Vijay Ayyar, VP of Corporate Development & International at crypto exchange Luno, which is an independently operating subsidiary of Digital Currency Group, recently talked about Bitcoin’s “boring” price action and why it might not be a bad thing.

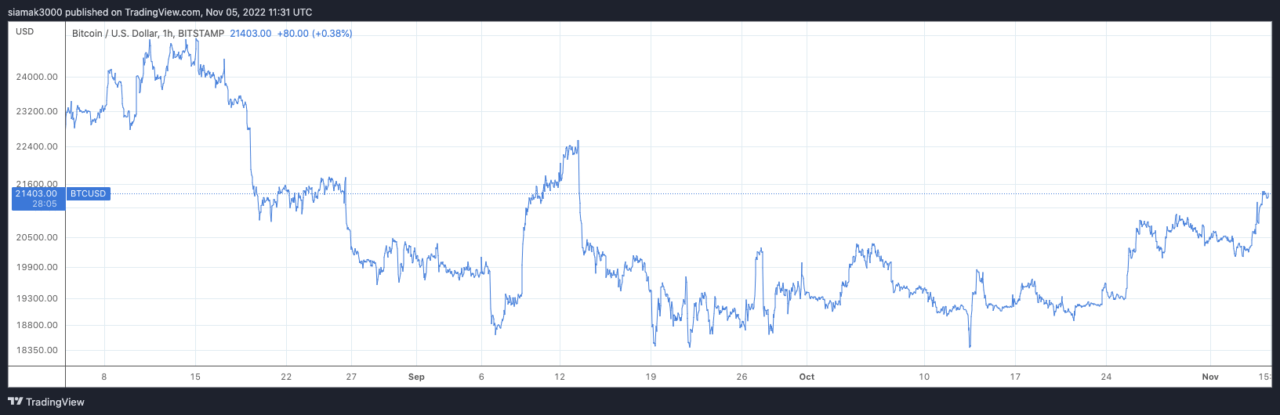

Data from TradingView shows that for the past couple of months the Bitcoin price has been hovering around the $20,000 level, which is substantially lower than the all-time high of just over $69,000 it reached on 10 November 2021.

According to a report by CNBC, “last week, the cryptocurrency’s 20-day rolling volatility fell below that of the Nasdaq and S&P 500 indexes for the first time since 2020.”

Ayyar told CNBC:

“Bitcoin has essentially been range bound between 18-25K for 4 months now, which indicates consolidation and a potential bottoming out pattern, given we are seeing the Dollar index top out as well… In previous cases such as in 2015, we’ve seen BTC bottom when DXY has topped, so we could be seeing a very similar pattern play out here.“

And Nexo Co-Founder Antoni Trenchev told CNBC that this price stability was “a strong sign that the digital assets market has matured and is becoming less fragmented.”

Ayyar went on to add:

“Bitcoin being stuck in such a range does make it boring, but this is also when retail loses interest and smart money starts to accumulate.“

Image Credit

Featured Image via Pixabay