On Friday (March 26), former Goldman Sachs executive Raoul Pal “spent 140 ETH on a cartoon picture of an Ape.”

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

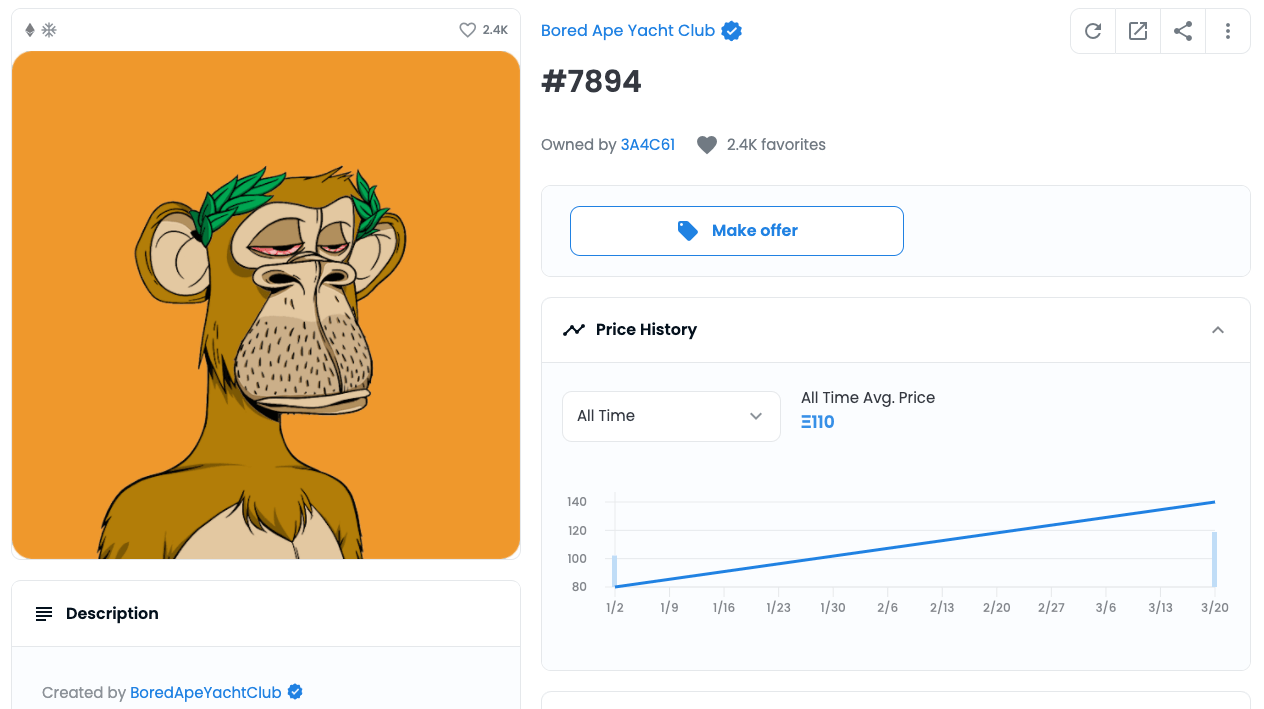

In a blog post published on March 26, Pal confessed to paying 140 ETH (worth around $400,000 at the time of purchase) for Bored Ape #7894 (“Seneca”)”

Paul went on to say that he “bought this particular ape because it is a clean and simple design” and because he “liked the rare laurel wreath and its symbolism.”

Next, he talked about why he had decided to invest in this particular NFT project, i.e. the Bored Ape Yacht Club (BAYC):

“Bored Ape Yacht Club has been around a while. You’ve all seen it so I’ll spare you the details but its basically a community of around 15,000 blokes in their 30’s who created a vibrant community (if a bunch of blokes in the US is your kind of thing) and they saw value in their community and became highly engaged. BAYC, unlike the precious (in both senses of the word) community of Crypto Punks, had IP rights embedded in their smart contracts. That led to Yuga Labs and community members being able to sell ‘merch’…

“I’d also seen that celebrities had caught on to the vibe – showing their Web 3 credentials at the nexus of street fashion (if $200k .jpegs at the time could be called ‘street’). Eminem, Jimmy Fallon, Paris Hilton and others flocked around the new movement that was fast becoming a brand…

“Then EVERYONE aped in…

“My view is that the future lies in social tokens and that was the way forward. You start with NFT communities (the Thousand True Fans model) and then built out a social graph. I had heard about the potential social token around BAYC so that got me focussed, outside of the glamour of the news flow…

“I got back from Utah and as soon as I got home, BAM! Yuga Labs buys Crypto Punks (the NFT OG project) and MeeBits from Larva Labs. Now, I knew something big was happening! Those projects are incredibly important in the space but didn’t have the same IP rights at BAYC but putting them all together in one place was HUGE. Yuga are building a Web 3 metaverse, media, fashion and art brand from the ground up and had made a daring move. This was something Web 3 had not yet seen…

“Then it was announced that they had raised $450m in a ‘seed’ round… The deck was mind blowing… I’m sure I’m missing many other key events but the next one for me was the BIG one; the social token dropped last week. The Ape Coin. $APE.“

Pal then explained why he believes that social tokens, such as $APE, are the “big” thing:

“You see, I BELIEVE in social tokens as Universal Basic Equity and the future of culture and community, municipalities and charities, of business models and economies…

“Now millions of people could join this Web 3 media empire as owners and participants. My view has always been that social tokens turn brand and community from an intangible asset on the balance sheet to a tangible asset. The market cap of $APE created $2bn of value and the fully diluted market cap suggests $13bn of value…

“I don’t think of social tokens are get-rich quick schemes but get rich slowly IF the community builds utility that has long-lasting value. Build utility, a vibrant, growing community and some quantifiable scarcity and you WILL build value over time, and everyone can participate – either via investment in the utility token (as deferred future utility) or by adding value to the community and being rewarded in tokens. The brand or creator is on an equal footing. All incentives are aligned.

He then switched his focus to BAYC:

“This is a network with a full system of money, an asset base (NFT’s) with open Web 3 IP, massive brand recognition and apps being built on top of the network... I have never seen anything like this, at this speed and at this scale before…

“I immediately bought my Ape, Seneca and bought $APE tokens, bought more Ape in Production NFT’s and will layer more on top. I didn’t get into the the Yuga capital raise sadly. but Im not sure what is a better bet, the equity or the network. I prefer the network…

“The future has arrived… You might not see it yet but when you look back in 10 years you will see the entire worlds business model has changed. Forever.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.