On Monday (2 January 2023), crypto analytics startup Santiment, which provides tools that make “powerful OnChain, Social & Financial analysis accessible to anyone”, analyzed the behavior of small to medium investors in several popular cryptocurrencies.

In a blog post titled “Small Investors in Big Cryptos”, Santiment had this to say about Cardano ($ADA):

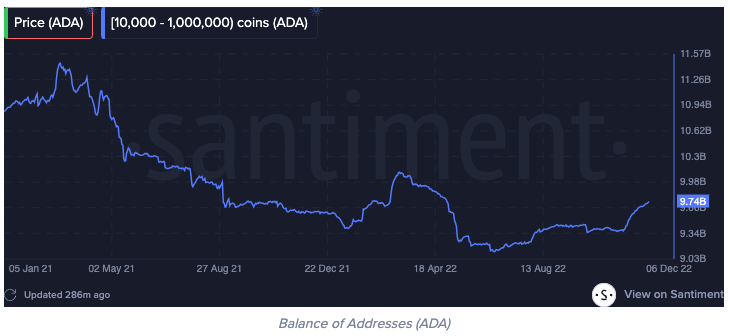

“In the case of Cardano (ADA), small to medium-sized investors holding between 10,000 and 1,000,000 ADA displayed similar behavior to the investors of other coins during the 2019 bear market. However, they stopped buying in the last stages of the 2021 bull market when the price of ADA reached 1.3 USD.

“Since then, these investors have been net sellers of ADA until two months ago, when the price reached 33 cents and dropped lower. This suggests that these investors may be cautious about the potential of ADA and have been selling off their holdings. It will be interesting to see if these investors decide to start accumulating aggressively again in the future.“

As for Bitcoin and Ethereum, the Santiment analyst wrote:

“According to the Balance of Addresses metric, small to medium-sized investors holding between 0.1 and 100 BTC in their wallets have generally been accumulating Bitcoin over the past few years. During the 2017 bull market, these investors were actively buying and accumulating more BTC. However, after the price peaked at around 20,000 USD per BTC, they started to sell off some of their holdings. They then started accumulating more aggressively during the market bottom, and continued to do so until the end of 2020.

“Despite this, they were not able to reach the peak levels seen in 2020 until last July, when the price of BTC dropped below 20,000 USD. Since then, these investors have been aggressively buying, adding an additional 9% to their holdings in the past six months. Overall, it seems that these investors tend to be correct over long-term periods, but may not always accurately predict short-term price movements…

“According to the data, small to medium-sized investors holding between 1 and 100 Ethereum (ETH) have generally been accumulating the cryptocurrency over the past few years. There have been only two major occasions when these investors sold off their ETH holdings, which were when the price broke above 150 USD in March 2019 and when it broke above 500 USD in 2020. This could potentially be a sign that these investors are taking profits when the price is perceived as being “overextended” or too high.

“Since the crash of 2021, these small to medium-sized investors have been actively accumulating ETH, indicating confidence among the retail crowd. This suggests that these investors believe in the long-term potential of ETH and are willing to hold onto their positions despite short-term market fluctuations.“

The blog post went on to say:

“It’s difficult to predict with certainty what small to medium-sized investors holding various cryptocurrencies will do in the future. However, based on the data analyzed, it appears that these investors tend to be confident in the long-term potential of the coins they are holding and are willing to hold onto their positions through short-term market fluctuations.“

Image Credit

Featured Image via Unsplash