CCData has established itself as a pivotal entity in the realm of digital asset exchange evaluation. Since its inception in 2019, the organization has been instrumental in setting benchmarks for assessing the risks associated with cryptocurrency exchanges. Their work is recognized as the industry standard, providing a comprehensive overview of the trading landscape through meticulous analysis of a wide array of trading venues, including spot, derivatives, and decentralized exchanges.

The Exchange Benchmark report by CCData is not just another document; it’s a critical tool that brings clarity and transparency to the digital asset exchange space. In a post-FTX world where trust is scarce and scrutiny is high, CCData’s report stands out with its robust methodology that incorporates over 200 qualitative and quantitative metrics. This methodical approach has garnered the trust of heavyweight industry players, such as VanEck, which relies on CCData’s benchmarking for its Bitcoin Trust ETF application. The report’s influence is further amplified by strategic partnerships with organizations like Ciphertrace by Mastercard, GBBC Digital Finance, TokenInsight, Hexagate, and VASPnet, enhancing its regulatory insights.

According to CCData’s press release, the latest iteration of the Exchange Benchmark reveals significant strides in the cryptocurrency exchange industry, particularly in the wake of FTX’s collapse. Here are the key findings:

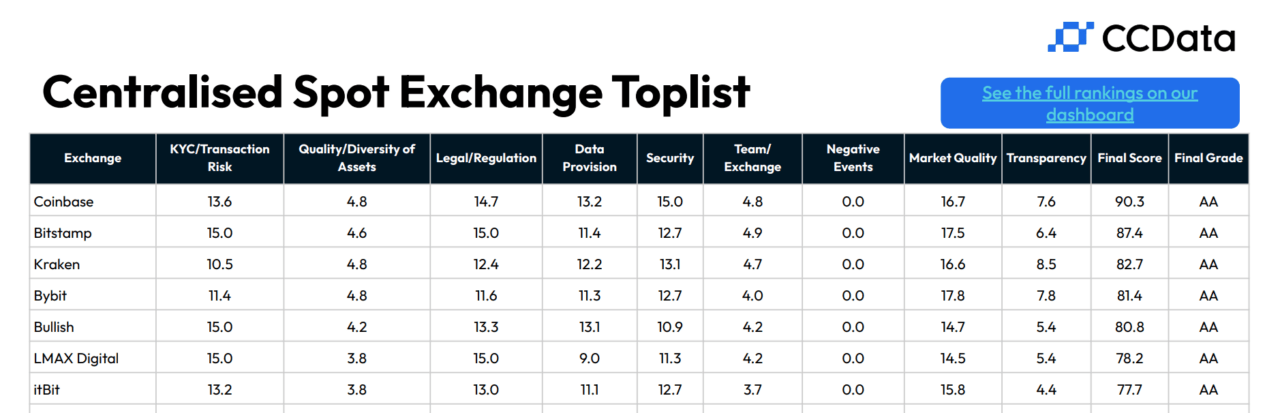

- A select group of seven exchanges, with Coinbase, Bitstamp, and Kraken at the helm, have achieved the coveted AA grade, signaling a leap forward in exchange standards.

- Coinbase has emerged as the frontrunner in the Centralised Exchange benchmark, boasting the highest security rating and dethroning Bitstamp from the top spot.

- In the derivatives exchange category, 8 out of 27 platforms have been awarded a Top-Tier (BB+) rating, with OKX leading the pack and Bybit also securing an AA grade.

- Uniswap stands alone with an AA rank among decentralized exchanges, recognized for its superior security and liquidity, followed by Curve, dYdX, and GMX.

- Regulatory compliance is on the rise, with 75 out of 107 centralized exchanges now holding regulatory licenses, as per VASPnet data.

- Exchanges are upping their game in Know Your Customer (KYC) practices, with the average KYC score reaching 3.2 out of 4, a notable increase from 2.8 just six months prior.

CCData’s CEO, Charles Hayter, underscores the intensified regulatory focus and the corresponding advancements made by exchanges to meet these elevated standards. The report reflects the industry’s commitment to enhancing operational quality, security, and compliance.

Coinbase’s Head of Institutional Product, Greg Tusar, echoes this sentiment, expressing pride in achieving the top grade in CCData’s benchmark and reaffirming Coinbase’s dedication to trust, security, and compliance.

The Exchange Benchmark is updated bi-annually, keeping pace with the dynamic infrastructure and regulatory shifts in the digital asset sector. The rankings from this report also feed into CCData’s CCCAGG Index, a trusted source for the true market price of digital asset pairs, which only includes data from ‘Top-Tier’ rated exchanges.

You can download the latest edition of CCData’s Exchange Benchmark report here.