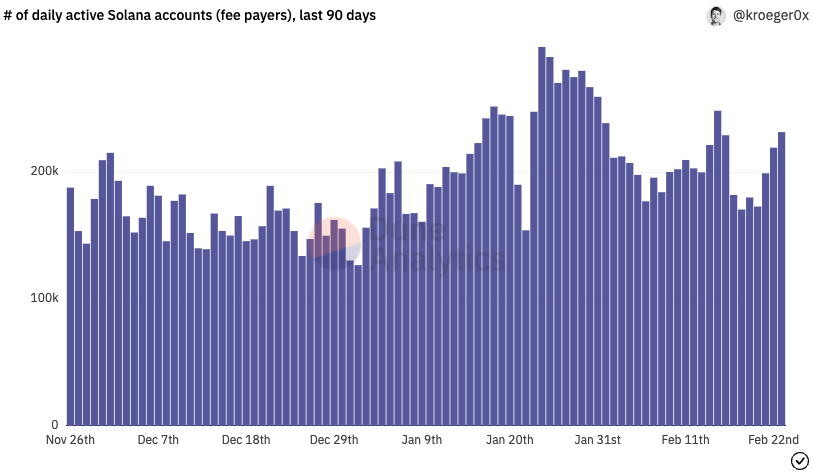

The number of daily active signers on Solana ($SOL), which are deemed a good proxy for daily active users, has jumped 300% since the network’s last update in late September, peaking at 299,000 in late January before dropping to 232,000.

According to OurNetwork, a weekly newsletter focused on on-chain analytics, data from Dune Analytics shows that the number of daily active signers dropped after Solana dealt with another episode of degraded performance.

The newsletters’ analysts noted that Solana’s daily active user numbers were bolstered by its top two wallets, Solflare and Phantom, both launching mobile applications for iOS devices, along with strong user participation on the network’s non-fungible token (NFT) market.

As reported by Daily Hodl, OurNetwork detailed that Solana’s NFT market “exploded into relevance in the second half of 2021,” and carried that momentum into this year, with its market capitalization recently reaching $1 billion.

After the launch of the Metaplex Protocol, which is an “affordable NFT ecosystem for marketplaces, games, arts & collectibles,” Solana’s NFT marketplace saw a surge of activity, with the cumulative number of NFT owners growing from 28,000 to almost 2.5 million, it adds.

Similarly, the number of NFT launches on the Solana blockchain “skyrocketed, with more than 8m total NFTs being minted using Metaplex.” Since September, it adds, the number of wallets holding more than one NFT surged to now be over 500,000.

Earlier this year, analysts at JPMorgan led by Nikolaos Panigirtzoglou have revealed they see Ethereum ($ETH), the second-largest cryptocurrency by market capitalization, losing market share to rivals like Solana when it comes to non-fungible tokens (NFTs).

In a note shared with clients, the analysts wrote that Ethereum’s volume share of non-fungible token trading fell from 95% at the start of 2021 to 80% as a result of the high transaction fees seen on the cryptocurrency’s network. They found that Solana has been a primary beneficiary as it has been seizing market share from Ethereum.

Other networks, including WAX and Tezos, are reportedly also gaining market share, JPMorgan’s analysts said. Notably, late last year analysts at the investment bank said ethereum has more growth potential than bitcoin as interest rates rise, as it powers an ecosystem of decentralized applications.

As CryptoGlobe reported, Alkesh Shah, a digital asset strategist at Bank of America has revealed he believes Solana has the potential to “become the Visa” of the cryptocurrency space as it focuses on scalability, low transaction fees, and ease of use.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay