The flagship cryptocurrency Bitcoin ($BTC) is now entering its “seventh bull cycle,” according to the head of $4.1 billion cryptocurrency hedge fund Pantera Capital, Dan Morehead, who predicts this year will be one where trust in the space is rebuilt.

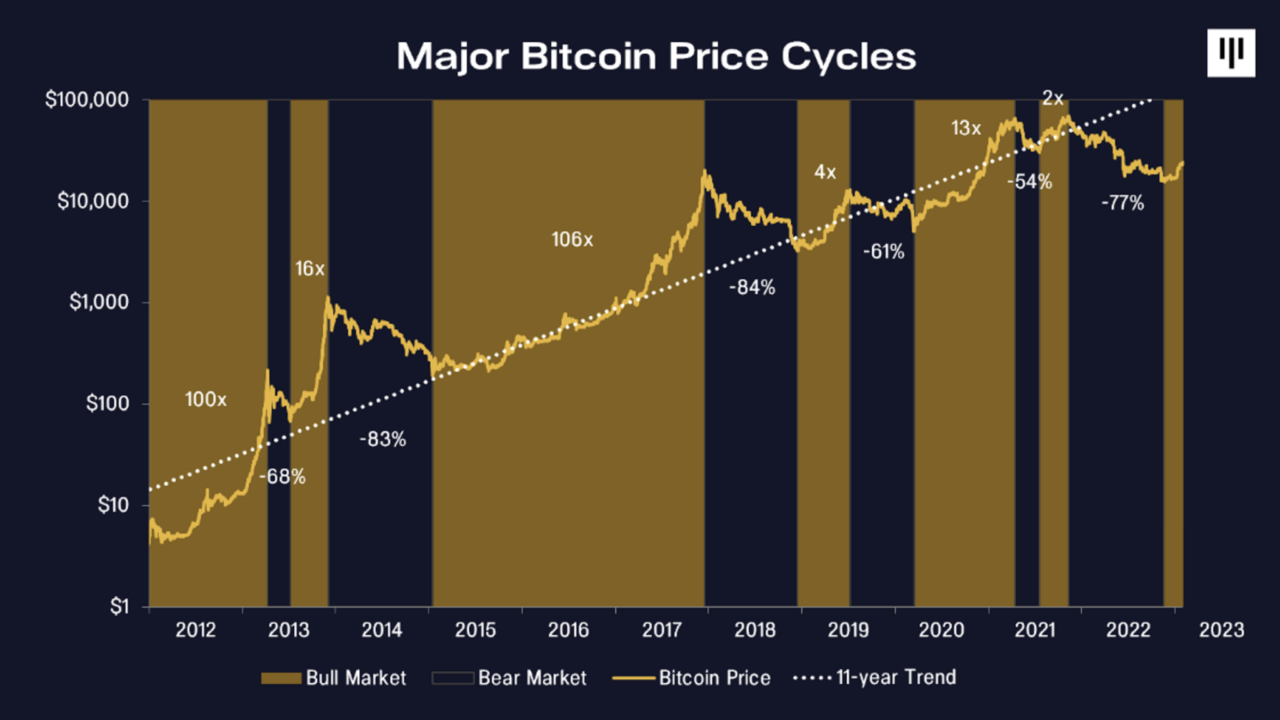

According to Pantera Capital’s latest “Blockchain Letter” update, which comes after BTC posted its best month of January in a decade, the cryptocurrency bear market ended on November 21, after 376 days, making it the second-largest bear market the space has faced.

To Dan Morehead, a former Goldman Sachs bond trader who created the fund in 2013, the time for bulls in the cryptocurrency space is here. The letter reads that Pantera has been through “ten years of Bitcoin cycles” and that he has traded through “35 years of similar cycles.” Morehead wrote:

I believe that blockchain assets have seen the lows and that we’re in the next bull market cycle – regardless of what happens in the interest-rate-sensitive asset classes.

The former bond trader noted that this bear market was the only one to “ more than completely wipe out the previous bull market. In this case, giving back 136% of the previous rally.” The drawdown of the bear market was 77%, above the median of 73%, he said.

Per Morehead, the market is now “beginning to grind higher,” as it rebuilds trust. Per his words, 2022 saw a “combination of bad actors skirting lines in jurisdictions without clear regulations. If 2022 was the year of breaking rules and failing, I believe 2023 is the year that entities instead follow the rules and enjoy the rewards of doing so.”

Pantera Capital, which has over $4 billion in assets under management, down from over $5.6 billion at the beginning of 2022, and whose portfolio includes 1Inch, Coinbase, BitG, Bitstamp, Brave, Ripple, and Polkadot, noted it believes centralized exchanges will recover “on a jurisdiction-by-jurisdiction level.”

The letter also says that decentralized finance “should not be overlooked” as centralized finance platforms rebuild trust.

Image Credit

Featured Image via Unsplash