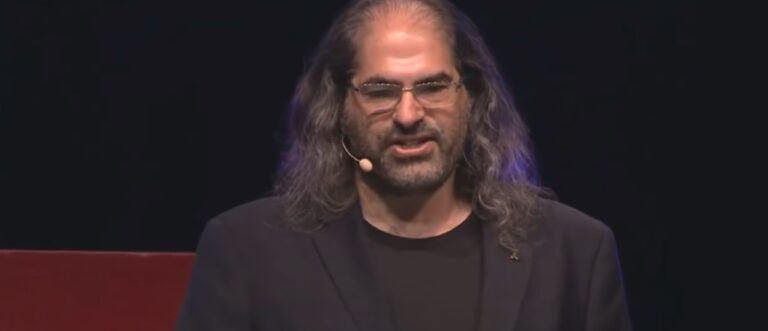

David Schwartz, Ripple’s Chief Technology Officer, recently shared his optimistic outlook on the XRP Ledger’s (XRPL) role in tokenizing real-world assets. The comments were made during an interview that followed his presentation at the Apex 2023 developer summit.

According to a report by The Crypto Basic published earlier today, Schwartz highlighted several advantages that make XRPL a compelling choice for asset tokenization. Among these are the platform’s low transaction costs and its smooth compatibility with decentralized exchanges. These features, he believes, make XRPL an excellent platform for initiating tokenized real-world assets.

Schwartz also touched on the importance of accessibility and adaptability in the context of tokenized assets. He stated that users are looking for a platform where they can easily purchase, sell, hold, and transfer assets without being restricted to a particular currency. For instance, Schwartz mentioned that tokenizing debt should not be confined to U.S. dollars, as doing so would limit its accessibility.

Expanding on this, Schwartz argued that XRPL offers easy access to a diverse array of assets, facilitating effortless exchanges. This broad applicability and ease of access, he noted, are among the key advantages of using XRPL for asset tokenization.

Looking ahead, Schwartz anticipates that XRPL will become a preferred platform for launching tokenized assets in the coming 18 months. This short timeline has generated excitement among XRPL supporters, including XRP influencer Amelie, who shared a clip of the interview on social media, captioning it, “The future is for XRP.”

In the same interview, Schwartz also discussed the growing significance of tokenization in transforming the financial landscape. He pointed out that people are increasingly becoming aware of the inefficiencies associated with transferring certain types of value. According to Schwartz, tokenization will democratize access to a variety of financial products, especially benefiting those in countries with limited access to traditional financial services.

Schwartz is confident that tokenized assets will provide broader access to high-quality investment products, such as collateralized loans and other financial services.