Data from the Bitcoin ($BTC) blockchain shows that large whales on the network have been taking advantage of the cryptocurrency’s market downturn to accumulate more BTC after distributing their coins ahead of the recent sell-off.

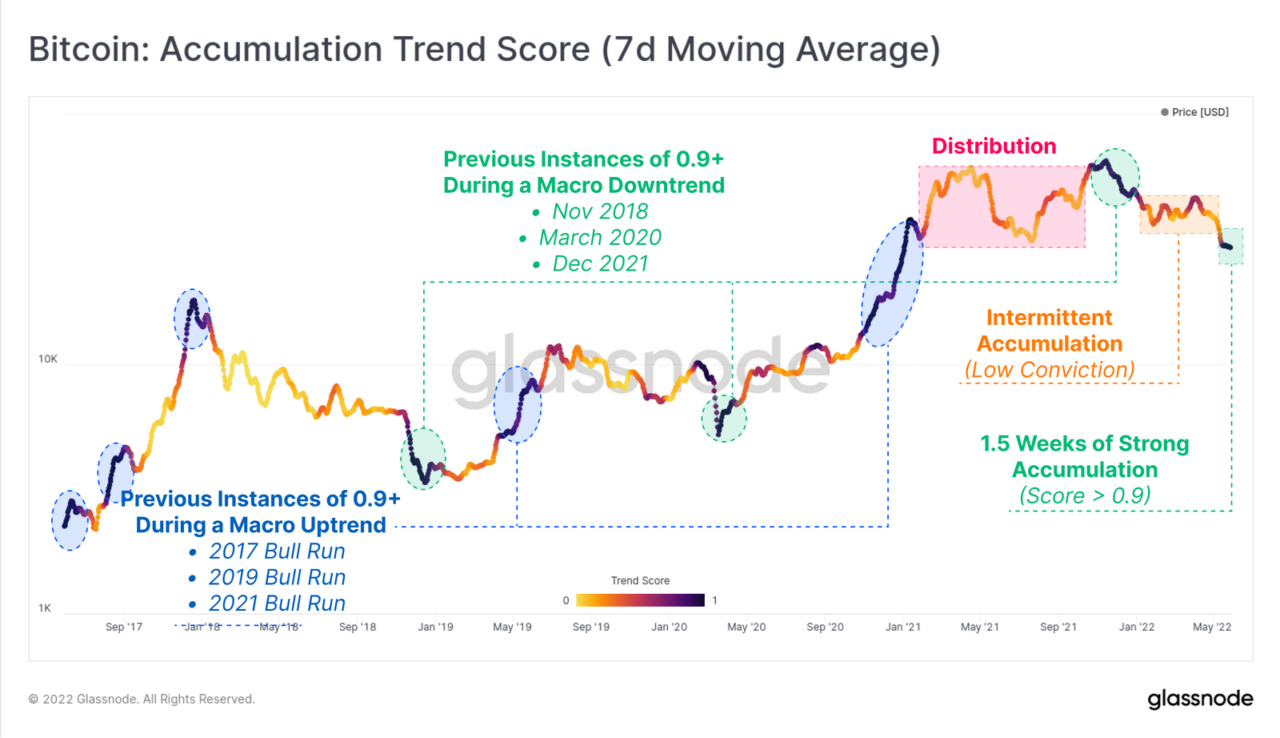

According to Glassnode’s latest on-chain report, a metric known as the “Accumulation Trend Score” has been at a 0.9 high for nearly two weeks now. The metric reflects the aggregate accumulating or distribution trend seen by Bitcoin investors on-chain while filtering out miners and cryptocurrency trading platforms.

When the Accumulation Trend Score is closer to zero it reflects investors are distributing their holdings or simply stopped accumulation. When it rises to be near 1, it shows investors have been strongly accumulating BTC.

Glassnode’s report details that the metric currently “indicates that existing entities on the network are adding significantly to their holdings.” Earlier this year, the Accumulation Trend Score had notably been in an “intermittent accumulation” period that showed investors’ conviction was low.

Over the last two weeks, in the aftermath of the collapse of the Terra ecosystem that saw the price of Bitcoin dip below the $30,000 mark to slowly recover over time, the metric’ score went to 0.9, showing “strong accumulation.”

Historically, strong accumulation was seen both during macro uptrends in the 2017, 2019, and 2021 bull runs, and during macro downtrends in the November 2018, March 2020, and December 2021 drops.

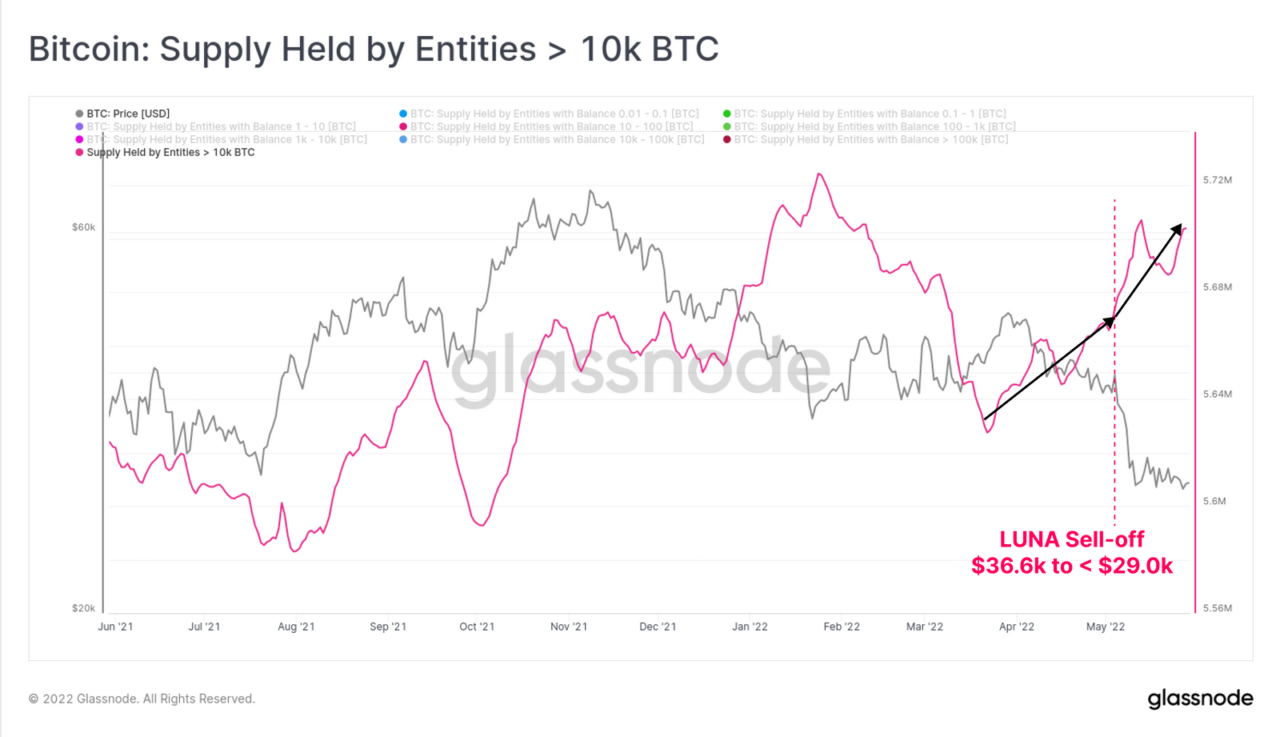

Glassnode’s report details that there are two wallet cohorts contributing to the accumulation trend, those with less than 100 BTC and those with over 10,000 BTC. The report shows that those with less than 100 BTC have seen their holdings increase following the recent sell-off, to the point their aggregate balance increased by 8’,724 BTC.

On the other hand, entities with over 10,000 BTC have increased their holdings by 46,269 BTC, even after the Luna Foundation Guard (LFG) sold over 80,000 coins on the market in early May in a bid to defend the UST peg.

As CryptoGlobe reported, JPMorgan has recently said cryptocurrencies are now the bank’s preferred alternative asset, as a major sell-off in the cryptocurrency space after the collapse of the Terra ecosystem hurt cryptos more than other alternative investments including private equity and private debt.

Alternative assets, it’s worth noting, are assets that don’t fall into typical categories such as stocks and bonds. Cryptocurrencies, real estate, private equity, and private debt all fall under this category.

Newsletter

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured image via Unsplash