On Tuesday (March 29), billionaire Mike Novogratz was asked to explain why Bitcoin had bounced from around $34,000 at the start of the Russia’s “special military operation” in Ukraine to over $47,000 now.

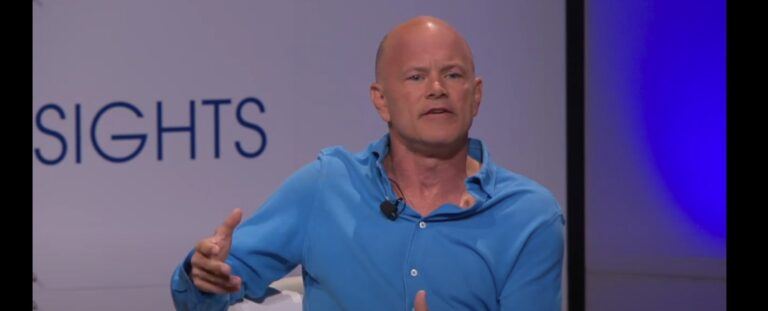

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a technology-driven financial services and investment management firm that provides institutions and direct clients with a full suite of financial solutions spanning the digital assets ecosystem.”

Novogratz’s comments about Bitcoin were made while he was being interviewed by Joe Kernen on CNBC’s “Squawk Box”.

Kernen started by asking what is Bitcoin’s long-term support level.

Novogratz replied:

“You know, early in the year, I thought we would be $30,000 – $50,000, but I also thought stocks would be a little softer than they are, and I think, you know, maybe what I got wrong was with all this selling in fixed income, that money’s got to go somewhere.

“We certainly see increased adoption in crypto. I mean, Janet Yellen pivoted and was much more friendly to crypto… than she’d ever been. That’s basically, you know, politicians listening to their constituents and getting to the president. And so, there was no magic there.

“I’m getting calls from senator after senator, ‘hey can you, can you help educate, can you help me figure this out’. And so, people have realized crypto is really popular, and I think you’re going to see the Democrats take a softer stance…

“Mostly we’re just seeing adoption, states saying they’ll take taxes, countries participating, sovereign wealth funds getting involved, pension funds, getting involved. And so, we’re still early in this adoption cycle. I’m much more optimistic than I was even, six, seven weeks ago.”

And when Kernen asked the Galaxy Digital CEO when he expects to see a spot Bitcoin ETF, Novogratz replied:

“I think we’re within a year. Listen, I think Genser has come, and he really wants to regulate crypto. He’s been doing it by enforcement, but at one point — he’s an intellectually honest guy — you can’t just keep postponing forever…

“The process with the SEC has been slow for companies trying to go through it, much slower than normal, but it has to have an end. And so, I’m hoping within the year. I’m not wildly optimistic anything happens anytime soon. There’s going to be congressional gridlock…

“Congress isn’t going to give any one of the agencies a roadmap on who gets to regulate. And so I think we’re kind of in this stasis position, but it does feel like things are moving in the right direction, albeit slowly.“

With regard to Novogratz saying that U.S. Treasury Secretary Janet Yellen was sounding much more crypto-friendly these days, he was referring to Yellen’s latest comments about crypto, which were made while she was being interviewed by CNBC “Squawk Box” co-anchor Andrew Ross Sorkin.

After Sorkin told Yellen that Russia’s energy chief had expressed on March 24 the idea that it might start accepting Bitcoin as payment for oil and gas, he asked her what it said about where “we are in the crypto conversation.”

Yellen replied:

“Well, crypto’s obviously grown by leaps and bounds, and it’s now playing a significant role, not really so much in transactions, but in investment decisions of lots of Americans. And the President just issued, a couple of weeks ago, an executive order tasking us and other agencies with thinking about the regulation of crypto.“

Sorked then asked Yellen if this meant that she was less skeptical about crypto these days than she has been in the past.

Yellen answered:

“I have a little bit of skepticism [because] there are I think valid concerns around it. Some have to do with financial stability, consumer investor protection, use for illicit transactions, and other things. On the other hand, there have been benefits from crypto, and we recognize that innovation in the payment system can be a healthy thing. We would like to come out eventually with recommendations that will create a regulatory environment in which healthy innovation can occur.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.