The co-founder of cryptocurrency trading and venture capital firm Three Arrows Capital, Su Zhu, has revealed he sees some signs that Bitcoin ($BTC) is reentering an accumulation range after the cryptocurrency’s price fell for seven weeks in a row for the first time in its history.

Per Su Zhu, the price of the flagship cryptocurrency being down for seven weeks is in itself an indicator BTC is in an accumulation range, as the spot and derivatives trading volumes going up while the Luna Foundation Guard (LFG) deployed its 80,000 BTC reserve in an attempt to defend the UST peg amid LUNA’s crash.

The co-founder of the cryptocurrency hedge fund also added that Bitcoin has been showing strength when compared to equities, at a time in which analysts from Bank of America noted the flagship cryptocurrency has been failing as an inflation hedge over its correlation with equities.

Zhu also pointed to a geographic premium seen during Asian trading hours, and to the Mayer multiple being at lows. The Mayer multiple, it’s worth noting, was created by Trace Mayer as a way to analyze the price of BTC in a historical context.

The multiple doesn’t indicate whether the cryptocurrency is overvalued or undervalued, but instead uses the multiple of Bitcoin’s price over its 200-day moving average. Zhu also pointed out that Bitcoin exchange-traded funds (ETFs) in Canada saw a 7,000 BTC inflows when the cryptocurrency dropped to $25,000, and to fear, uncertainty and doubt (FUD) surrounding Tether as “secondary signs.”

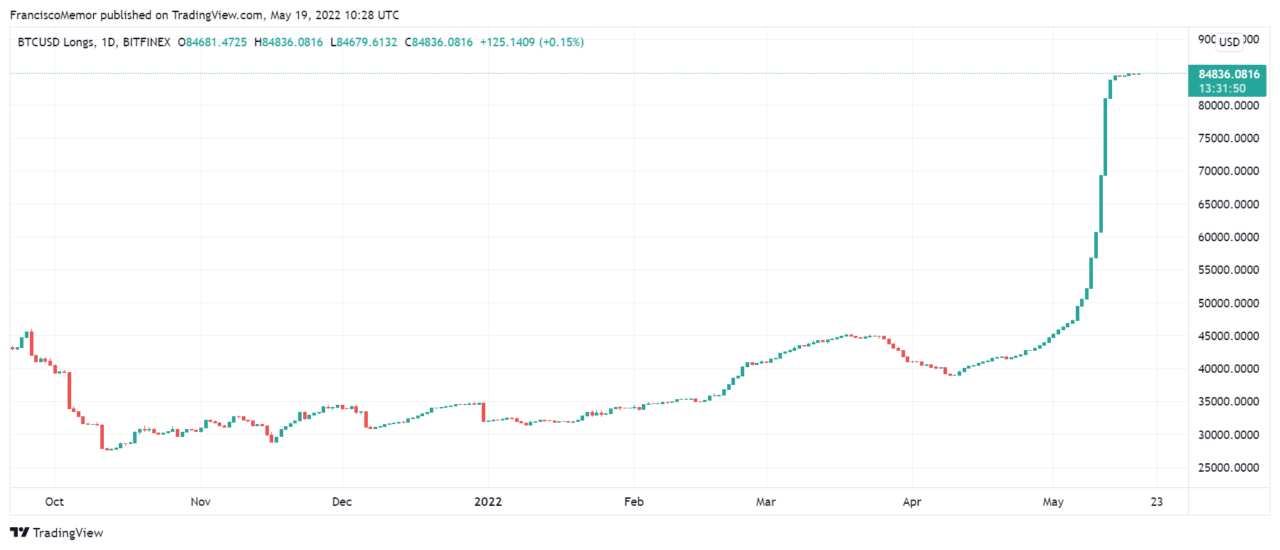

The co-founder noted that Bitfinex longs have broken through their all-time highs, showing traders on the platform are bullish on the flagship cryptocurrency. Similarly, traders are shorting bitcoin to “hedge private sales,” he said.

Zhu also suggested potential events that could lead to a rally include El Salvador’s conference with representatives of 44 nations on Bitcoin, a sovereign wealth fund conducting “thesis-driven allocation” to BTC, and the Organization of Petroleum Exporting Countries (OPEC) using it for international payments.

As CryptoGlboe reported, retail investors have been taking advantage of the flagship cryptocurrency’s recent dip towards the $30,000 mark to accumulate more BTC even at a time in which over 40,000 coins worth over $1.16 billion have moved to exchanges.

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash