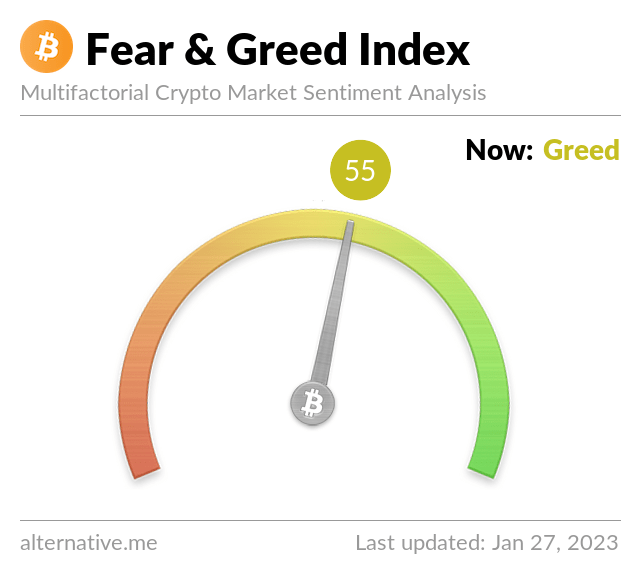

Bitcoin ($BTC) has recently seen its Fear & Greed Index, which serves as an aggregate for investor confidence and attitude towards the market, has risen to a state of “greed” for the first time in nearly a year.

The move to a state of greed is being seen at a time in which the price of the flagship cryptocurrency Bitcoin appears to be stabilizing around the $23,000 mark after outperforming most other assets so far this year in a surprising recovery.

The index, which utilizes multiple sources, including social media, to produce a relative number that reflects investor sentiment, has risen from 6 when BTC dropped below $18,000 last year. Per the index behavior in the cryptocurrency market is “very emotional” and people “ get greedy when the market is rising which results in FOMO (Fear of missing out).”

The index also adds that people “often sell their coins in irrational reaction of seeing red numbers.” The index has been in a state of “extreme fear” and “fear” since March of last year, and has kept on dropping as more bankruptcies have been announced in the space, including that of Celsius Network, BlockFi, and Genesis’ lending unit. The collapse of FTX saw the index dip significantly as confidence in centralized exchanges took a hit.

The index claims that market sentiment extremes can signal a potential reversal in price. Extreme fear indicates that investors are “too worried,” and could present a buying opportunity, while greed indicates the market is due for a correction.

As CryptoGlobe reported, Bloomberg commodity strategist Mike McGlone, who is a well-known cryptocurrency bull, has recently suggested BTC investors should be accumulating the flagship cryptocurrency before its price explodes upward and hits $150,000.

The commodity strategist added that he believes the recent cryptocurrency market rally that saw the flagship cryptocurrency’s price hit $23,000 this month is a case of investor “hopium,” and that cryptocurrency prices are likely to keep dropping as the Federal Reserve and other central banks keep raising interest rates to control inflation.

Per his words investors are “supposed to be careful with this rally.” Notably, last year McGlone defended that Bitcoin’s price hitting $100,000 was just a “matter of time,” as both adoption and demand for the cryptocurrency are increasing.

Image Credit

Featured image via Unsplash