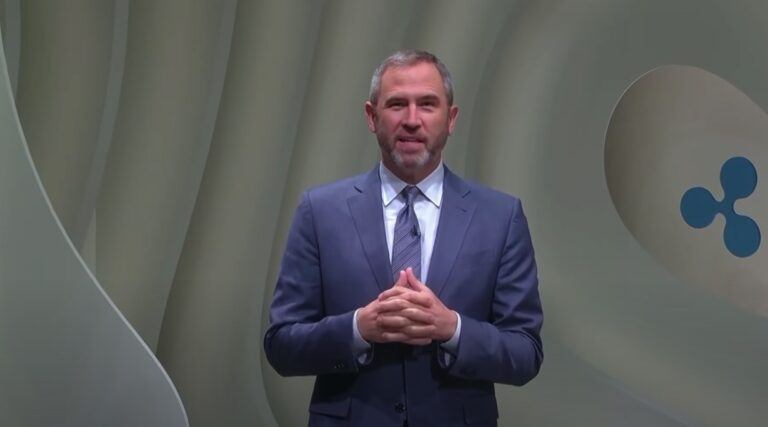

During his visit to Singapore for TOKEN2049, Ripple CEO Brad Garlinghouse sat down with Bloomberg reporter Annabelle Droulers to discuss a range of topics, including Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), the company’s international expansion, and the broader state of the cryptocurrency industry.

Garlinghouse expressed frustration with the SEC’s reluctance to engage constructively with the crypto community. He contrasted this with other jurisdictions like Singapore, Hong Kong, the U.K., and Dubai, where governments are partnering with the industry to provide clear regulations. He criticized SEC Chair Gary Gensler’s approach, stating, “Gary Gensler is a hammer and everything looks like a nail.”

Garlinghouse revealed that Ripple has spent well over $100 million defending itself against the SEC’s allegations. Despite the financial toll, he remains optimistic about the outcome, noting that the judge in their case has clearly stated that XRP is not a security.

Garlinghouse announced that 80% of Ripple’s hiring this year would be outside the United States. While acknowledging that the U.S. has fallen behind in the race to become a global crypto hub, he doesn’t believe the door is permanently shut. He anticipates shifts in administrations and potential congressional action to bring about changes.

Despite regulatory challenges and low trading volumes, Ripple has continued to grow. Garlinghouse mentioned that the company has a strong balance sheet and has made acquisitions to expand its product suite. Ripple aims to be an infrastructure provider around blockchain and crypto technologies.

Discussing the recent security compromise at Fortress Trust, a crypto custodian that Ripple is acquiring, Garlinghouse clarified that the issue was due to an end-user compromise caused by a spear phishing attack. He emphasized that such attacks are a risk not just in crypto but also in traditional banking and securities. Ripple made the affected customers whole, reinforcing their commitment to security.

Garlinghouse expressed that what bothers him is not the strictness of regulations but the lack of clarity. He mentioned that Ripple received in-principle approval for a major payments institution license in Singapore and has applied for a license in Dubai. He criticized the SEC for propagating confusion, stating that “confusion masquerades as power to the SEC.”

Garlinghouse expressed optimism about the appellate court system in the U.S., stating that it tends to be more conservative, which he believes bodes well for Ripple. He also referred to a recent court decision involving Grayscale, where the court used harsh language against the SEC, to highlight the regulatory body’s recent legal setbacks.