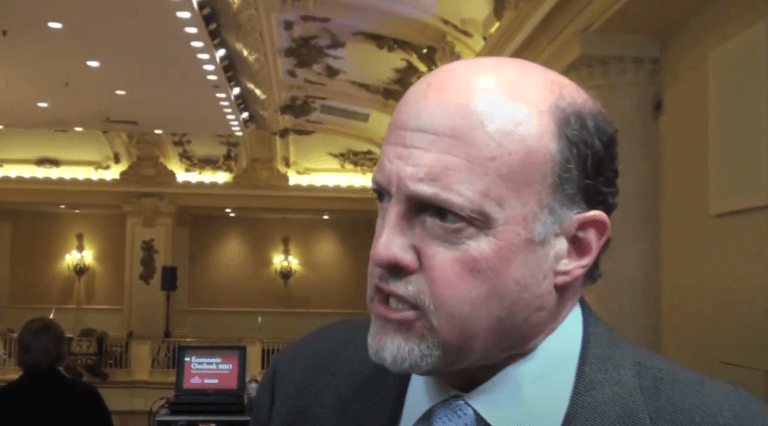

Former hedge fund manager Jim Cramer, who is is the host of CNBC show “Mad Money w/ Jim Cramer“, is “studying” Coinbase Global Inc. (NASDAQ: COIN).

On Monday, Cramer, who is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet, sent out the following tweet:

On 14 April 2021, when Coinbase became a public company on the Nasdaq exchange via a direct stock listing; Coinbase stock (COIN) closed at $328.28 per share, valuing the company at $85.8 billion on a fully diluted basis.

On that day, Cramer showed how bullish he was on Coinbase stock by sending out the following tweet:

However, since November 2021, when the latest “crypto winter” started, he has been bearish on both cryptoassets in general and Coinbase stock.

On 10 November 2021, one day after Coinbase released its Q3 2021 financial results, he tweeted:

And here is how Cramer criticized Coinbase management on 12 May 2022:

On 26 July 2022, Coinbase shares dropped 21% after Bloomberg reported that the U.S. Securities and Exchange Commission (SEC) is investigating Coinbase to determine if the crypto exchange is offering unregistered securities. This led Cramer to send out the following three Coinbase-related tweets that day:

On Thursday (August 4), Coinbase’s Brett Tejpaul (who is Head of Coinbase Institutional) and Greg Tusar (who is Head of Institutional Product) published a blog post, in which they stated that Coinbase and BlackRock were going to “create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin.”

The blog post went on to say that “Coinbase is partnering with BlackRock, the world’s largest asset manager, to provide institutional clients of Aladdin®, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime.” Apparently, Coinbase Prime will “provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.”

Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock, had this to say:

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.“

This announcement helped Coinbase stock, which had closed at $67.23 on Wednesday (August 3), to close on Thursday at $88.94.

Coinbase is expected to announce its Q2 2022 financial results next Tuesday (August 9).

As for Cramer’s current bearish attitude towards crypto, 5 July 2022, said during a conversation with Joe Kernen, a co-anchor of CNBC’s “Squawk Box“:

“Right now, it looks like that everything’s bad, and I’m not gonna deny that every asset class is getting hurt. The one I’m most interested in is crypto. There’s a lot of people in crypto. Crypto really does seem to be imploding, but of course we [went] from three trillion to one trillion. Why should it stop at one trillion?

“There’s no real value there. I mean, you look at these companies… There’s these companies that you never heard of and they blew up the weekend, and you jsay to yourself ‘holy cow! there’s six hundred million dollars just going down the drain’, and we had Gary Gensler, the [SEC] Chairman, on a few weeks ago, he just said ‘look, anybody who has a come hither rate of investment… the rate that you earn… you can kind of forget about it’, and that’s what’s happening. How many places can Sam Bankman-Fried save?“

However, just one month earlier, Cramer told CNBC’s “Make It“:

“If you’re a young person and you’re thinking about crypto, I think it’s smart.

“I think crypto should be part of a person’s diversified portfolio. I can’t tell you not to own crypto. I own crypto: I own Ethereum. Why did I buy Ethereum? Because I was in a bidding auction for charity to buy what was known as an NFT, and they wouldn’t let me do dollars. I had to buy it in Ethereum.

“So I researched it, and I said, ‘well, you know, got some qualities I like — scarcity, value — not as hot, so to speak, as Bitcoin. So, I bought it. These are hope securities. Now I don’t like hope. I think you should not ever invest on hope, but these are speculative, and one of the things that I teach in my classrooms is it’s okay to own something that’s speculative.

“You must admit that it’s speculative. So, you don’t put it in the Procter & Gamble class, [it’s] not Coca-Cola, it’s not Apple, but I suggest and accept speculation. Now, when I started Mad Money, I said, ‘I think you should own a spec and I think you should own a gold stock’.

“And ever since crypto came along, I have said that instead of, say, 10% being gold, 5% should be gold and 5% should be crypto. What do I think is the value of crypto? I have no idea. Here’s what I know you’re thinking, though. You’re thinking ‘I have seen fortunes made in crypto and I want a shot at making a fortune’.

“And unlike many of the so-called graybeards who come on TV, I agree with you. You have every right to try to make some money in crypto. I would prefer that you would do it in Ethereum or Bitcoin, which have the largest following, seem like they’re the most legitimate. I would be careful not to borrow money as many people do own these because these are speculative…

“Bitcoin can’t live your house. It’s not a mortgage. It’s a piece of paper, or in this case, it’s not even a piece of paper. So, I don’t want any borrowing. Borrow for your house, borrow for your car, but don’t borrow for crypto, but I would never discourage you from buying crypto because of all the fortunes that have been made and how it could make a whole new group of people fortunes. I’d like that to be you.“