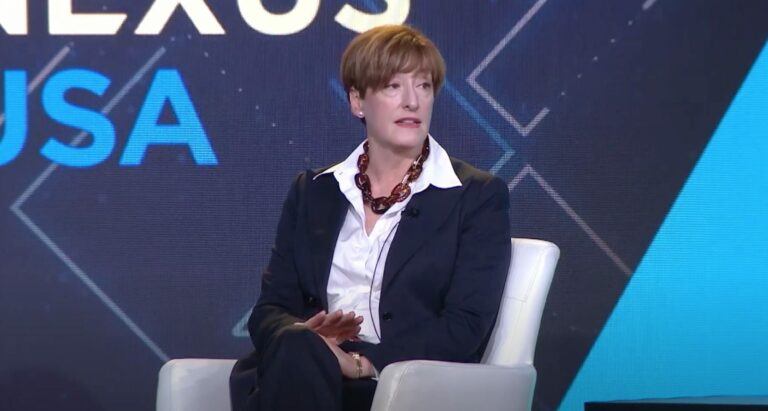

According to a report by The Daily Hodl published on October 2, Caitlin Long, CEO of Custodia Bank and a seasoned Wall Street investor, predicted that the Federal Reserve will persist in raising interest rates in a recent interview with Kitco News. Contrary to popular opinion, Long believes that inflation is making a comeback. She suggests that the Federal Reserve will likely surprise people by the extent to which it will raise rates to keep inflation in check.

Long points out that large U.S. corporations have successfully adjusted to the environment of rising interest rates. She notes that these corporations have secured low long-term interest rates for borrowing, allowing them to borrow at around 2% while earning between 5% and 5.25% on their cash reserves. These reserves are typically held in treasury bills or money market funds. This financial strategy has enriched these corporations and contributed to their growth.

Long asserts that specific sectors of the U.S. economy, notably the labor markets, are already experiencing a recession. She describes the current economic situation as “tilted” and “unbalanced.” Large corporations are benefiting from the Federal Reserve’s policy of higher interest rates, while other sectors are struggling. Long encapsulates this widening economic disparity with the phrase, “The rich have assets, and the poor have debt.” She observes that as the Federal Reserve continues its policy of rate hikes, those who own high-yielding treasury bills are becoming wealthier, exacerbating economic inequalities.

Earlier this month, Long spoke about the bank’s unique position in the financial landscape during an interview with Benzinga. With a background in top-tier banks and a law degree from Harvard, Long founded Custodia Bank to serve as a secure and compliant bridge between traditional finance and digital assets, particularly Bitcoin. Unlike many traditional banks, Custodia is not a lender; it is a depository institution focused on customer services. Long revealed plans to soon launch Bitcoin custody services, emphasizing the bank’s motto of “security and compliance first.”

Long also touched on the broader financial ecosystem, criticizing the Federal Reserve’s approach to cryptocurrency regulation and suggesting that programmable money could revolutionize the financial world. She noted that younger generations, who are already comfortable with digital transactions, expect the ability to move money seamlessly. Long expressed hope that Custodia Bank would attract major industry players who have yet to engage with Bitcoin, while maintaining rigorous security and compliance standards.