On Thursday (October 27), in a filing with the U.S. Securities and Exchange Commission (“SEC”), Core Scientific (Nasdaq: CORZ), which is one of the world’s largest publicly-traded crypto mining companies, disclosed that it was having financial difficulties, which could lead to the firm going bankrupt.

Core Scientific has three lines of business:

- “Purpose-built development and operation infrastructure for blockchain computing”

- “Fully integrated self-mining operation focused on the next generation of digital assets.”

- “Fully managed hosting solutions for digital asset mining, blockchain applications, and AI.”

Here are the coins that Core Scientific mines:

The firm’s Form 8-K filing stated that

“As previously disclosed, the Company’s operating performance and liquidity have been severely impacted by the prolonged decrease in the price of bitcoin, the increase in electricity costs, the increase in the global bitcoin network hash rate and the litigation with Celsius Networks LLC and its affiliates (‘Celsius’).

“As a result, management has been actively taking steps to decrease monthly costs, delay construction expenses, reduce and delay capital expenditures and increase hosting revenues. In addition, the Board has decided that the Company will not make payments coming due in late October and early November 2022 with respect to several of its equipment and other financings, including its two bridge promissory notes.

“As a result, the creditors under these debt facilities may exercise remedies following any applicable grace periods, including electing to accelerate the principal amount of such debt, suing the Company for nonpayment or taking action with respect to collateral, where applicable. Any such creditor actions may result in events of default under the Company’s other indebtedness agreements, including its two series of convertible notes due 2025, and the potential exercise of remedies by creditors under such agreements...

“In light of the foregoing, the Company is in the process of exploring a number of potential strategic alternatives with respect to the Company’s capital structure, including hiring strategic advisers, raising additional capital or restructuring its existing capital structure…

“These discussions may not result in any agreement on commercially acceptable terms or at all. Furthermore, the Company may seek alternative sources of equity or debt financing, delay capital expenditures or evaluate potential asset sales, and potentially could seek relief under the applicable bankruptcy or insolvency laws.

“In the event of a bankruptcy proceeding or insolvency, or restructuring of our capital structure, holders of the Company’s common stock could suffer a total loss of their investment… Given the uncertainty regarding the Company’s financial condition, substantial doubt exists about the Company’s ability to continue as a going concern for a reasonable period of time.“

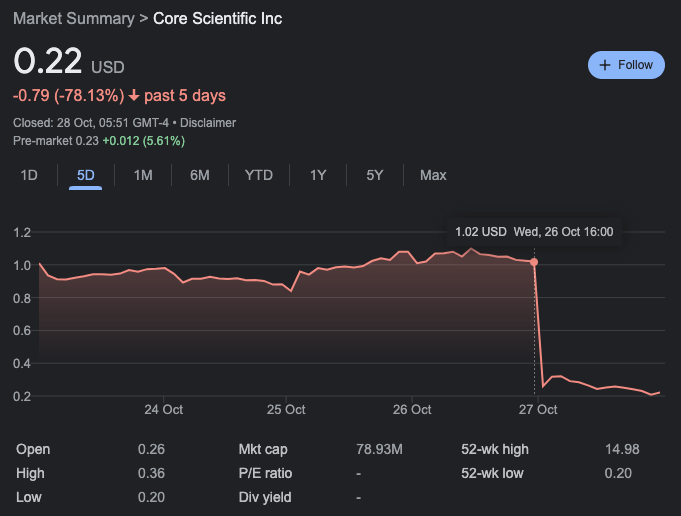

CORZ closed on Wednesday at $1.02. On Thursday, the market found out about the above disclosures, which caused the stock to drop to $0.22, which is a fall of 78.43%. Since the start of the year, the firm’s stock has fallen 97.89%.

Image Credit

Featured Image via Pixabay