Introduction

This report provides a comprehensive analysis of Bitcoin (BTC) for 23 June 2023. The data includes real-time price, volume, bid/ask, day’s range, technical indicators, and moving averages.

Price and Volume Overview

As of 10:46 a.m. UTC on 23 June 2023, on Binance, Bitcoin is trading at $30,069.2, down by $110.8 (-0.37%) from its previous close. The trading volume over the last 24 hours was 50,211 BTC. The bid price is $30,069.2, and the ask price is $30,069.2. The day’s range is between $29,525.6 and $30,351.1.

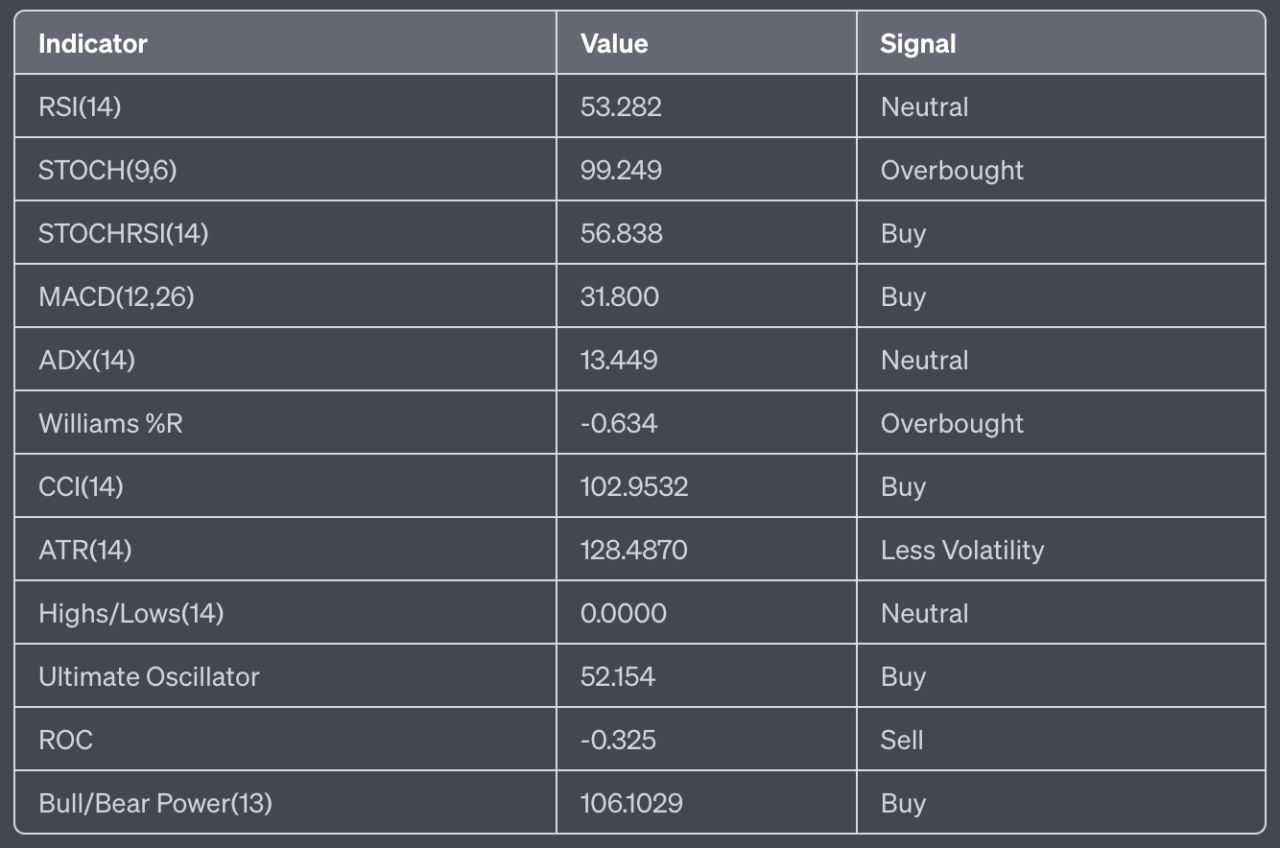

Technical Indicators

Technical indicators are used to predict future price movements and market trends.

Here’s a detailed breakdown of the technical indicators for Bitcoin (BTC):

- RSI(14): The 14-day Relative Strength Index is 53.282, indicating a neutral position. The RSI measures the speed and change of price movements on a scale of 0 to 100. Traditionally, the asset is considered overbought when the RSI is above 70 and oversold when it’s below 30. In this case, BTC is in the middle of the range, suggesting a balanced market condition.

- STOCH(9,6): The Stochastic Oscillator is 99.249, indicating an overbought condition. This momentum indicator compares a particular closing price of the asset to a range of its prices over a certain period of time. The current value suggests that BTC is closer to its highs than its lows, which is typically viewed as a bullish signal but also suggests a potential price correction due to overbought conditions.

- STOCHRSI(14): The Stochastic RSI is 56.838, indicating a buy position. This is a technical momentum indicator that compares the level of the RSI to its high-low range over a set time period. The current value suggests a potential upward price movement.

- MACD(12,26): The Moving Average Convergence Divergence is 31.800, indicating a buy position. The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD line crossing above the signal line can be a bullish signal, and when it crosses below, it can be a bearish signal. In this case, the MACD line is above the signal line, indicating a bullish signal.

- ADX(14): The Average Directional Index is 13.449, indicating a neutral position. The ADX is used to measure the strength or weakness of a trend, not the actual direction. Values below 25 may indicate a weak trend.

