Chris Burniske, a Partner at the crypto-focused venture capital firm Placeholder, recently shared his insights on the current state and future trajectory of the cryptocurrency market on social media platform X (formerly known as Twitter). With Bitcoin hovering around the $40K level, Burniske provided a comprehensive analysis of the market’s direction, highlighting several key points.

Here are the main highlights from Burnikse’s analysis:

- Expectation of Further Decline: Burniske anticipates that the crypto market will consolidate further and drop lower than most people expect. He attributes this to a variety of factors, which, due to their complexity, he did not detail in his social media post. These factors include crypto-market specific elements, macroeconomic conditions, adoption rates, and new product development.

- Market Denial and Sobriety: He observed a sense of denial in the market, likening it to partiers who are yet to sober up. Burniske noted the prevalence of ‘drunkenness’ in market behavior over the past month, suggesting that a period of reckoning is due.

- Bitcoin’s Potential Low Points: In his view, Bitcoin is likely to drop to at least $30-36K to reach a local bottom. He also mentioned the possibility of Bitcoin testing mid-to-high $20K levels before the market can genuinely start moving towards previous all-time highs (ATHs).

- Volatile Path Ahead: Burniske warned of a volatile path to recovery, including potential market fakeouts. He expects this process to unfold over several months.

- Patience as a Virtue: Emphasizing patience, Burniske suggested that if his predictions hold, other cryptocurrencies might experience a more significant percentage drop than Bitcoin.

- Long-Term Market Outlook: Despite his short-term bearish outlook, Burniske remains optimistic about the long-term trend. He recalled calling the cycle bottom in November 2022 and continues to believe in the robustness of the long-term market trend. His current comments are focused on a local top and bottom, not a cycle-wide top and bottom.

- Market Parabolas and Macro Conditions: He pointed out that the market has recently seen its first parabolas of the cycle, which are now breaking. Additionally, he expressed concerns about precarious macroeconomic conditions.

- New Product Development: While acknowledging that new product innovations in the crypto space are close, he believes they are not quite there yet, and the market still feels insular.

- Personal Investment Stance: Burniske clarified that he is not majorly de-risking his investments but is instead being more cautious and strategic – “counting my bullets and sharpening my blade.”

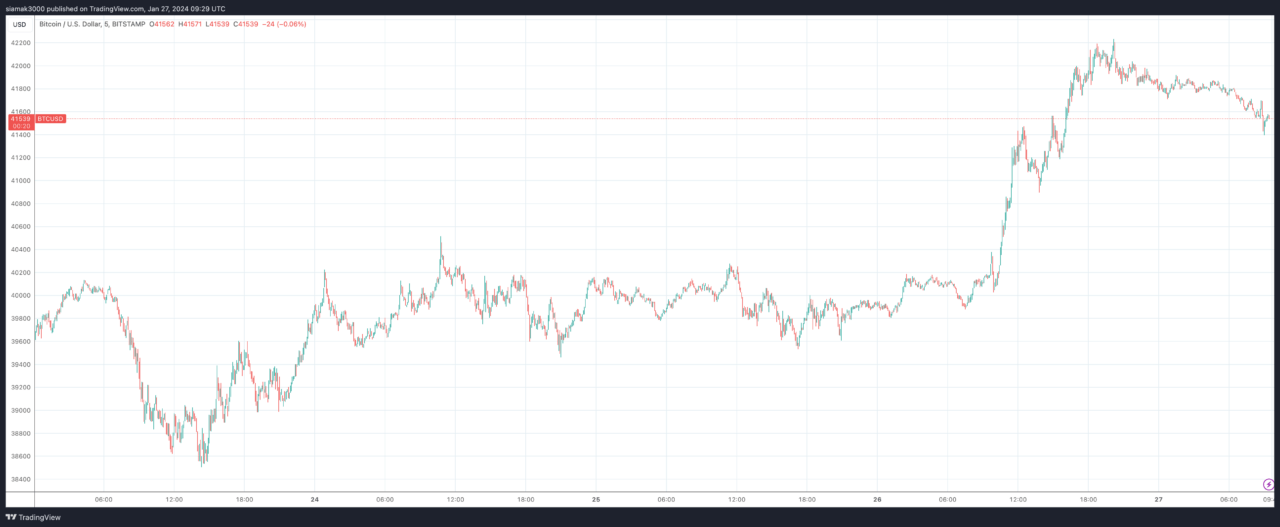

Bitcoin is currently trading at around $41,548, up 3.73% in the past 24-hour period.

Featured Image via Pixabay