Grayscale Investments (“Grayscale”), the world’s largest digital currency asset manager with $44.1 billion of assets under management (as of 1 September 2021), has announced a new single-asset investment product dedicated to $SOL, the native token of the Solana blockchain.

Grayscale, a subsidiary of incubator and crypto-focused venture capital firm Digital Currency Group (DCG), issued a press release yesterday (November 30) to announce the launch of Grayscale® Solana Trust, which is the sixteenth product in Grayscale’s suite of crypto investment products (fourteen of these are single-asset products and two are diversified products).

Grayscale says that Solana is “a smart contract platform first conceived in a 2017 whitepaper” and that “like the Ethereum network, the Solana network is one of a number of projects intended to expand blockchain use beyond just a peer-to-peer money system.” It also mentions that the Solana protocol “introduced the Proof-of-History (PoH) consensus mechanism as an alternative to pure Proof-of-Stake (PoS) and Proof-of-Work (PoW) blockchains.”

Grayscale Solana Trust is “solely and passively invested in SOL, enabling investors to gain exposure to SOL in the form of a security while avoiding the challenges of buying, storing, and safekeeping SOL directly.”

Grayscale CEO Michael Sonnenshein had this to say:

“For the last eight years, Grayscale has been at the forefront of offering investors efficient exposure to the ever-evolving digital currency ecosystem. We have had a front row seat to the mainstream acceptance and adoption of crypto, and increasingly find that investors are diversifying their exposure beyond digital assets like Bitcoin and Ethereum. Our family of Grayscale products will continue to expand alongside this exciting asset class, as we remain committed to offering investors opportunities to access the digital economy.“

Grayscale goes on to say that its Solana Trust is now “open for daily subscription by eligible individual and institutional accredited investors.” The annual fee is 2.5%.

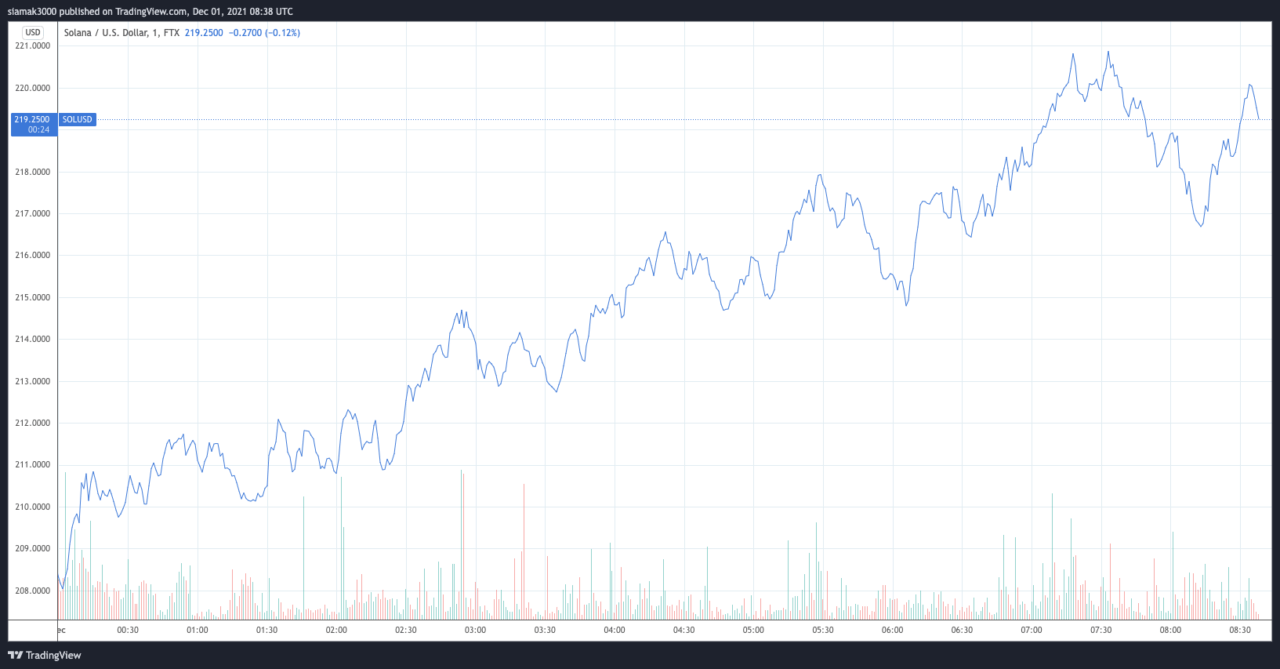

According to data by TradingView, on crypto exchange FTX, currently (as of 8:38 a.m. YTC), $SOL is trading around $219.2550, up 9.36% in the past 24-hour period.

However, what is really impressive is $SOL’s return on investment vs USD for the year-to-date (YTD) period, which is an insane 14420%.

Earlier today (December 1), Kyle Davies, Co-Founder of Singapore-based hedge fund management firm Three Arrows Capital tweeted:

Yesterday (November 30), Hxro Network ($HXRO), a Solana-powered “decentralised derivatives liquidity network for risk-based applications”, announced via a press release “the closing of a $34 million strategic funding round co-led by SIG DT Investments (A Susquehanna International Group Company), Jump Crypto, and Blockchain Capital.”

This $34 million funding round was “backed by a marquee list of principal trading firms including SIG DT, Jump Crypto, Alameda Research, Chicago Trading Company, and Pattern Research as well as venture participation from Blockchain Capital, Solana Ventures, Coinbase Ventures, Commonwealth Asset Management, CoinFund, Genesis, LedgerPrime, Mantis, and Magnus Capital.”

Per the press release, the Hxro Network “plans to initially support markets for the most well-known crypto-assets, and will later agnostically extend to markets for any high-fidelity data supplied by network-approved oracles.” This “enables the Network to provide the underlying market infrastructure for everything from crypto and traditional assets to live in-play sports wagering and other event-driven markets.”

Dan Gunsberg, Co-Founder of Hxro Network, had this to say:

“The notional size of incumbent derivatives markets is still many times that of what is available in DeFi. The mission of Hxro Network is to change that in a way where all market participants, no matter the size of their contribution and participation, can benefit. Today’s announcement is further validation of Hxro Network’s community-based vision to build the most robust and scalable decentralized derivatives primitive available in the marketplace.

“We’ve coordinated some of the most experienced participants from both traditional and crypto markets to participate in the design and build of the network’s most critical foundational elements. Under normal circumstances these teams would be incredibly competitive with one another.

“However, they all share a common goal of unlocking the frictions that exist in incumbent markets and creating an open marketplace through the application of decentralized technology. As a community, we are creating a very powerful foundation for decentralized derivatives to scale and become a significant part of the fabric of the global derivatives landscape.“

Hxro Network is aiming to “begin launching v1 network components to Solana mainnet next month and into Q1 of next year.” The startup plans to use the round proceeds to “fund the network treasury, bootstrap early protocol liquidity, and fund network rewards.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.