- Williams %R: The Williams %R is -0.634, indicating an overbought condition. This momentum indicator measures overbought and oversold levels. Readings above -20 are considered overbought, and readings below -80 are considered oversold. The current reading suggests that BTC is in an overbought condition.

- CCI(14): The Commodity Channel Index is 102.9532, indicating a buy position. The CCI is a momentum-based oscillator used to help determine when an investment vehicle is reaching a condition of being overbought or oversold. A CCI above 100 may indicate an overbought condition, while a CCI below -100 may indicate an oversold condition.

- ATR(14): The Average True Range is 128.4870, indicating less volatility. The ATR is a technical analysis indicator that measures market volatility by decomposing the entire range of an asset price for that period. Lower values typically represent less volatility and more stable price movements.

- Highs/Lows(14): The value is 0.0000, indicating a neutral position. This indicator is used to identify the highest and lowest prices for the asset over a particular period.

- Ultimate Oscillator: The value is 52.154, indicating a buy position. This is a technical indicator that is used to measure momentum across multiple timeframes. A value below 30 often indicates an oversold condition, while a value above 70 indicates an overbought condition.

- ROC: The Rate of Change is -0.325, indicating a sell position. The ROC is a momentum oscillator, which measures the percentage change between the current price and the n-period past price. A negative ROC indicates a bearish signal, suggesting that the price is decreasing.

- Bull/Bear Power(13): The value is 106.1029, indicating a buy position. These indicators measure the balance of power between bulls (buyers) and bears (sellers). A positive value indicates that bulls are in control, while a negative value indicates that bears are in control.

So, in summary, while the majority of the technical indicators suggest a “BUY” action, the overbought conditions indicated by the Stochastic Oscillator, Williams %R could suggest a potential price correction in the near future. The neutral condition indicated by the RSI, ADX, and Highs/Lows, however, suggests a balanced market condition for Bitcoin.

Moving Averages

Moving averages are a type of data smoothing technique that analysts use in technical analysis to identify trends in a set of data, such as stock prices. They help to reduce the noise and fluctuation in price data to present a smoother line, making it easier to see the overall direction or trend.

There are several types of moving averages, but two of the most common ones are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Simple Moving Average (SMA): The SMA is calculated by adding the prices for a certain number of periods and then dividing by that number of periods. For example, a 5-day SMA would add the closing prices for the last five days and then divide by five. The SMA gives equal weight to all the data points in its calculation.

Exponential Moving Average (EMA): The EMA is similar to the SMA but gives more weight to recent data. This means it responds more quickly to recent price changes than the SMA. The calculation of the EMA is a bit more complex than the SMA, involving an exponential smoothing factor to give more weight to recent prices.

The significance of different period moving averages (like 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day) lies in the timeframe that traders are interested in:

5-day, 10-day, and 20-day moving averages are often used for short-term trends. They respond quickly to price changes and are useful for traders looking to take advantage of short-term price movements. 50-day and 100-day moving averages are more medium-term. They are less sensitive to daily price fluctuations and provide a clearer picture of the medium-term trend.

200-day moving average is a long-term trend indicator. It’s less sensitive to daily price fluctuations and provides a clearer picture of the long-term trend. Many traders consider a market to be in a long-term uptrend when the price is above the 200-day moving average and in a long-term downtrend when it’s below.

It’s important to note that moving averages are lagging indicators, meaning they are based on past prices. They can help identify a trend but won’t predict future price movements.

Simple Moving Averages (SMA):

MA5: The 5-day SMA is at 30028.3, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the short term.

MA10: The 10-day SMA is at 30011.0, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the short term.

MA20: The 20-day SMA is at 30021.9, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term.

MA50: The 50-day SMA is at 29951.5, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term.

MA100: The 100-day SMA is at 28619.0, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

MA200: The 200-day SMA is at 27333.6, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

Exponential Moving Averages (EMA):

MA5: The 5-day EMA is at 30043.4, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the short term.

MA10: The 10-day EMA is at 30034.1, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the short term.

MA20: The 20-day EMA is at 30038.0, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term.

MA50: The 50-day EMA is at 29640.5, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term.

MA100: The 100-day EMA is at 28882.3, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

MA200: The 200-day EMA is at 27958.0, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

The moving averages for Bitcoin (BTC) on 23 June 2023 all suggest a strong buy signal, indicating bullish trends in the short, medium, and long term. The 5-day simple and exponential moving averages, which are more sensitive to recent price changes, indicate a buy signal, suggesting that the short-term trend is bullish.

The 10-day, 20-day, 50-day, 100-day, and 200-day moving averages, which are less sensitive to daily price fluctuations and therefore provide a clearer picture of the longer-term trend, also suggest a buy signal. This indicates that the medium and long-term trends are also bullish.

In summary, the moving averages suggest that the overall trend for Bitcoin is upward, and the price is expected to increase in the short, medium, and long term.

Conclusion

In conclusion, the market sentiment for Bitcoin (BTC) as of June 23, 2023, leans towards a bullish outlook. Most technical indicators and moving averages suggest a “BUY” action. This implies upward pressure on the price in the short term. However, the overbought conditions indicated by the Stochastic Oscillator and Williams %R could suggest a potential price correction in the near future.

The moving averages, particularly the long-term ones, reinforce this bullish sentiment, with the 50-day, 100-day, and 200-day moving averages all indicating a buy signal. This suggests that the overall trend for Bitcoin is upward, and the price is expected to increase in the long term.

As always, it’s important to note that while technical analysis tools can provide useful insights, they are not a guarantee of future performance, and all trading strategies should be used in conjunction with other market information and individual research.

Featured Image Credit: Photo / illustration by “Dylan Calluy” via Unsplash