automatic payouts and settlements, mobile applications, technical documentation, REST and FIX API protocols, advanced White Label options, and more.

United with Marksman, a crypto liquidity supply engine, B2Trader modernises administration and ensures access to the latest market data. With Marksman, crypto brokers easily link to top exchanges, generate diverse liquidity pools, and establish failover protocols.

B2Trader is available as a turnkey solution or for integration with any CRM via REST API. Future customers can contact account managers, receive a free demo, and introduce their crypto spot broker within a week.

Contacts:

+44 208 068 8636