On September 22, Jamie Coutts, an analyst specializing in cryptocurrency markets at Bloomberg Intelligence, took to social media platform X to share his insights on Bitcoin’s current on-chain activity. Coutts emphasized that two particular metrics—namely, the number of long-term Bitcoin holders and the volume of transactions on the Bitcoin blockchain—are at historic peaks.

Coutts pointed out that the community of Bitcoin holders who seldom sell their assets, commonly referred to as HODLers, has reached an all-time high. Concurrently, the number of transactions taking place on the Bitcoin blockchain has also soared to unprecedented levels. These indicators suggest a robust and active blockchain network, even as Bitcoin’s market price remains subdued.

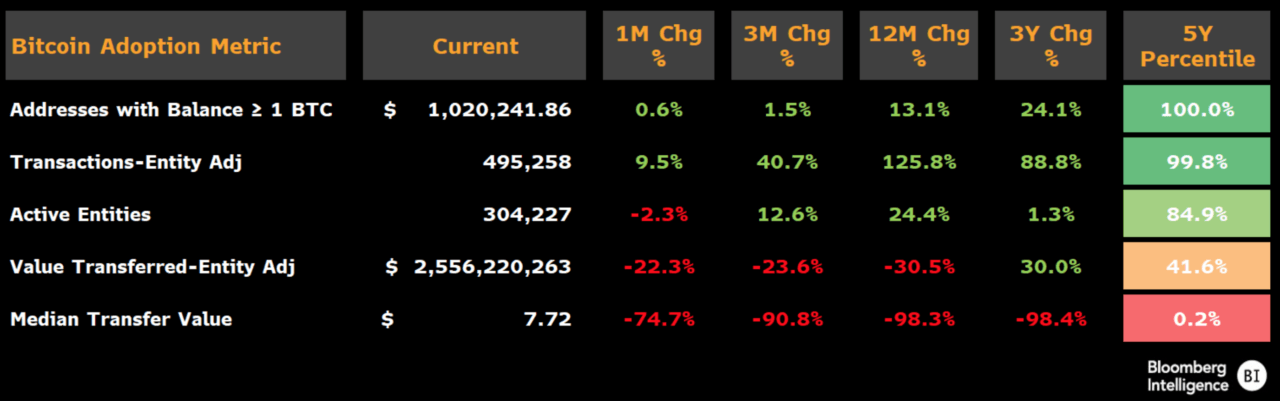

However, Coutts also drew attention to the declining economic value of Bitcoin transactions. Specifically, he mentioned that the median value of each Bitcoin transaction has plummeted by 98.4% over the past three years, reaching its lowest point since 2013. Summarizing the situation, Coutts stated that while blockchain activity is flourishing, Bitcoin’s economic value appears to be significantly diminished.

In a detailed breakdown, Coutts shared the following metrics:

- Long-term holders are at an all-time high.

- Transaction volumes are at an all-time high.

- Active entities on the blockchain are in the 85th percentile compared to the last five years.

- The value of Bitcoin transactions has decreased by 30% over the past 12 months.

- The median transaction value stands at $7.72, the lowest since 2013.

Coutts also spotlighted the increasing prevalence of Bitcoin inscriptions, a feature that enables Bitcoin holders to include additional data within individual units of the cryptocurrency, known as satoshis. He noted that this feature has been a significant driver of transaction activity on the Bitcoin network in recent months, suggesting it’s more than just a passing trend.

While Coutts acknowledged the bullish indicators in Bitcoin’s on-chain metrics, he also warned on September 13 that the cryptocurrency is currently facing headwinds due to a global liquidity crunch. He explained that this lack of liquidity has historically aligned with the expansion and contraction of Bitcoin’s market cycles. Coutts concluded that unless there is a reversal in the global liquidity situation, Bitcoin’s price is unlikely to experience a significant uptick and may even trend downward.

Featured Image via Midjourney