Earlier today, eToro announced on its website that due to regulatory concerns, it would be “limiting ADA and TRX” for users based in the U.S. and that these users would “no longer be able to open new positions in, or receive staking rewards for, Cardano (ADA) and TRON (TRX)” but would be “able to close existing positions.”

Here are some important things to be aware of:

- Users based in the U.S. will not be able open new $ADA or $TRX positions starting on 26 December 2021.

- Users based in the U.S. will not be able to enjoy staking rewards for $ADA and $TRX since staking support for these two assets will end on 31 December 2021. Final rewards (in USD) will be paid out on 15 January 2022.

- Users based in the U.S. will still be able to maintain their existing $ADA and $TRX balances on the exchange. They will also be able to close their positions, i.e. sell their $ADA and/or $TRX holdings for USD; however, sometime in Q1 2022 eToro will also limit the selling of such holdings.

- eToro is trying to make the eToro Money crypto wallet compatible with $ADA and $TRX (hopefully early in 2022).

This unexpected move by eToro forced Hoskinson to take to YouTube to clarify some of the confusion surrounding this news.

In summary, Hoskinson said that (1) neither the Cardano Foundation nor IOHK had been contacted by any financial regulators about $ADA; eToro’s move is the result of lack of regulatory clarity around cryptoassets; and although it is unfortunate that eToro felt it had to take this action, the de-listing of $ADA on the eToro platform in the U.S. will have no meaningful impact on the liquidity of ADA for the following reasons:

- $ADA is one of the most liquid cryptoassets in the market;

- eToro was not handling a huge amount of $ADA trading volume; and

- last Thursday (November 18), Bitstamp, which is one of the largest (if not the largest) crypto exchanges in Europe, announced that it was preparing to list $ADA.

As CryptoGlobe reported, in a blog post published on November 18, Bitstamp explained the listing schedule for $ADA:

- November 23: “Deposits and withdrawals open but trading is not enabled yet.“

- November 24 (around 11:00 A.M. UTC): “You will be able to place and cancel limit orders, but they will not be matched.“

- November 24 (around 03:00 P.M. UTC): “Order matching will start and trades will be executed normally.“

Then, “once the order books gather sufficient liquidity”, Bitstamp will “enable all order types and card purchases for the new trading pairs as well.”

This means that on November 24, we should see the trading of $ADA to go live on Bitstamp.

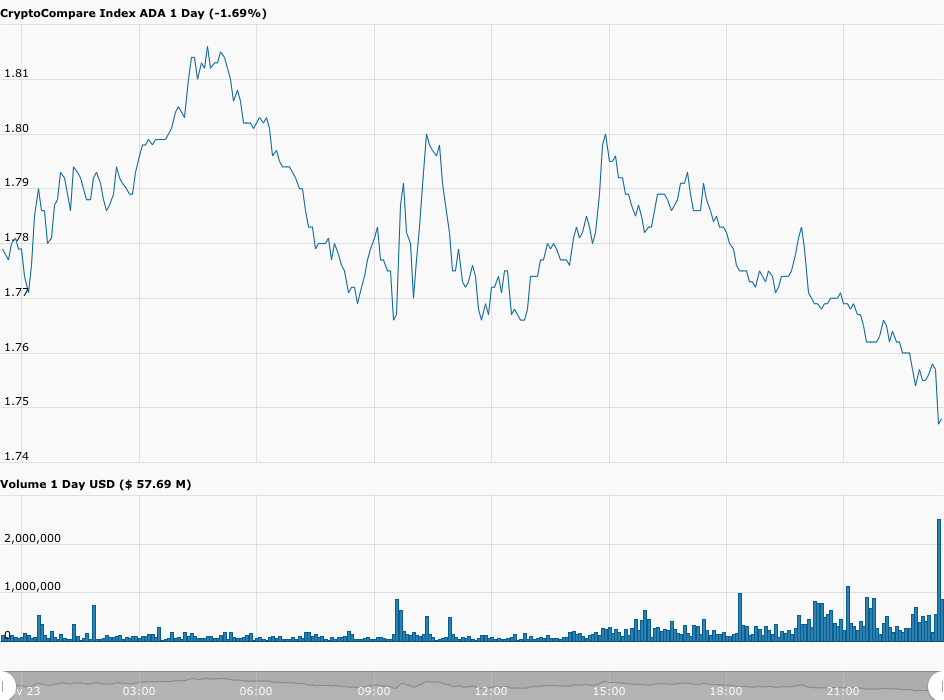

According to data by CryptoCompare, $ADA is currently (as of 23:30 UTC on November 23) trading around $1.748, down 1.69% in the past 24-hour period.

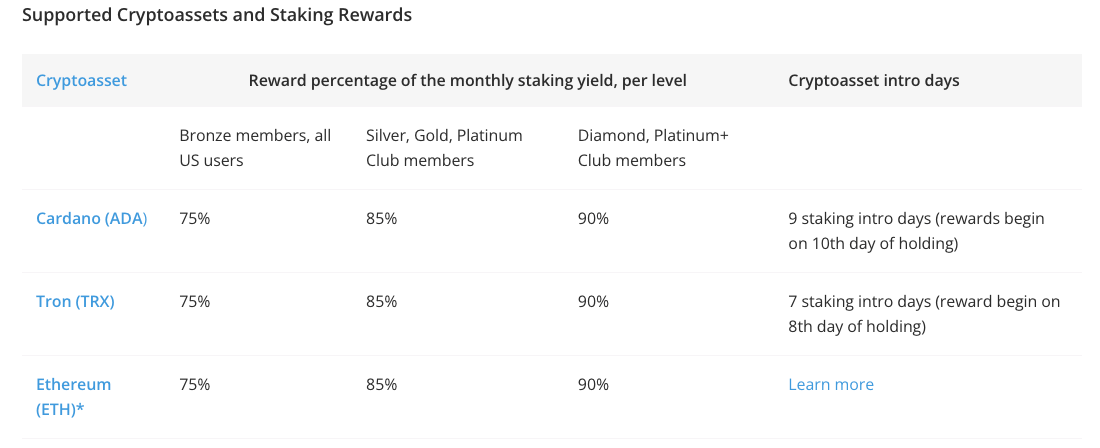

One possible reason for this move by eToro is that they are concerned that by offering staking support for $ADA and $TRX, it could give these these two cryptoassets security-like attributes, which could mean eToro US getting into trouble with the U.S. SEC. It is worth bearing in mind that currently eToro offering staking support for only three cryptoassets: $ADA, $TRX, and $ETH 2.0.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.