Bitcoin is currently trading at $43,200 after rising more than 4% over the past week, with the launch of spot Bitcoin exchange-traded funds (ETFs) in the US having helped its price rise exponentially last year. Analysts currently believe BTC may nevertheless keep going,to surpass $122,000 next year.

According to a panel of experts surveyed by Finder, the price of the flagship cryptocurrency is, based on the average prediction of the panelists, expected to be at a new al-time high of $77,423 by the end of this year, and turn to $122,688 by the end of 2025 and a whopping $366,935 by 2030.

Bitcoin fell below the $40,000 mark shortly after the launch of spot Bitcoin ETFs, pressued by significantly outflows from Grayscale’s Bitcoin Trust, which converted into a spot Bitcoin ETF while new funds from BlackRock, Fidelity, Invesco, and others launched offering exposure to BTC.

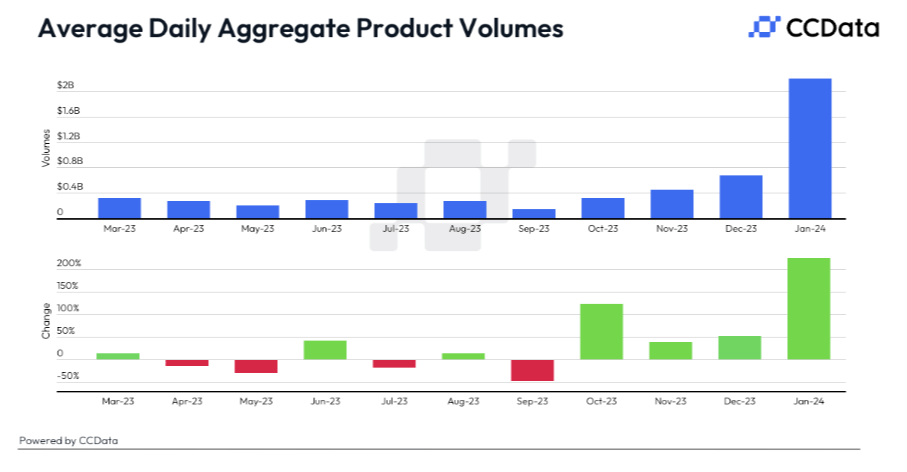

According to CCData’s latest Digital Asset Management Review report, the average daily trading volumes in the cryptocurrency investment product space hit a new high of $2.19 billion last month after four consecutive months of growth. The rise was linked to the introduction of spot ETFs in the US, along with improving market sentiment.

Finder’s panelists have notably raised their BTC price predictions from previous surveys, predicting for the first time a rise above $100,000 by 2024 and above $300,000 per coin by 2030.

Kadan Stadelmann, CTO of Komodo, attributed Bitcoin’s “potential to reach $80,000 in 2024” to several factors, including major companies and institutional investors showing growing interest in the cryptocurrency, the launch of spot Bitcoin ETFs, and the upcoming Bitcoin halving event, which will reduce the coinbase reward miners receive from 6.25 BTC to 3.125 BTC per block.

Not every expert was as bullish, however. University of Canberra Senior Lecturer John Hawkins said that if spot BTC ETFs are popular “there could be a temporary price increase,” but said that he sees BTC as a “speculative bubble” in the medium to longer-term.

Featured image via Unsplash.