Crypto loans platform Binance Loans now allows $ADA and $AVAX — the native tokens of smart contract platforms Cardano and Avalanche respectively — to be used as staking collateral assets.

On 26 July 2021, Binance published a blog post that explained what crypto loans and what their use cases are:

“The fundamentals of crypto loans are very similar to traditional loans. One key factor where they differ lies in how the funds are accounted for. With traditional loans, banks or other institutions use credit scores to calculate the amount of risk they can invest into a borrower. With crypto loans, credit scores are totally unnecessary. Instead, traders can use their crypto assets as collateral for the lender to hold until the loan is paid back.

“Aside from this difference, the mechanisms behind the loan are similar in a technical sense. Crypto loans generally collect interest hourly, instead of monthly. Also, the terms for loans can be shorter than traditional loans. With crypto loans, traders can borrow from 7 to 180 days on platforms such as Binance Loans.

“The reason crypto loans operate on such a shorter time scale is that cryptocurrencies are much more volatile than traditional currencies, making them riskier for the lender and borrower. Should a cryptocurrency drop drastically in value, the collateral a lender took on could become worth much less than what was borrowed. Thus, hourly rates and shorter borrowing terms are applied.

“There are a few reasons why a crypto loan may be attractive to investors. Traders often don’t want to liquidate their assets, and when funds are needed, it is useful to have the option to open a loan. Another common use for a crypto loan would be to receive interest on assets. For instance, traders can use BTC as collateral to acquire a loan in BUSD or USDT (any stablecoin). The collateral will likely be worth more than the loan itself, but once the loan is repaid including interest, the collateral is returned. At this point, the BTC may have appreciated, leaving the borrower with a profit.

“Another reason to use a crypto loan rather than a traditional loan is the speed at which funds can be acquired. BTC loans can be acquired nearly instantly, making your crypto assets extremely liquid and convertible, to capitalize on market opportunities quickly and easily.”

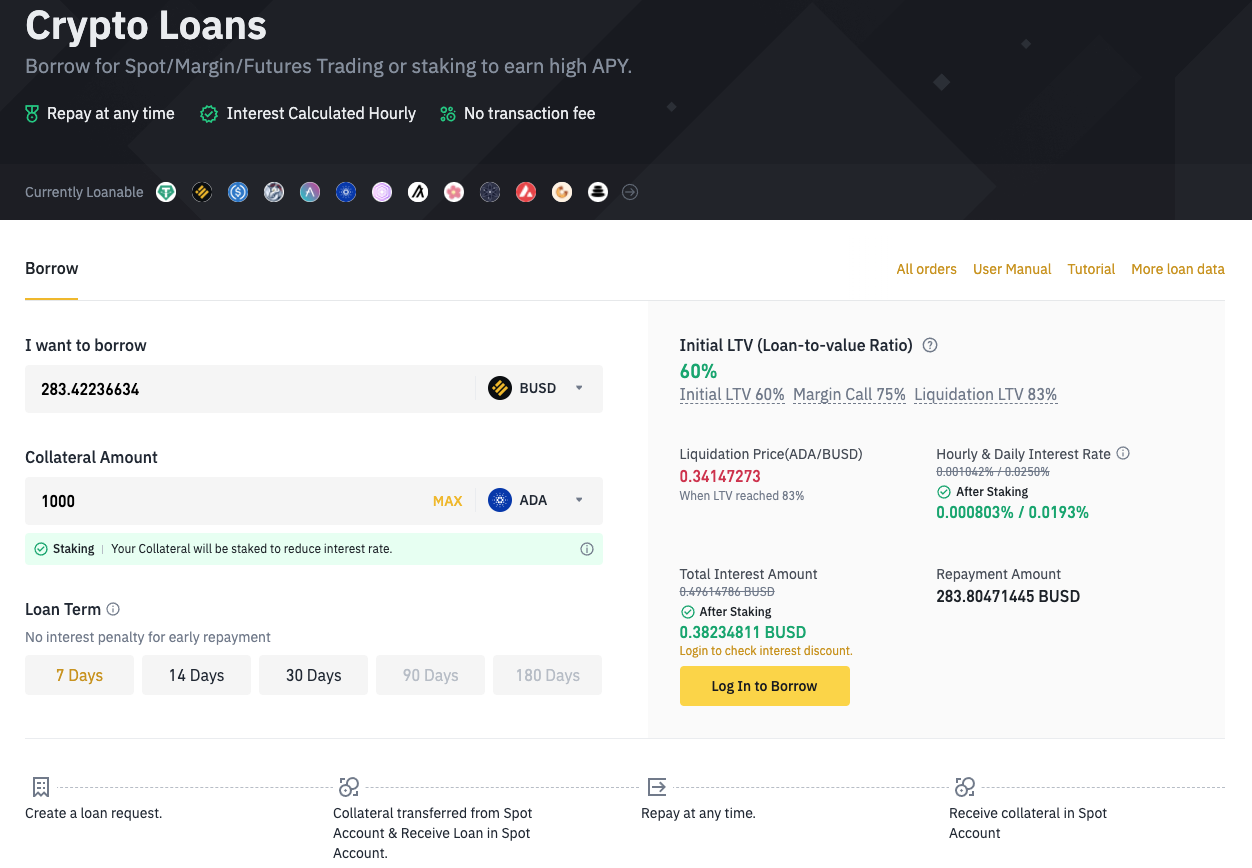

Here is some useful information about Binance Loans:

- “As long as you are a registered user of Binance, you can borrow on Binance Loan.“

- Binance Loans supports the borrowing of 20 cryptoassets (including $BTC, $ALGO, and $BAT).

- Binance Loans supports the use of 20 cryptoassets as collateral (including $BTC, $BNB, and $DOGE).

- “Loan terms of 7, 14, 30, 90 and 180 days are available. You can always repay in advance and the interest is calculated based on the hours borrowed.“

- “Interest is calculated hourly, and less than one hour is calculated as one hour. The interest rate is determined by the time you make the loan.”

- “You have to repay them manually on the Order page. The interest has to be repaid before the principal.“

- “LTV is the value of your loan to the value of your collateral. The price used here is Index Price. Different collateral coins have different initial LTVs, which means when you use different coins as collateral of the same value, the loan you make is of a different value too.“

- Collateral can “be used for staking to generate profit and to deduct interest.”

On May 25, Binance announced that it had added $ADA and $AVAX as staking collateral assets on the Binance Loans platform.

Newsletter

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.