According to a Cointelegraph article, which cites a report by K33 Research published yesterday, analysts Vetle Lunde and Anders Helseth say the crypto market is dramatically underestimating the potential impact of a spot Bitcoin ETF approval. The K33 report highlights that the past three months have seen a favorable shift in the likelihood of a spot Bitcoin ETF gaining approval. Despite this, K33 believes the sentiment has not been reflected in the current pricing of Bitcoin or other major cryptocurrencies.

Lunde and Helseth argue that the approval of a spot Bitcoin ETF would result in “enormous inflows” and significantly increase the buying pressure for Bitcoin. They contrast this with the relatively “negligible” downside if the ETF were to be rejected, stating that Bitcoin prices would continue as they have been.

The analysts further criticize the market’s current outlook on spot ETF approvals as wrong. They point to Bloomberg ETF analysts James Seyffart and Eric Balchunas, who are now predicting a 75% chance of a spot Bitcoin ETF approval within the year.

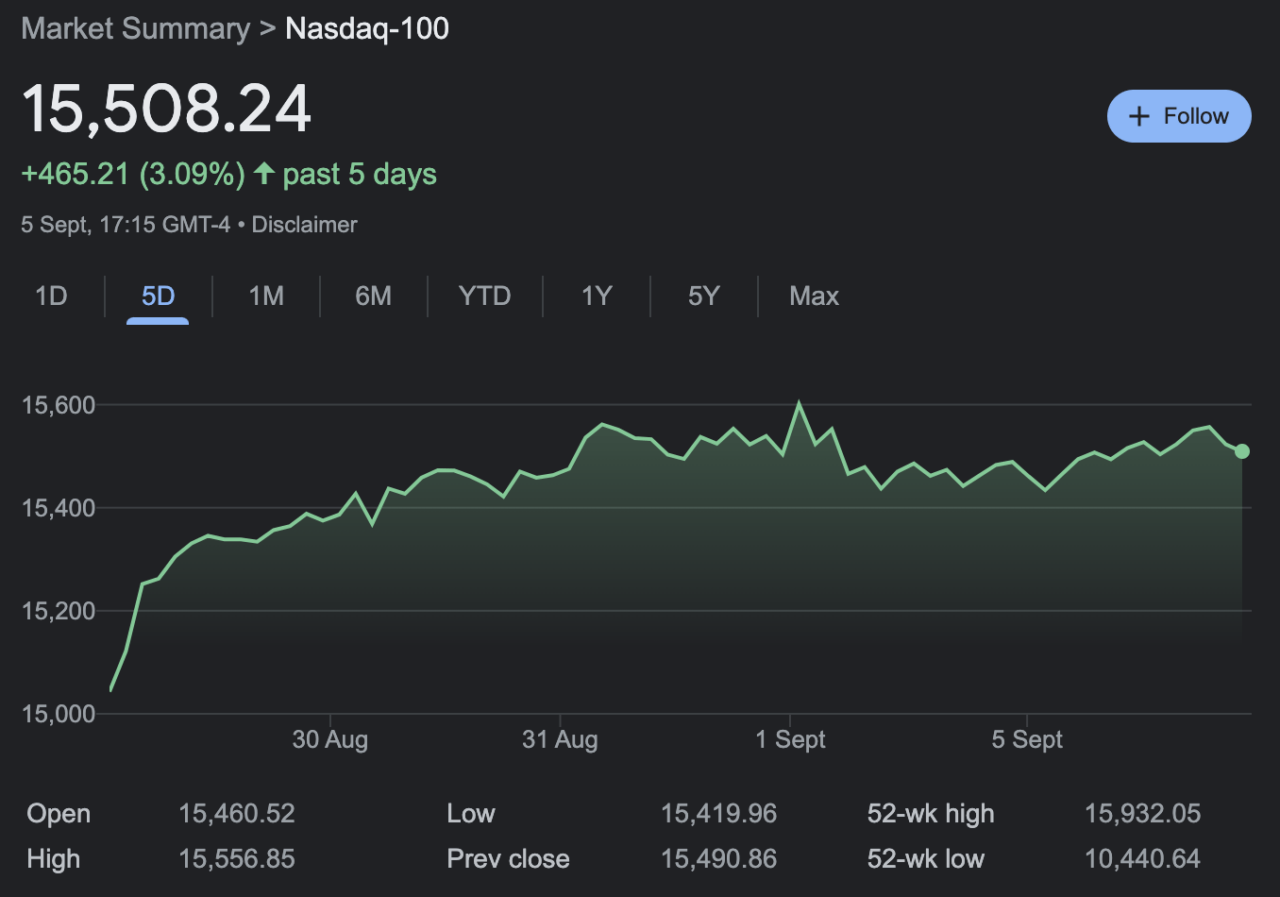

In light of this, Lunde and Helseth assert that the market is, by all accounts, a “buyer’s market.” They consider it reckless not to accumulate Bitcoin at its current levels. To support their bullish stance, they cite a recent 2% gain in the Nasdaq-100 index, which is often viewed as an indicator of the broader market’s risk appetite.

Lunde and Helseth also discuss the future of Ether (ETH), predicting that it is likely to outperform Bitcoin in the next two months. They attribute this to strong momentum ahead of a futures-based ETF listing for Ether. Drawing parallels to Bitcoin, which saw a roughly 60% increase in the weeks leading up to the launch of its first futures-based ETF on October 19, 2021, they expect Ether to follow a similar trajectory. A decision on a futures-based Ether ETF is expected to be handed down in mid-October and is reportedly set to get approval from the SEC.

On 31 August 2023, the U.S. Securities and Exchange Commission (SEC) announced a delay in its decision-making process for seven spot Bitcoin ETF proposals.

Last week, during an appearance on CNBC’s “Squawk Box”, former SEC chair Jay Clayton expressed little surprise at the delay. He noted that the SEC’s postponement aligns closely with the timeframe set by the DC Circuit Court for reconsidering its earlier rationale against approving a Bitcoin ETF.

Clayton emphasized that the SEC must differentiate between securities and non-securities offerings in the crypto landscape, including stablecoins. He also pointed out that the SEC is not the sole financial regulator wrestling with these issues; other financial regulatory bodies are also in the mix.

When questioned about whether he would have approved a Bitcoin ETF, Clayton refrained from giving a direct answer. However, he clarified that Bitcoin is not a security and that retail and institutional investors have strong interest in accessing it. He also mentioned that reputable financial providers are eager to offer Bitcoin products to the general public. According to Clayton, approving a Bitcoin ETF is “inevitable,” and the disparity between futures-based and spot-based Bitcoin products is unsustainable.

Featured Image Via Midjourney