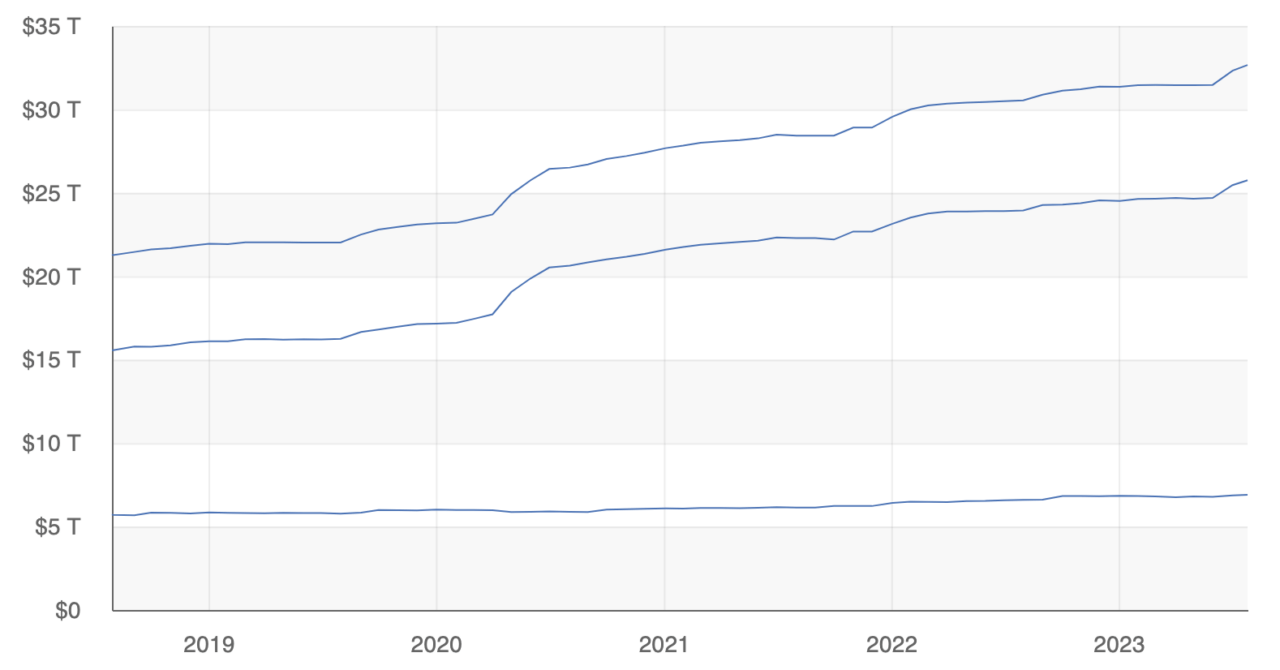

According to data from the U.S. Department of the Treasury’s Bureau of the Fiscal Service, from June 27 to July 27, 2023, the U.S. Total Public Debt Outstanding jumped from $32,65 trillion to $32.26 trillion, which is an increase of over $392.75 billion.

But what exactly is the Total Public Debt Outstanding, and why does it matter? In simple terms, it represents the total amount of debt the U.S. federal government owes to creditors – both external and internal. This includes debt held by the public, such as U.S. Treasury securities held by individuals, corporations, and foreign governments, as well as intragovernmental holdings, which are government account series securities held by federal agencies. The level of public debt is crucial as it can influence interest rates, impact the country’s credit rating, and affect economic growth.

According to an article from The Daily Hodl, the rapid accumulation of debt has resulted in the U.S. facing quarterly interest payments nearing $1 trillion, as the Federal Reserve Bank of St. Louis reported.

The article went on to say that this concerning financial landscape has prompted a stern warning from the Cato Institute, a libertarian think tank. The institute has declared the burgeoning U.S. debt a national security matter. They argue that the continuous delay in implementing responsible fiscal reforms in the face of growing federal debt could lead to economic decline and a potential fiscal crisis.

The Cato Institute further warns that a weaker economy and growing concerns among international bondholders about the U.S. government’s ability to service its debt could negatively impact America’s international standing. They believe the high and rising U.S. federal debt could lead to suppressed private investment, reduced incomes, and an increased risk of a sudden fiscal crisis.

The institute also highlights the urgent need for entitlement reform. Social Security, Medicare, Medicaid, and other needs-based programs account for half of the federal budget, with defense spending making up one-fifth. The Cato Institute proposes the creation of a debt commission to tackle entitlement reform. They suggest that the commission’s recommendations should automatically become law once approved by the President.

The Cato Institute emphasizes that unsustainable fiscal policy threatens American economic and military strength. They argue that by reforming entitlement programs and reducing spending, legislators can prevent high debt from undermining America’s prosperity and security. They believe that a well-designed debt commission can assist Congress in achieving these goals.

Featured Image by Mackenzie Marco via Unsplash