Last week, Hester Peirce, a Commissioner at the U.S. Securities and Exchange Commission (SEC), criticized the agency for the decision to force crypto exchange Kraken to shut down its crypto staking services for all U.S. clients.

On 9 February 2023, Kraken announced in a blog post that it had agreed to shut down its crypto staking services for U.S. clients:

“Today, two Kraken subsidiaries announced a settlement with the U.S. Securities and Exchange Commission (SEC) concerning Kraken’s on-chain staking program. Because of this settlement, Kraken has agreed to end its on-chain staking services for U.S. clients.

“Starting today, Kraken will automatically unstake all U.S. client assets enrolled in the on-chain staking program. These assets will no longer earn staking rewards. This applies to all staked assets except for staked ether (ETH), which will be unstaked after the Shanghai upgrade. U.S. clients will not be able to stake any additional assets, including ETH. Kraken will continue to offer staking services for non-U.S. clients through a separate Kraken subsidiary… Staking services for non-U.S. clients will continue uninterrupted. Non-U.S. clients can continue to stake and unstake assets, as well as automatically earn and stake rewards, as usual.“

On the same day, the SEC issued a press release about Kraken that stated:

“The Securities and Exchange Commission today charged Payward Ventures, Inc. and Payward Trading Ltd., both commonly known as Kraken, with failing to register the offer and sale of their crypto asset staking-as-a-service program, whereby investors transfer crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21 percent.

“To settle the SEC’s charges, the two Kraken entities agreed to immediately cease offering or selling securities through crypto asset staking services or staking programs and pay $30 million in disgorgement, prejudgment interest, and civil penalties.“

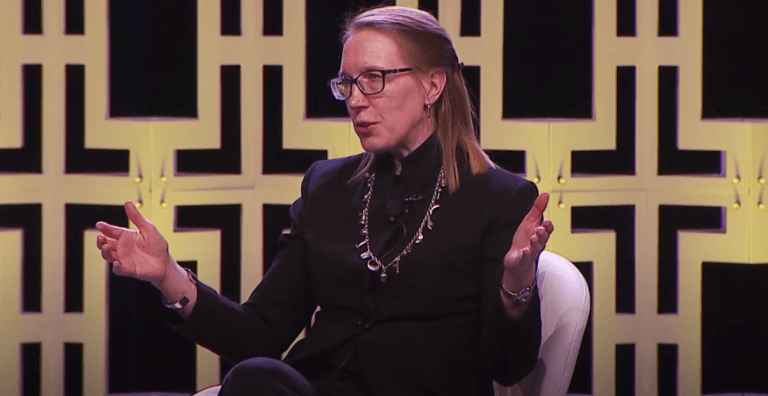

In a statement (“Kraken Down: Statement on SEC v. Payward Ventures, Inc., et al.”) published on the SEC website on 9 February 2023, Peirce raised questions about the SEC’s analysis of the staking program as a securities offering, including the potential need for separate registration of each token’s staking program, necessary disclosures, and accounting implications for Kraken.

Peirce criticized the SEC’s approach, saying that it was more efficient and fair to issue guidance on staking programs rather than speaking through enforcement actions. She also expressed concern about the regulator’s decision to shut down the program entirely, calling it paternalistic and lazy. Instead of developing a workable registration process that would provide valuable information to investors, the SEC simply shut down the program, said Peirce.

She went on to add:

“The program will no longer be available in the United States, and Kraken is enjoined from ever offering a staking service in the United States, registered or not. A paternalistic and lazy regulator settles on a solution like the one in this settlement: do not initiate a public process to develop a workable registration process that provides valuable information to investors, just shut it down.

“More transparency around crypto-staking programs like Kraken’s might well be a good thing. However, whether we need a uniform regulatory solution and if that regulatory solution is best provided by a regulator that is hostile to crypto, in the form of an enforcement action, is less clear.“