On Wednesday (2 November 2022), Charles Edwards, Co-Founder of digital asset management firm Capriole Investments, introduced a new Bitcoin valuation tool.

Edwards took to Twitter earlier today to say that his “Bitcoin Yardstick” metric is a very simple way to figure out how cheap/expensive Bitcoin is at any particular time:

He went on to say:

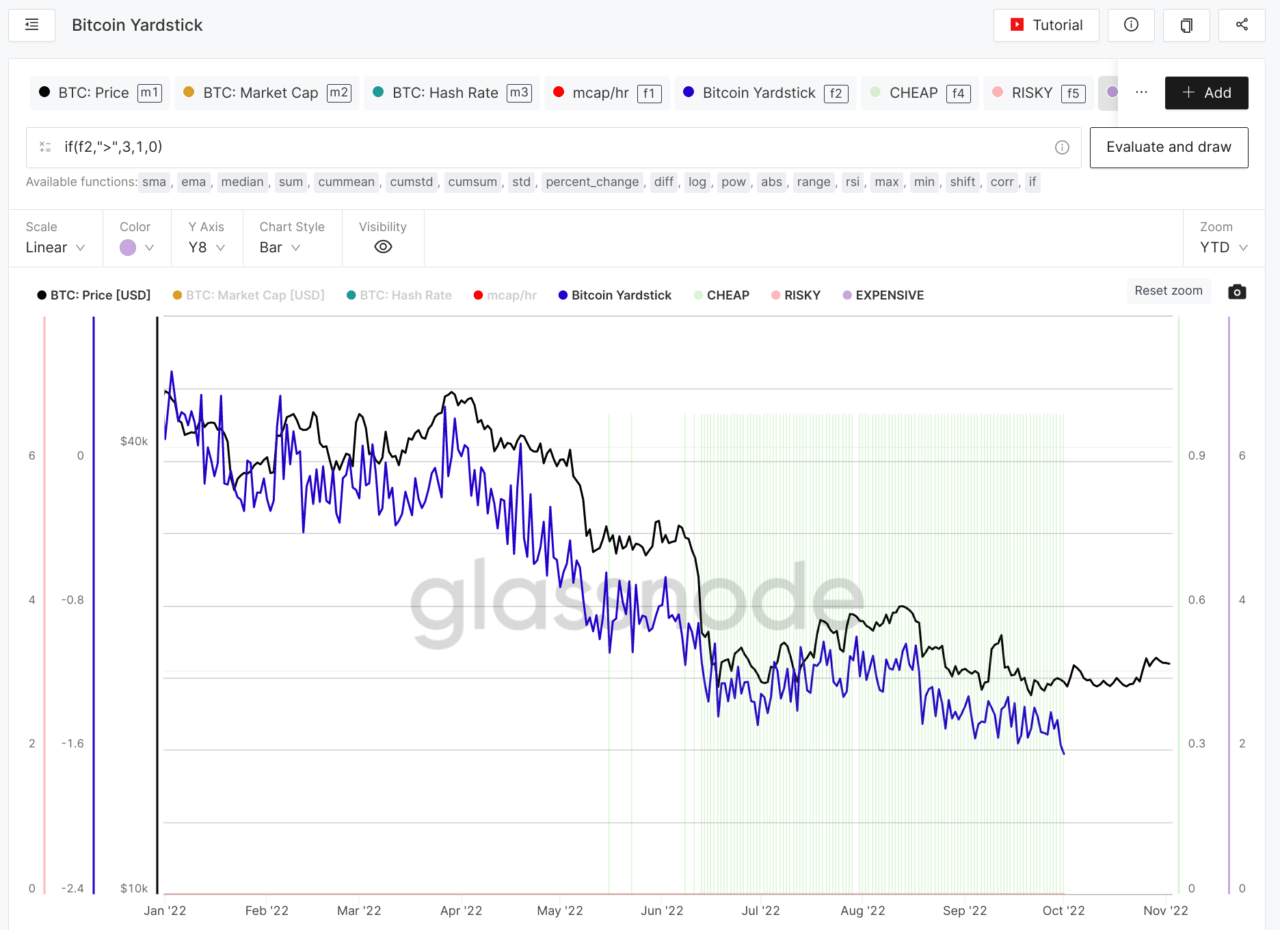

“Similar in concept to a PE Ratio, except instead of stock earnings, the Bitcoin Yardstick is taking the ratio of energy work done to secure the Bitcoin network in relation to price. Lower readings = cheaper Bitcoin = better value…

“Here’s an application of the Bitcoin Yardstick which identifies when Bitcoin is: – Cheap: Yardstick > 1 deviation under the mean – Risky: Yardstick > 2 deviations above the mean – Expensive: Yardstick > 3 deviations above the mean…

“Today we are seeing the second lowest reading for the Bitcoin Yardstick in all of Bitcoin’s history. This means that on a relative basis, Bitcoin is extraordinarily cheap given the amount of energy being used on what is the most powerful computer network in the world.“

Crypto analytics startup Glassnode has already added support for the Bitcoin Yardstick in its popular product Glassnode Studio:

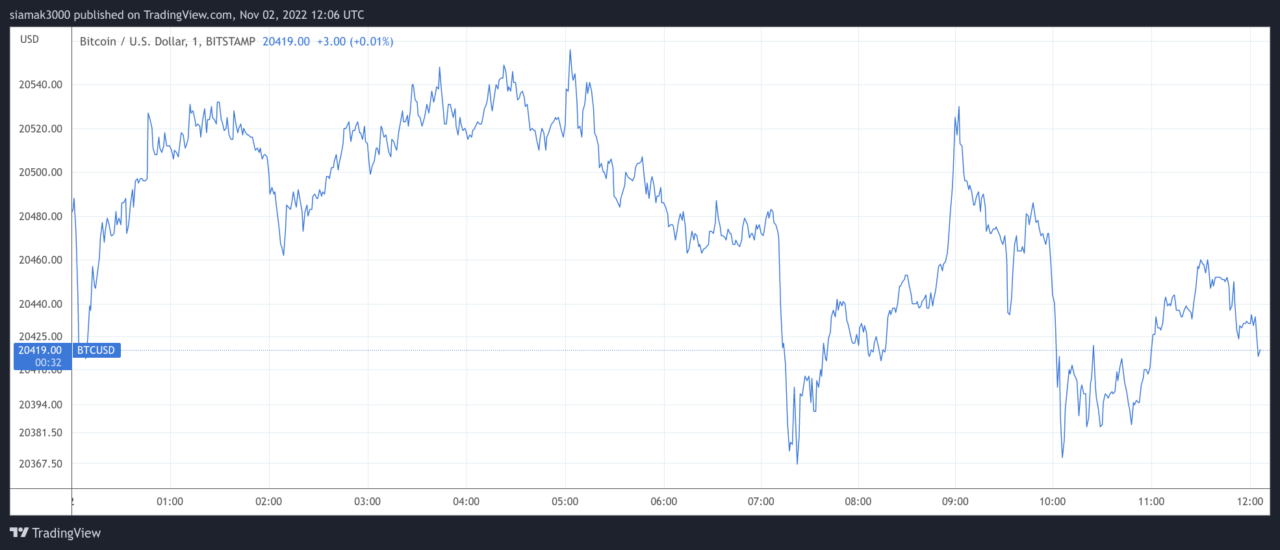

According to data by TradingView, on Bitstamp, currently (i.e. as of 12:06 p.m. UTC on 2 November 2022) Bitcoin is trading around $20,419, down 0.59% in the past 24-hour period.

Image Credit

Featured Image via Pixabay