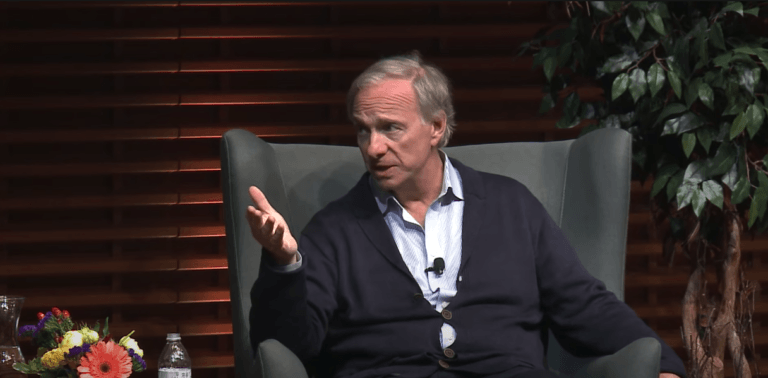

In an appearance on CNBC’s “Squawk Box” earlier today, Ray Dalio, the founder of Bridgewater Associates, delved into a comprehensive analysis of the current state of the U.S. economy, focusing on the debt crisis, Treasury yields, and the broader economic outlook

The 74-year-old American, whose net worth is estimated by Forbes to be around $15.4 billion (as of 17 November 2023), created the asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School.

Dalio began by addressing the recent changes in bond yields, emphasizing the need to return to fundamental economic principles. He pointed out that bond yields should align with the expected inflation rate, which he estimates to be around 3 to 3.5%. Additionally, he mentioned that real interest rates, which are the returns on debt assets above the inflation rate, should be in the vicinity of 1.5% to 2%. This, according to Dalio, would result in overall interest rates hovering around 4.5% to 5%.

A significant part of Dalio’s analysis revolved around the supply and demand for bonds. He highlighted the government’s need to sell a substantial amount of bonds, equivalent to the size of the deficit. This raises concerns about whether there is adequate demand for these bonds, especially considering the losses many bondholders, including banks and central banks, have incurred. Dalio sees this supply-demand issue as a fundamental risk that will influence bond yields.

Dalio also discussed the broader economic context, noting the government’s increased debt due to financial transfers to the household and business sectors. He believes that this strategy, while beneficial to these sectors, has led to a growing debt burden for the government. He foresees an emerging squeeze as the savings from government checks gradually decrease and debt maturities rise, creating financial pressure.

Despite these challenges, Dalio observed that the household sector’s income has remained robust due to low unemployment rates and relatively high compensation levels. This has been a result of the transfer of wealth from the government to the private sector. However, he anticipates a gradual weakening of the economy, not a sharp downturn, as these factors play out.

When asked about the future of interest rates, Dalio predicted that rates would likely remain around their current levels or decrease slightly. He expects the economy’s growth rate to slow to around zero or 1%, exerting a slight downward pressure on interest rates. However, he also noted the importance of the supply issue in this context.

Addressing the longer-term implications of the U.S. debt situation, Dalio expressed concern about the cycle of borrowing money to pay for debt service. He explained that when debt grows faster than income, debt service starts to encroach on spending, a problem that applies to both the government and individuals. This cycle can accelerate, leading to a supply and demand problem for bonds. Dalio also pointed out the impact of internal political and social conflicts on foreign demand for U.S. bonds, which could exacerbate the debt crisis.

On 24 October 2023, during a panel at the Future Investment Initiative in Riyadh, Saudi Arabia, Ray Dalio shared a rather bleak forecast for the global economy in 2024. The discussion, moderated by David Rubenstein, co-founder of Carlyle, took place between 24 and 26 October 2023.

In his remarks, Dalio pointed to a confluence of factors shaping his gloomy outlook. Political instability, contentious monetary policies, and an overall environment rife with conflict were cited as key reasons for his concern. These elements, according to Dalio, challenge the notion of maintaining a positive view of the global economic landscape in the coming year.

Dalio acknowledged the remarkable strides in technology, which hold the promise of beneficial outcomes. However, he warned that these advancements could also lead to complications. He specifically noted that the anticipated monetary policies are likely to exert a profound influence globally, adding to his bearish stance.

Further, Dalio commented on the increasing disparities worldwide, likely alluding to social and economic inequalities, though he did not delve into specifics. He stressed the importance of how people interact with each other in the face of these challenges. For Dalio, ensuring peace and nurturing a healthy, competitive environment devoid of conflict is essential for the world to effectively navigate and prosper in these changing times.