In a recent online auction, a single non-fungible token (NFT) asset created for the Ethereum-powered metaverse “The Sandbox” sold for 149 ETH (over $650K).

What Is the Sandbox?

Here is how Binance Research described The Sandbox back in August 2020:

“The Sandbox is a virtual world built on the Ethereum blockchain, where players can build, own, and monetize their gaming experiences… The SAND token is an ERC-20 utility token that is used for value transfers as well as staking and governance… Players can create digital assets in the form of Non-Fungible Tokens (NFTs), upload them to the marketplace, and integrate into games with Game Maker.“

And here is how Wikipedia describes it:

“The game is entitled “The Sandbox” because it provides users with tools to create their own nonlinear gameplay, commonly known as a “sandbox mode“. The player takes the role of “Deity apprentice” and sets about crafting their own universe through the exploration of resources such as water, soil, lightning, lava, sand, glass, and many more complex elements such as humans, wildlife, and mechanical contraptions. Players encounter tasks like using water and dirt to make mud, and challenges like making a battery or building an electrical circuit. Players can save worlds they have created and also upload them to a public gallery.“

The list of celebrities and brands that The Sandbox has partnered with includes Snoop Dogg, South China Morning Post, Hell’s Kitchen, and Atari.

What Was Special About This NFT Asset?

The “Metaflower Super Mega Yacht” NFT was created for The Sandbox metaverse by Republic Realm, and it is part of their Fantasy Collection.

Republic Realm is “one of the most active investors in and developers of the metaverse real estate ecosystem.” The company invests in, manages, and develops “assets including NFTs, virtual real estate, metaverse platforms, gaming, and infrastructure.” Currently, it is “one of the largest landowners in Axie Infinity, Decentraland, The Sandbox and Treeverse.”

Here is the description of “The Metaflower Super Mega Yacht” from the NFT marketplace OpenSea:

“The Metaflower is a one of one ultra luxury megayacht. With a DJ booth, helicopter landing pad, and hot tub, among other amenities, this Fantasy Collection NFT provides access to The Fantasy Marina and is designed to be the crown jewel of The Sandbox.“

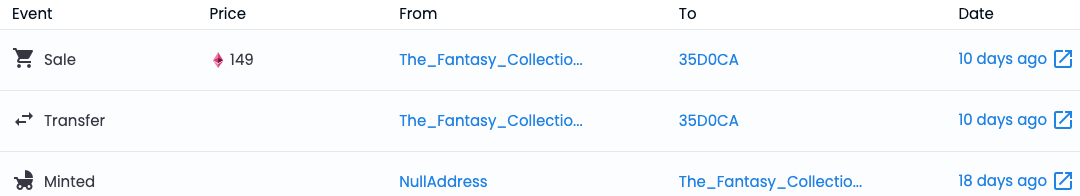

This NFT was minted 18 days ago and the first sale (for 149 ETH) took place 10 days ago:

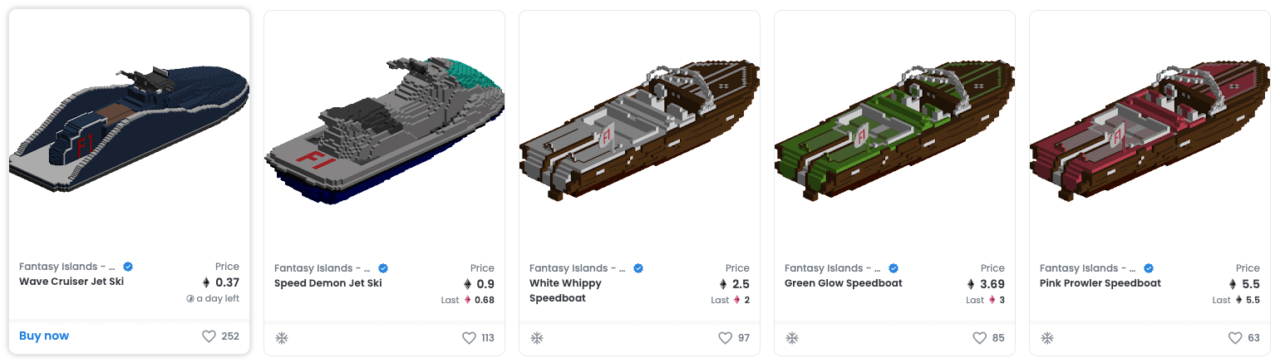

Here are a few other NFTs from this collection that you can currently buy on OpenSea:

According to a report by Insider published yesterday (December 2), data by DappRadar shows that “a total of $106 million was spent on virtual property in the last week, with purchases of digital land, luxury yachts and other assets.” The report says that for the week November 22 to 28, the The Sandbox platform “attracted $86.56 million in unique non-fungible token land sales that are tied to the blockchain.” Apparently, “in second place was Decentraland, another virtual platform that brought in $15.53 million in sales of digital plots of land.”

In a research report released last month, Grayscale Investments (“Grayscale”), a subsidiary of Digital Currency Group, said that “the market opportunity for bringing the Metaverse to life may be worth over $1 trillion in annual revenue and may compete with Web 2.0 companies worth ~$15 trillion in market value today.”

The 19-page research report (titled “The Metaverse: Web 3.0 Virtual Cloud Economies”) was written by Head of Research David Grider, Head of Research and Research Analyst Matt Maximo.

Grider and Maximo started by explaining what they mean by the term metaverse:

“Crypto cloud economies are the next emerging market investment frontier and the Metaverse is at the forefront of this Web 3.0 internet evolution. The Metaverse is a set of interconnected, experiential, 3D virtual worlds where people located anywhere can socialize in real-time to form a persistent, user-owned, internet economy spanning the digital and physical worlds…

“Projects like Decentraland are creating an open-world metaverse where users can log in to play games, earn MANA (the native token of Decentraland, with which users can purchase NFTs, including LAND or collectibles, and vote on economy governance), or create NFTs, giving them real world interoperability for the value of their time spent in-game.“

They then explained the difference between a “Web 2.0 Closed Corporate Metaverse” and a “Web 3.0 Open Crypto Metaverse”:

“Many gamers today spend their money and hours of their time building digital wealth within Web 2.0 closed corporate metaverse worlds. The problem is, most game developers don’t let players monetize their investment and efforts. Developers prohibit players from trading items with other players and keep these worlds closed so players cannot transfer their in-game wealth to the real economy.

“Web 3.0 open crypto metaverse networks solve this problem by eliminating the capital controls imposed on these virtual worlds by Web 2.0 platforms. This new paradigm allows users to own their digital assets as Non-Fungible Tokens (NFTs), trade them with others in the game, and carry them to other digital experiences, creating an entirely new free-market internet-native economy that can be monetized in the physical world. This evolution of the ‘creator economy’ is known as ‘Play to Earn’.“

Next, they pointed out that “gaming is just one of the most immediately addressable segments where value is already starting to naturally shift to Web 3.0”, and that in fact “the Metaverse opportunity extends far beyond gaming”. Grayscale estimates the metaverse to be “a trillion-dollar revenue opportunity across advertising, social commerce, digital events, hardware, and developer/creator monetization”.

They then looked at the various segments of the blockchain-based virtual economy.

The authors concluded by saying that the immense potential of the metaverse, which has made Facebook “pivot towards the Metaverse” and change its name to Meta, could “serve as a catalyst for other Web 2.0 tech giants and investors to follow.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.