On Thursday (October 13), Uniswap Labs, the startup behind Uniswap Protocol, which is “an open-source protocol for providing liquidity and trading ERC20 tokens on Ethereum”, announced that it had raised $165 million in Series B funding.

Here is an explanation of how Uniswap Protocol Works

“Uniswap is an automated market maker. In practical terms, it is a collection of smart contracts that define a standard way to create liquidity pools, provide liquidity, and swap assets.

“Each liquidity pool contains two assets. The pools keep track of aggregate liquidity reserves and the pre-defined pricing strategies set by liquidity providers. Reserves and prices are updated automatically every time someone trades. There is no central order book, no third-party custody, and no private order matching engine.

“Because reserves are automatically rebalanced after each trade, a Uniswap pool can always be used to buy or sell a token — unlike traditional exchanges, traders do not need to match with individual counterparties to complete a trade.“

In a blog post published yesterday, Hayden Adams, who is the Founder and CEO of Uniswap Labs, said:

“When I built the Uniswap Protocol in 2018, it was an experiment to see if I could create something that fully embodied the values of Ethereum: transparent, secure, and accessible. Since then, it has grown and evolved in ways I never imagined. It’s supported $1.2 trillion in trading volume to date and has become critical public infrastructure for exchanging digital value.

“Now, Uniswap Labs is bringing the powerful simplicity and security that has defined the Uniswap Protocol to even more people across the world by investing in our web app and developer tools, launching NFTs, moving into mobile — and more! To support this growth, I’m so excited to announce that we’ve raised $165 million in Series B funding, led by Polychain Capital and with participation from longtime investors a16z crypto, Paradigm, SV Angel, and Variant.“

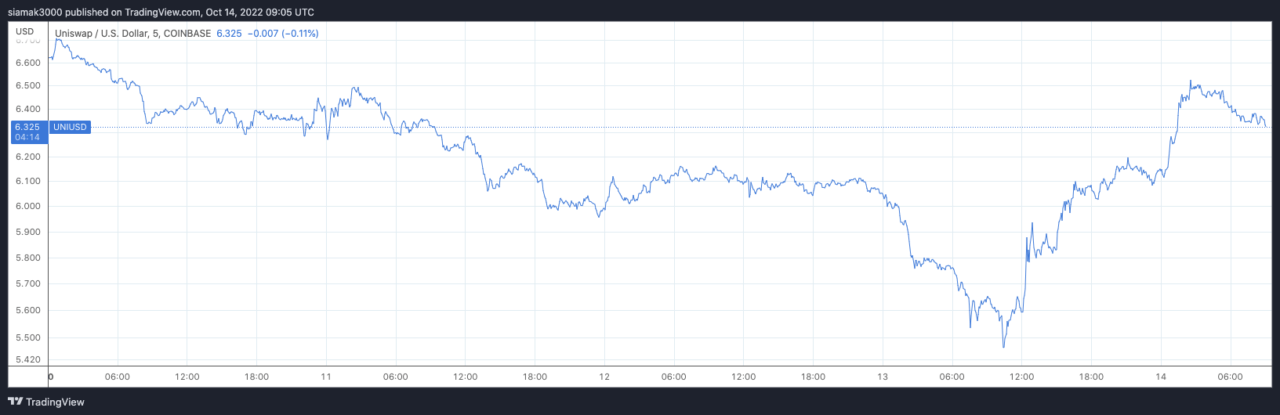

According to data by TradingView, on Coinbase, $UNI, which is the governance token of Uniswap (launched on 16 September 2020), is currently (as of 9:05 a.m. UTC on October 14) trading around $6.32, up 12% in the past 24-hour period.