On Tuesday (March 14), Robin Brooks, Chief Economist at the Institute of International Finance (IIF), explained why he does not believe that Bitcoin is a useful asset.

The Institute of International Finance (IIF) is a global organization comprising around 400 members from over 60 countries in the financial industry. The IIF offers its members pioneering research, unmatched global advocacy, and the opportunity to attend premier industry events that harness its powerful network.

Its goal is to aid the financial industry in the careful management of risks, promote the development of sound industry practices, and advocate for regulatory, financial, and economic policies that align with the wide-ranging interests of its members, as well as stimulate global financial stability and sustainable economic growth. Members of IIF include commercial and investment banks, insurance companies, asset managers, exchanges, sovereign wealth funds, professional services firms, development banks, hedge funds, and central banks.

Anyway, yesterday, Brooks, who in the past has served as a Senior Economist at the International Monetary Fund (IMF), gave several reasons why he is not impressed with Bitcoin:

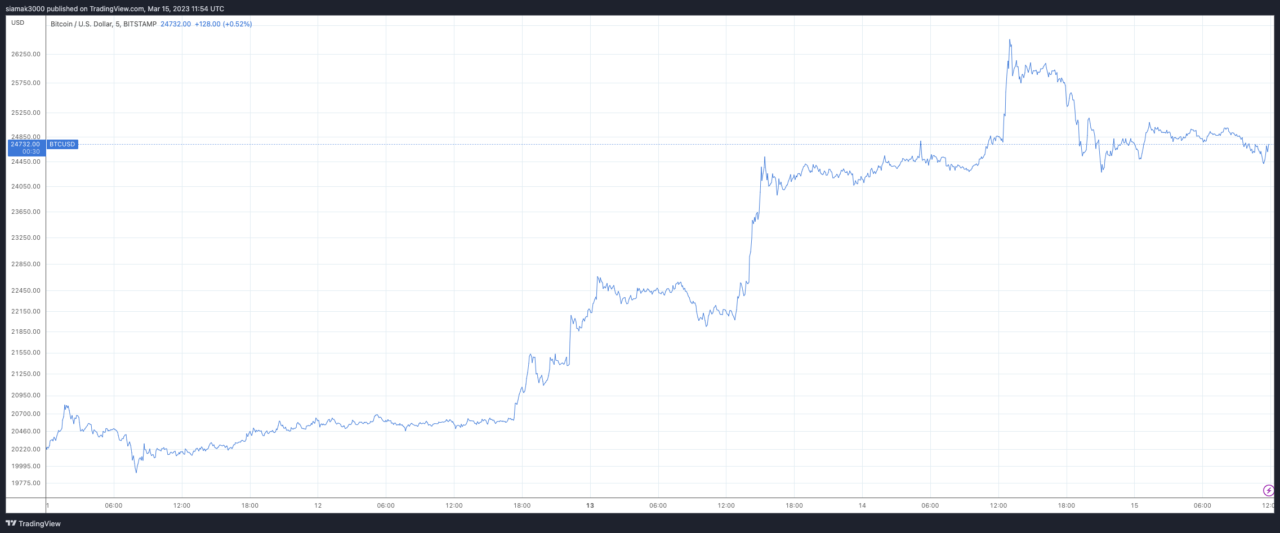

According to data from TradingView, currently (i.e., as of 11:54 a.m. UTC on March 15), Bitcoin is trading at around $24,732, up 49.7% in the eyar-to-date period:

Image Credit

Featured Image via Pixabay