While the stablecoin sector of the cryptocurrency space rapidly grew in the past, it has now been declining for 13 consecutive months, while Tether’s USDT stablecoin has kept on dominating it. It’s now near a new all-time high in its market capitalization, with TUSD gaining market share on Binance thanks to zero-fee trading.

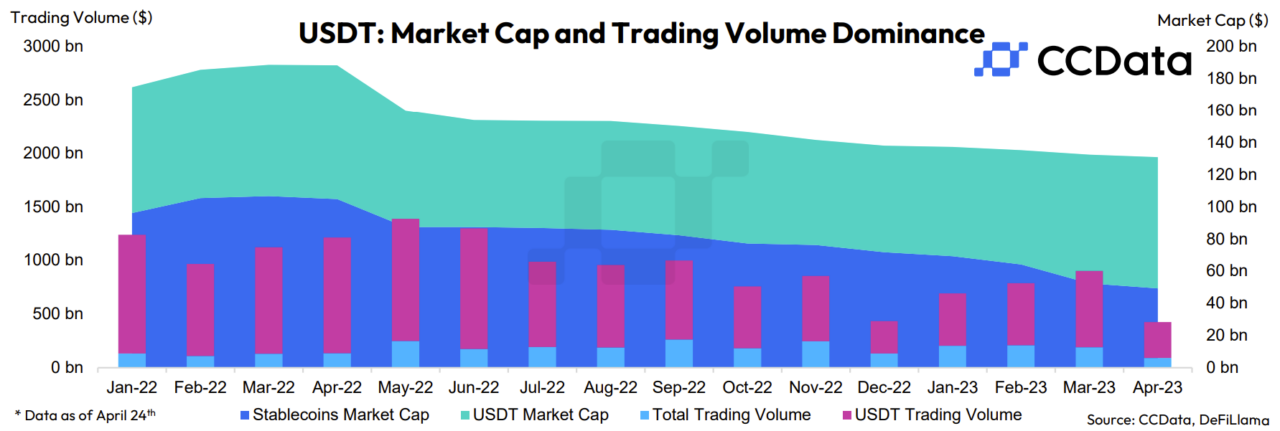

According to CCData’s latest Stablecoins & CBDCs report, USDT’s market capitalization has risen 2.03% in April to $81.5 billion, near its $83.7 billion all-time high seen in May of last year. The stablecoin’s dominance of the market has risen for a fifth consecutive month, reaching 62.1%.

USDT, according to the report, accounted for 79% of all stablecoin trading volume on centralized exchanges in April, making it the largest counterparty with 2,931 trading pairs.

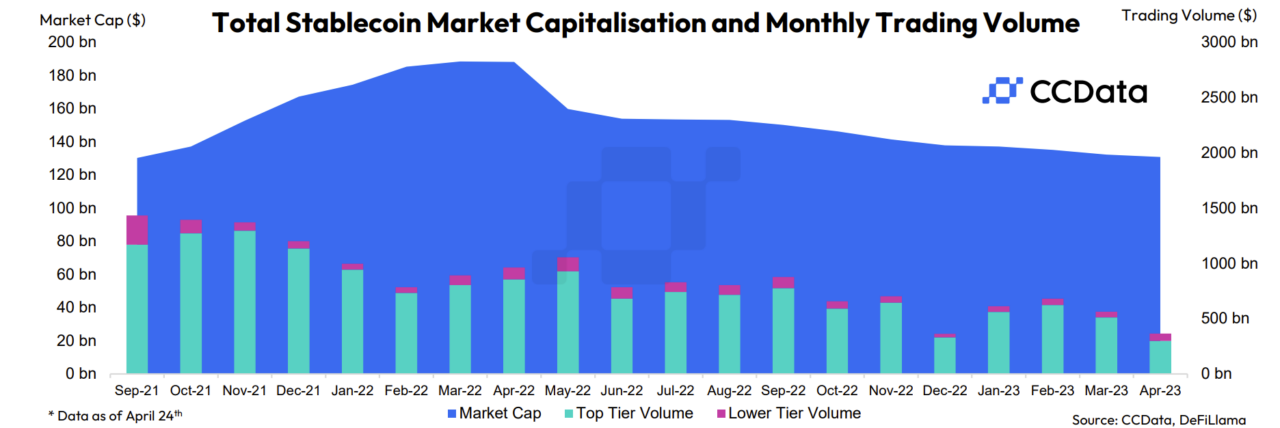

CCData’s report also details that the total market capitalization of the stablecoin sector dropped by 1.08% to $131 billion in April, marking its lowest level since September 2021.

The decline came amid a 13.6% drop in trading volumes to $775 billion in March, driven by multiple stablecoins depegging during that month. April’s trading volume was only $365 billion as of April 23.

However, these declines haven’t seen the end of competition in the sector. The launch of zero-fee spot trading for BTC and ETH trading pairs of TUSD on Binance has led to a surge in the stablecoin’s market share on the exchange. As of April 22nd, the report details that TUSD’s market share reached an all-time high of 15.9%, with a trading volume of $987 million.

TUSD has now become the third-largest stablecoin by trading volume on centralized exchanges, boasting a market share of 6.5% and surpassing USDC for the first time since June 2020.

It’s worth noting that Binance’s stablecoin BUSD has been declining over regulatory pressures, including an investigation by the New York Department of Financial Services (NYDFS), and instructions by the regulator to cease the minting of new BUSD tokens, as well as a Wells Notice from the U.S. Securities and Exchange Commission (SEC).

Image Credit

Featured Image via Unsplash