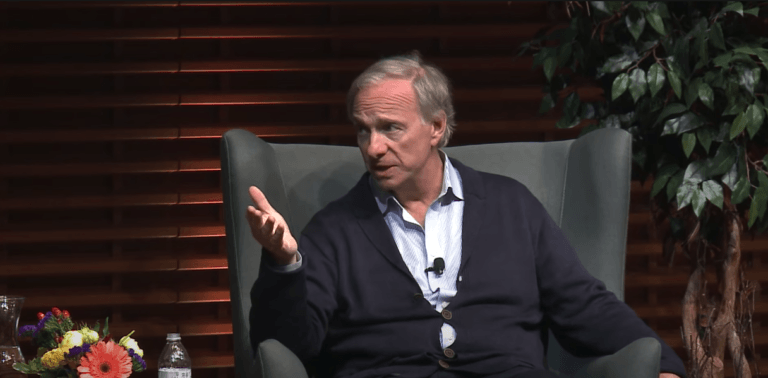

Legendary billionaire hedge fund manager Ray Dalio recently commented on Bitcoin.

Dalio is the founder, chairman, and co-chief investment officer of Bridgewater Associates.

The 72-year American — whose net worth is estimated by Forbes to be around $20 billion — created asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $138 billion in assets under management as of April 2020, and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

According to a report by The Daly Hodl published on December 20, during an interview Yahoo Finance’s editor-in-chief Andy Serwer on December 15, Dalio was asked about his crypto portfolio and his reply was:

“Well, I’m not going to give the precise amount of Bitcoin – but I do own some Ethereum as well. But the answer to your question is that I don’t own a lot of it. I view it as alternative money in an environment where the value of cash money is depreciating in real terms.

“And I think it’s very impressive that for [the] last 10, 11 years, that programming has still held up, it hasn’t been hacked and so on, and it has an adoption rate.“

He also explained why he is often quoted as saying that he believes “cash is trash”:

“I would like to say that cash – I’ve been quoted [saying] ‘cash is trash’ – which most investors think is the safest investment is, I think, the worst investment. And that it’s important because it loses buying power.

“The one thing I would say to investors is don’t judge anything in your returns or your assets in nominal terms, in terms of how many dollars you have. View it in terms of inflation-adjusted dollars.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.